Barclays Upgrades Robert Half Outlook Amid Mixed Fund Sentiment

Fintel reports that on January 3, 2025, Barclays changed its view of Robert Half (LSE:0KX9) from Underweight to Equal-Weight.

Analysts Predict a Slight Decline in Share Value

As of December 23, 2024, Robert Half has an average one-year price target of 66.83 GBX/share. Predictions for the share price range from a low of 52.43 GBX to a high of 92.55 GBX. This average price target indicates a potential decrease of 3.77% when compared to its latest reported closing price of 69.45 GBX/share.

Also, check our leaderboard featuring companies with the largest potential price increases.

Strong Revenue Growth Ahead

Robert Half is expected to see projected annual revenue of 7,911MM, marking a 34.40% increase. The annual non-GAAP EPS is projected to be 6.66.

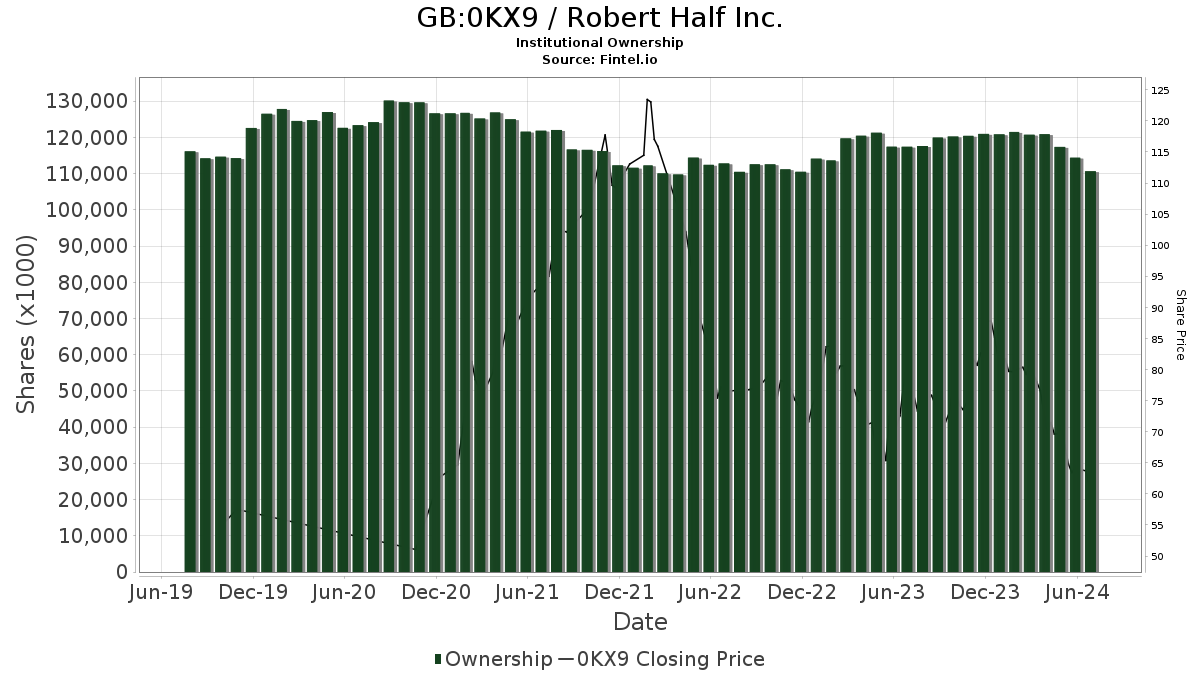

Fund Sentiment Shows Decline in Holdings

Currently, there are 1,017 funds and institutions invested in Robert Half. This is a decrease of 188, or 15.60%, from the previous quarter. The average portfolio weight of all funds in 0KX9 has risen by 20.44%, now at 0.19%. In the last three months, total institutional shares owned increased by 1.96% to 129,304K shares.

Changes Among Major Shareholders

Boston Partners holds 7,283K shares, or 7.18% of the company. This is an increase from their previous holding of 3,728K shares, representing a 48.82% rise. However, they have reduced their portfolio stake in 0KX9 by 20.33% over the last quarter.

The iShares Core S&P Small-Cap ETF has 6,501K shares, accounting for 6.41% ownership. They reported a slight decrease from 6,686K shares, down by 2.84%, and have withdrawn 8.06% of their portfolio allocation in 0KX9 in the last quarter.

Mawer Investment Management increased its stake to 4,681K shares, or 4.61% of Robert Half, up from 3,632K shares, reflecting a 22.41% increase and a 30.57% growth in portfolio allocation over the last three months.

Additionally, Capital Research Global Investors now holds 3,999K shares, or 3.94% ownership, a full increase from their previous 0 shares. Charles Schwab Investment Management holds 3,285K shares, representing 3.24% ownership, with an increase of 4.86% from 3,125K shares, although they decreased their portfolio allocation in 0KX9 by 12.62% this past quarter.

Fintel is a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, providing data on fundamentals, analyst reports, ownership data, and more.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.