Barclays Upgrades Rockwell Automation to Overweight Status

On May 30, 2025, Barclays raised its outlook for Rockwell Automation (BIT:1ROK) from Equal-Weight to Overweight.

Analyst Price Forecast Indicates Possible Decline

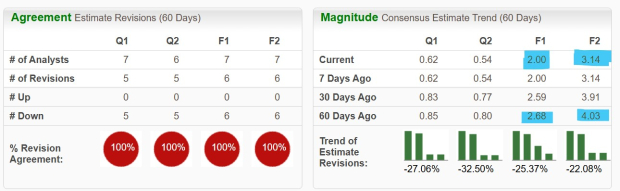

The average one-year price target for Rockwell Automation, as of May 7, 2025, is €258.55 per share. Predictions range from a low of €193.25 to a high of €341.07. This average price target represents a potential decrease of 5.54% from the latest closing price of €273.70 per share.

The expected annual revenue for Rockwell Automation is projected to reach €10,025 million, reflecting a growth of 25.81%. The estimated annual non-GAAP EPS stands at 14.35.

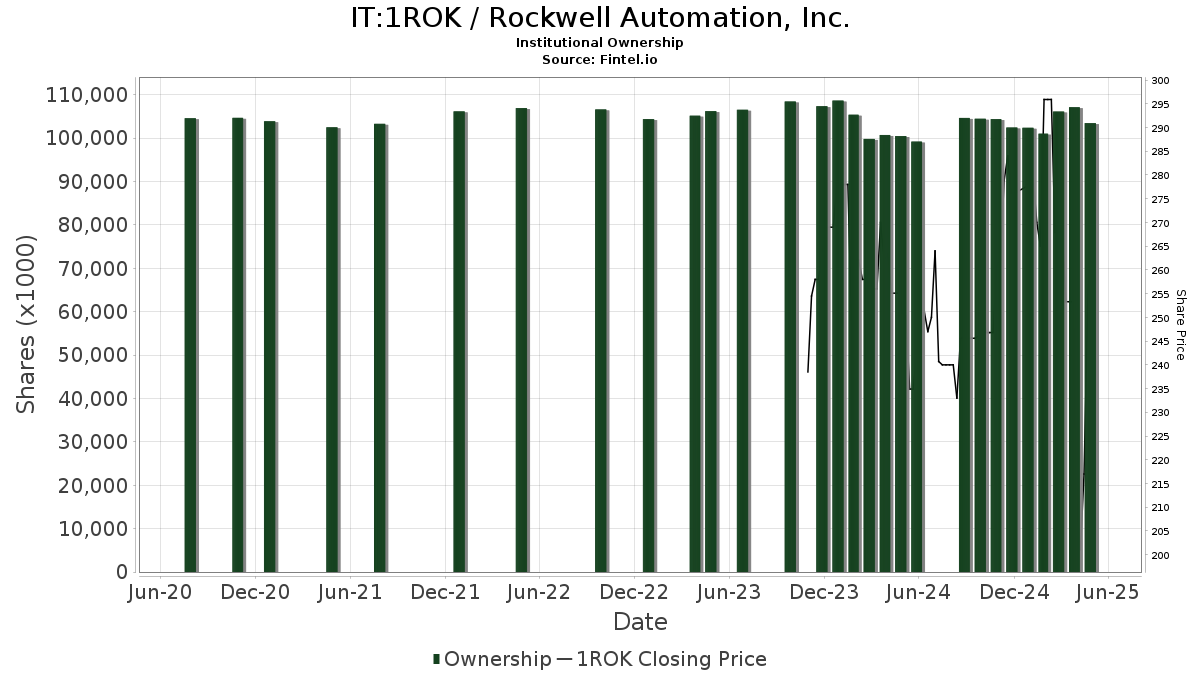

Fund Sentiment Overview

Currently, 1,998 funds or institutions are reporting positions in Rockwell Automation. This marks a decrease of 9 owners, or 0.45%, in the last quarter. Average portfolio weight of all funds dedicated to 1ROK increased by 44.68% to 0.24%. Nevertheless, total shares held by institutions dropped by 2.34% to 103,659,000 shares over the past three months.

Institutional Shareholder Actions

Price T Rowe Associates currently holds 5,870,000 shares, indicating 5.21% ownership. This reflects a reduction from 7,115,000 shares, a decrease of 21.21%. The firm lowered its portfolio allocation in 1ROK by 61.03% last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 3,573,000 shares, equating to 3.17% ownership, up from 3,544,000 shares (an increase of 0.79%). However, its portfolio allocation in 1ROK decreased by 4.94% last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 3,141,000 shares, accounting for 2.79% ownership, an increase from 3,056,000 shares (up 2.70%). Their portfolio allocation in 1ROK also fell by 5.12% in the last quarter.

Geode Capital Management currently owns 2,826,000 shares, representing 2.51% ownership, an increase from 2,734,000 shares (up 3.25%). Their portfolio allocation decreased by 49.86% in the last quarter.

Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) holds 2,435,000 shares, which is 2.16% ownership, up from 2,426,000 shares (an increase of 0.37%). The firm also reduced its portfolio allocation in 1ROK by 8.39% last quarter.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.