Barclays Upgrades Keysight Technologies: Investor Outlooks Brighten

Analyst Price Forecast Suggests Significant Growth Ahead

Fintel reports that on November 4, 2024, Barclays upgraded their outlook for Keysight Technologies (NYSE: KEYS) from Equal-Weight to Overweight.

As of October 22, 2024, the average one-year price target for Keysight Technologies stands at $172.49 per share. Predictions indicate a range from a low of $151.50 to a high of $194.25. This average price target reflects a potential increase of 12.32% from its latest closing price of $153.57 per share.

Check out our leaderboard showcasing companies with the largest potential price target increases.

Rising Revenue Projections and Earnings Forecasts

The projected annual revenue for Keysight Technologies is estimated at $6,099 million, marking a 21.91% increase. Additionally, the projected annual non-GAAP EPS is noted at 8.79.

Investor Sentiment Insights

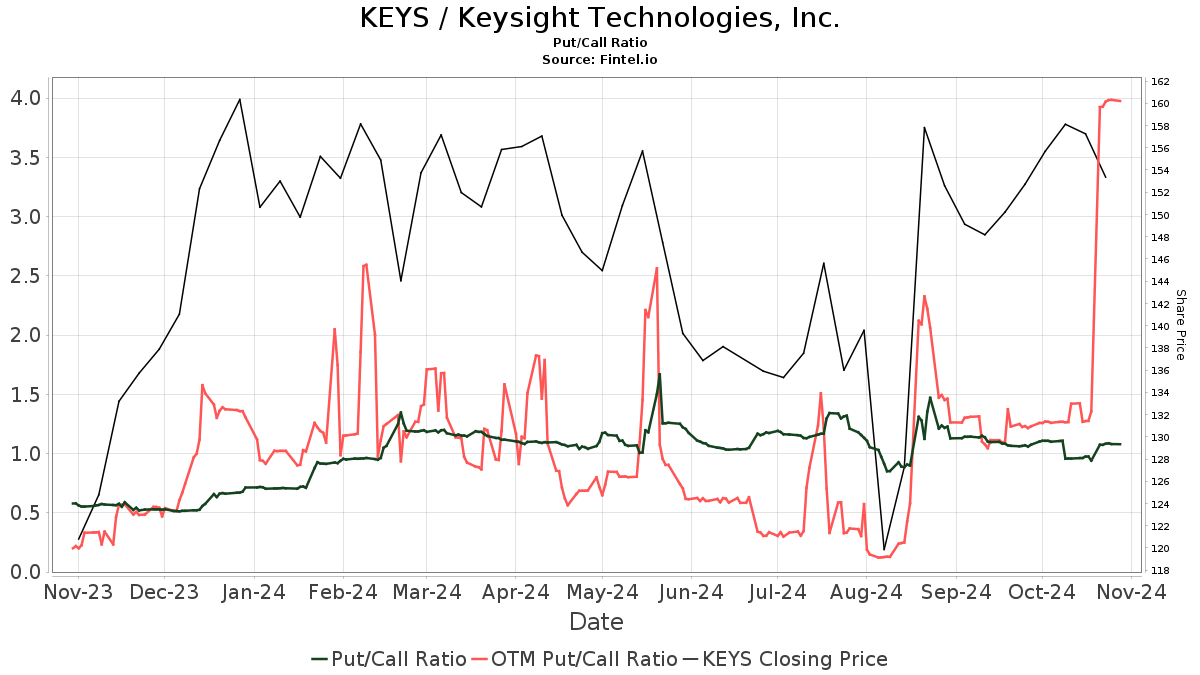

Currently, 1,694 funds or institutions report holding positions in Keysight Technologies. This number reflects a decrease of 13 owners, or 0.76%, from the last quarter. The average portfolio allocation across all funds dedicated to KEYS has increased by 4.76% to 0.23%. In the past three months, total shares owned by institutions rose by 3.64%, totaling 176,049K shares.  The put/call ratio for KEYS stands at 1.11, indicating a bearish outlook among investors.

The put/call ratio for KEYS stands at 1.11, indicating a bearish outlook among investors.

Institutional Movements in Keysight Shares

Price T Rowe Associates has raised its stake to 8,380K shares, now holding 4.83% of the company, up from 3,161K shares previously—an increase of 62.28%. This firm has boosted its investment in KEYS by 126.34% over the last quarter.

On the other hand, the Vanguard Total Stock Market Index Fund Investor Shares holds 5,532K shares (3.19% ownership), which is a slight increase of 0.59% from 5,499K shares previously, although its portfolio allocation in KEYS dropped by 14.45% in the last quarter.

Vanguard 500 Index Fund Investor Shares now owns 4,480K shares (2.58% ownership), up 1.77% from 4,401K shares. However, it has reduced its allocation in KEYS by 15.73% recently.

Swedbank AB holds 4,421K shares, representing 2.55% ownership, an increase of 6.61% from previously held shares. Yet, it decreased its portfolio allocation by 32.68% last quarter.

T. Rowe Price Investment Management owns 4,129K shares (2.38% ownership), down from 5,252K shares, marking a decrease of 27.19%. The firm’s portfolio allocation in KEYS has decreased by 29.08% in the last quarter.

Keysight Technologies Overview

(This description is provided by the company.)

Keysight Technologies, Inc. (NYSE: KEYS) is a prominent technology firm dedicated to helping enterprises, service providers, and government organizations accelerate innovation and secure connections worldwide. Their solutions streamline network optimization and facilitate quicker, cost-effective market entry for electronic products, ranging from design simulation to manufacturing testing. Keysight’s clientele spans various sectors, including communications, aerospace, defense, automotive, energy, semiconductor, and general electronics. In fiscal year 2020, Keysight reported revenues totaling $4.2 billion.

Fintel serves as one of the most comprehensive investment research platforms available to individual investors, financial advisors, and small hedge funds, offering detailed insights into market trends.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.