Barclays Upgrades Rockwell Automation Outlook Amid Mixed Fund Sentiment

On May 30, 2025, Barclays raised Rockwell Automation’s (WBAG:ROK) outlook from Equal-Weight to Overweight.

Analyst Price Forecast Indicates Potential Decline

As of December 20, 2023, Rockwell Automation’s average one-year price target is €248.30 per share. Forecasts range from €202.00 to €315.00, which suggests a 10.72% decline from the last closing price of €278.10.

Projected Revenues and EPS Growth

Rockwell Automation’s projected annual revenue is €9.839 billion, reflecting a 23.48% increase. The projected non-GAAP EPS stands at 14.11.

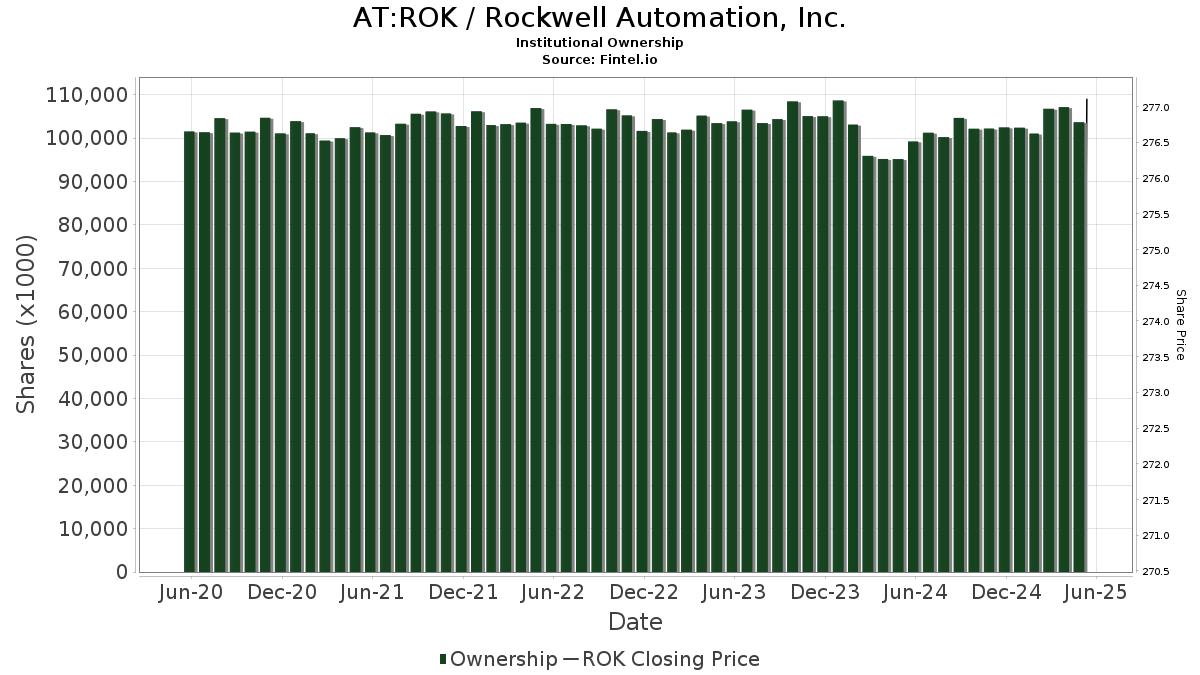

Current Fund Sentiment

A total of 1,998 funds report positions in Rockwell Automation, an increase of 0.79% in ownership over the last quarter. Average portfolio weight in ROK rose by 58.11% to 0.24%. Institutional shares decreased by 2.91% to 103.659 million in the last three months.

Institutional Ownership Changes

Price T Rowe Associates reduced its holdings from 7.115 million shares to 5.870 million shares, a drop of 21.21%.

Vanguard Total Stock Market Index Fund Investor Shares slightly increased its shares from 3.544 million to 3.573 million, marking a 0.79% rise.

Vanguard 500 Index Fund Investor Shares increased its ownership from 3.056 million to 3.141 million shares, up by 2.70%.

Geode Capital Management raised its shares from 2.734 million to 2.826 million, a 3.25% increase, while decreasing its portfolio allocation in ROK by 49.86%.

Vanguard Mid-Cap Index Fund Investor Shares reported an increase from 2.426 million to 2.435 million shares, up by 0.37%, with a portfolio decrease of 8.39%.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.