Barclays Lowers Coty’s Rating Amid Mixed Institutional Sentiment

On November 7, 2024, Barclays downgraded Coty (ENXTPA:COTY) from Equal-Weight to Underweight.

Current Fund Sentiment Towards Coty

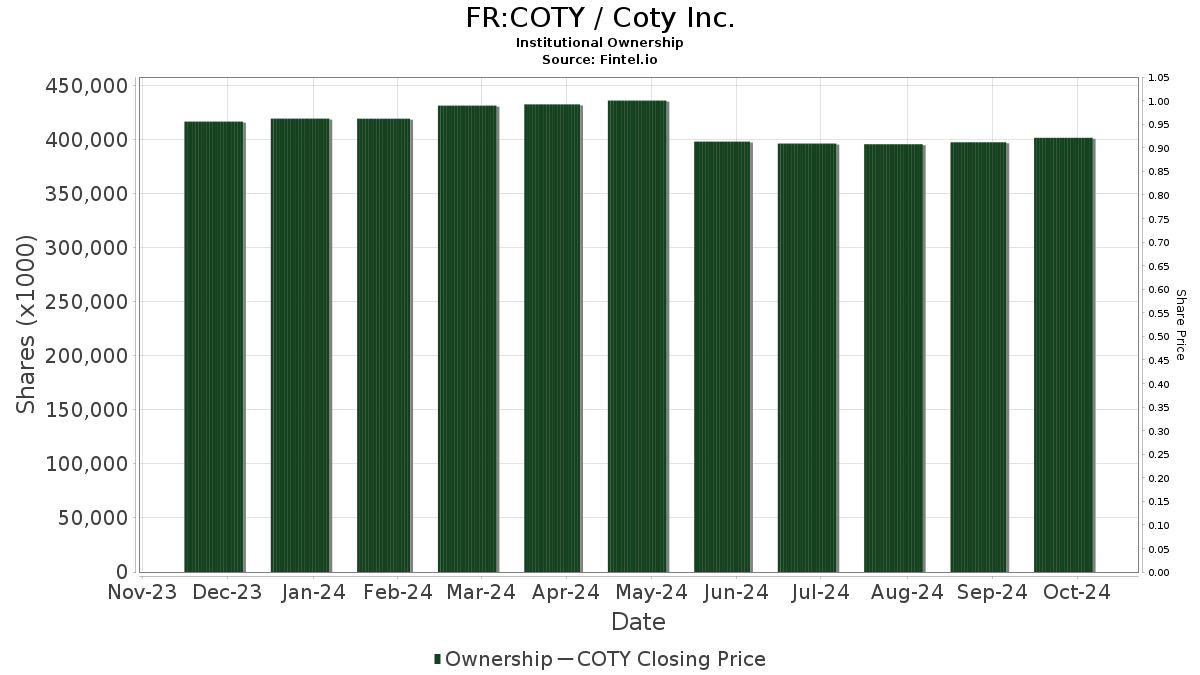

A total of 662 funds or institutions currently hold positions in Coty, marking a decrease of 5, or 0.75%, from the previous quarter. The average portfolio weight of all the funds invested in COTY is now at 0.14%, reflecting a notable increase of 10.80%. Over the last three months, institutional ownership rose by 3.71%, totaling 407,137K shares.

Activity Among Other Institutional Shareholders

Bnp Paribas Arbitrage owns 34,064K shares, representing 3.93% of Coty’s ownership. This is a slight decrease from the previously reported 34,265K shares, showing a change of 0.59%. The firm reduced its allocation in Coty by 22.73% over the last quarter.

Banco Santander increased its holdings slightly, now owning 23,034K shares (2.65%) compared to the previous 22,954K shares, reflecting an increase of 0.35%. However, this firm still decreased its portfolio weight in Coty by 32.90% last quarter.

Credit Agricole S A holds 20,682K shares or 2.38% of Coty. Previously, this firm owned 20,614K shares, marking a minor increase of 0.33%. Nonetheless, it significantly lowered its portfolio allocation by 85.17% in the past three months.

Ameriprise Financial holds 18,107K shares, accounting for 2.09% of the company, up from 15,586K shares—an increase of 13.92%. Still, it reduced its portfolio allocation by 82.68% last quarter.

Finally, the IJH – iShares Core S&P Mid-Cap ETF owns 11,337K shares (1.31%), down from 11,705K shares, showing a decrease of 3.24%. This firm also cut its portfolio allocation in Coty by 16.93% during the last quarter.

Fintel is a leading research platform offering valuable insights for individual investors, traders, and small hedge funds. Our data spans a variety of investing metrics including fundamentals, analyst reports, ownership trends, and more for better financial decision-making.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.