Barnes Group Inc. Reports Dismal Third-Quarter Earnings Amid Mixed Sales Performance

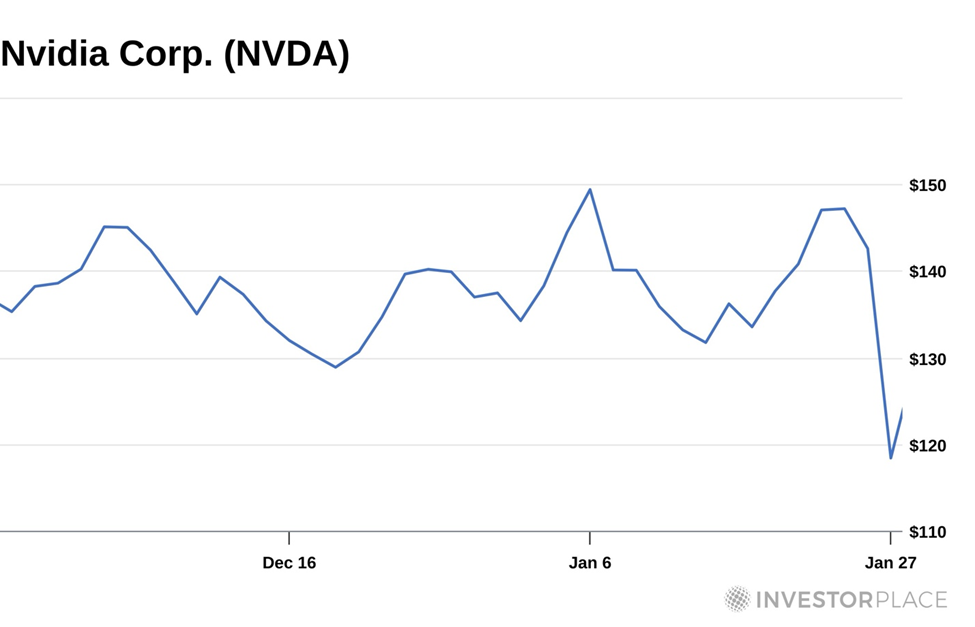

Barnes Group Inc. reported adjusted earnings of 9 cents per share for the third quarter of 2024, falling short of the Zacks Consensus Estimate of 39 cents. This marks a significant decline of 52% compared to the same quarter last year.

Keep track of all quarterly updates: See Zacks Earnings Calendar.

Sales Overview: A Tale of Two Segments

Total sales reached $388 million, exceeding the Zacks Consensus Estimate of $373 million. This represents a year-over-year increase of 7%, with organic sales growth recorded at 4%.

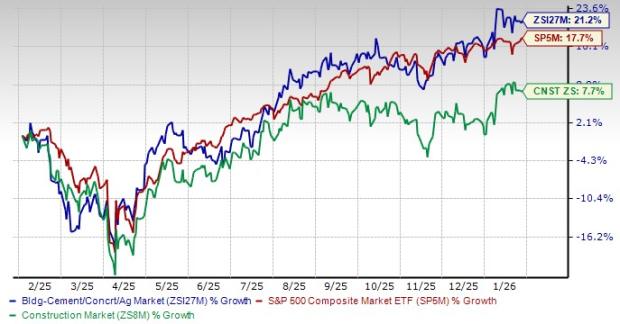

Barnes Group’s sales are categorized into two segments: Industrial and Aerospace. Here’s a concise look at each segment:

Sales from the Industrial segment totaled $156 million, which is a 24% decrease year over year. However, organic sales saw a slight gain of 1%. Our projection for this segment was $164.5 million.

Conversely, the Aerospace segment demonstrated a robust performance, generating sales of $232 million, marking a 49% year-over-year increase. Organic sales in this category grew by 9%, bolstered by a 39% contribution from acquisitions.

EPS Performance: Barnes Group’s Standing

Barnes Group, Inc. price-consensus-eps-surprise-chart | Barnes Group, Inc. Quote

Analyzing Margins

The cost of sales for Barnes Group rose by 2.3% year over year to $259.4 million. Encouragingly, selling and administrative expenses decreased by 12.9% to $84.9 million.

Adjusted operating income increased to $47.9 million, reflecting a 23% year-over-year rise, while operating margins improved by 150 basis points to reach 12.3%.

Balance Sheet and Cash Flow Highlights

By the end of the third quarter, Barnes Group held cash and cash equivalents totaling $80.7 million, a decline from $89.8 million as recorded at the end of 2023. The company’s long-term debt decreased to $1.14 billion from $1.28 billion at the close of 2023.

During the first three quarters of 2024, Barnes Group generated a net cash flow of $49.8 million from operating activities, down from $71 million during the same time last year. Capital expenditures increased to $41.8 million, an 11.8% rise year over year, while adjusted free cash flow declined to $20.4 million from $33.6 million a year earlier.

Throughout the first nine months, Barnes Group provided $24.4 million in dividends to its shareholders, remaining nearly stable compared to the previous year.

Looking Ahead: 2024 Expectations

Following its planned acquisition by Apollo Funds, Barnes Group has halted its previously provided financial forecast for 2024.

Zacks Rank and Other Stocks to Consider

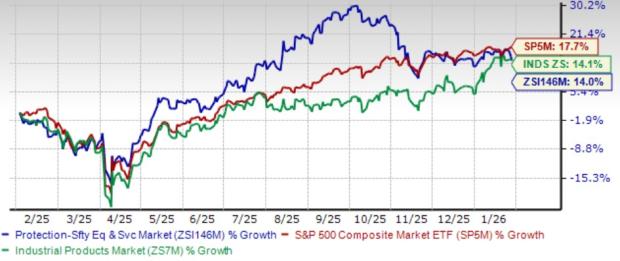

Barnes Group currently holds a Zacks Rank #4 (Sell).

Consider these companies with better rankings:

Flowserve Corporation FLS currently has a Zacks Rank #2 (Buy). It has delivered a trailing four-quarter average earnings surprise of 18.2%. Over the last 60 days, the consensus estimate for Flowserve’s 2024 earnings has risen by 0.7%.

Ingersoll-Rand plc IR also holds a Zacks Rank #2, reporting a trailing four-quarter average earnings surprise of 11%. The consensus estimate for Ingersoll-Rand’s 2024 earnings has seen a modest increase of 0.6% over the last two months.

Parker-Hannifin Corporation PH is yet another company with a Zacks Rank #2, achieving a trailing four-quarter average earnings surprise of 11.2%. The earnings consensus estimate for Parker-Hannifin’s fiscal 2025 (ending June 2025) has grown by 0.3% recently.

Access Zacks’ Recommendations for Just $1!

Absolutely no strings attached.

Years ago, we surprised our members by offering a 30-day trial for only $1, providing no obligation beyond this initial fee.

Many took advantage of this deal, while others hesitated, believing there must be a catch. We simply want you to explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others that achieved 228 positions with significant gains in 2023 alone.

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Ingersoll Rand Inc. (IR): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Read the full article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.