Barrick Gold Reports Strong Earnings Growth in Q4 2024

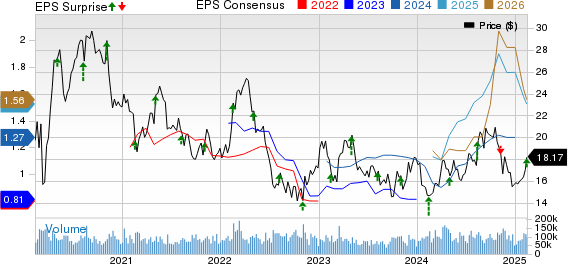

Barrick Gold Corporation (GOLD) achieved net earnings of $996 million, or 57 cents per share, for the fourth quarter of 2024. This marks a significant increase from $479 million, or 27 cents per share, from the same quarter last year.

Excluding one-time items, adjusted earnings per share were 46 cents, exceeding the Zacks Consensus Estimate of 41 cents.

Discover the latest EPS estimates and surprises on Zacks Earnings Calendar.

Barrick reported total sales of $3,645 million, reflecting a year-over-year increase of about 19.2%.

Operational Highlights from Barrick Gold

The company produced 1,080,000 ounces of gold in the reported quarter, which is approximately 2.5% higher than last year. The average realized gold price rose to $2,657 per ounce, marking an increase of around 33.8%.

Year-over-year, the cost of sales climbed about 5.1% to $1,428 per ounce. Additionally, all-in-sustaining costs (AISC) saw a rise of approximately 6.4% to $1,451 per ounce.

Financial Overview of Barrick Gold

At the close of the quarter, Barrick had cash and cash equivalents amounting to $4,074 million, a slight decrease of 1.8% from the previous year. The company’s total debt remained stable at $4,729 million.

The operating cash flow reported was $1,392 million, while free cash flow reached $501 million.

Year-End Results for Barrick Gold in FY24

For the year 2024, Barrick reported total sales of $12,922 million, a rise of 13% compared to last year. Earnings per share surged by 69% to $1.22, while adjusted net earnings increased by 50% to $1.26. Operating cash flow rose by 20% year over year, totaling nearly $4.5 billion. Notably, free cash flow jumped 104%, amounting to $1,317 million.

Looking Ahead: Barrick’s Production Guidance

For 2025, Barrick forecasts attributable gold production between 3.15 and 3.5 million ounces. AISC is projected to be between $1,460 and $1,560 per ounce, with cash costs expected in the range of $1,050 to $1,130 per ounce. Additionally, the cost of sales is anticipated to also land between $1,460 and $1,560 per ounce.

In terms of copper production, Barrick estimates between 200,000 and 230,000 tons at an AISC of $2.80 to $3.10 per pound, with cash costs projected at $1.80 to $2.10 per pound and costs of sales between $2.50 and $2.80 per pound.

Total attributable capital expenditures are expected to range from $3,100 million to $3,600 million in 2025.

Furthermore, Barrick’s board has authorized a new share repurchase program allowing for the buyback of up to $1 billion of its outstanding common shares over the next 12 months. This follows the termination of the prior repurchase program initiated on February 14, 2024, under which Barrick repurchased $498 million of common shares.

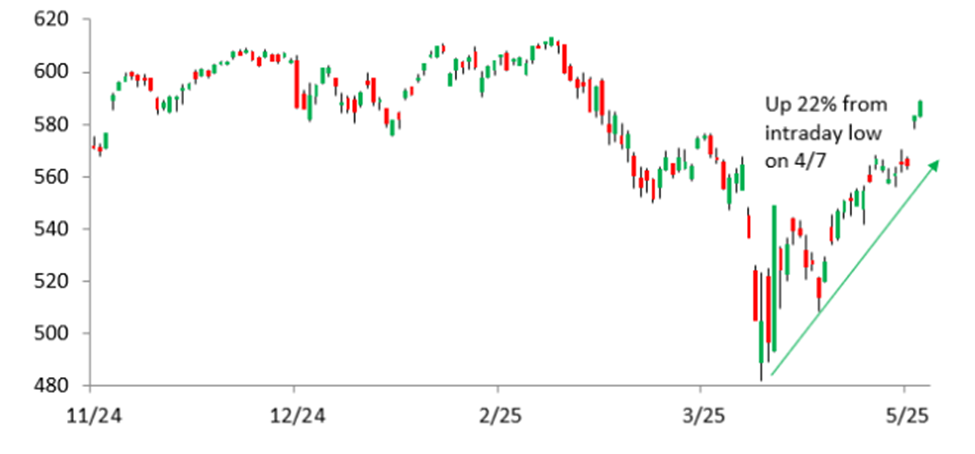

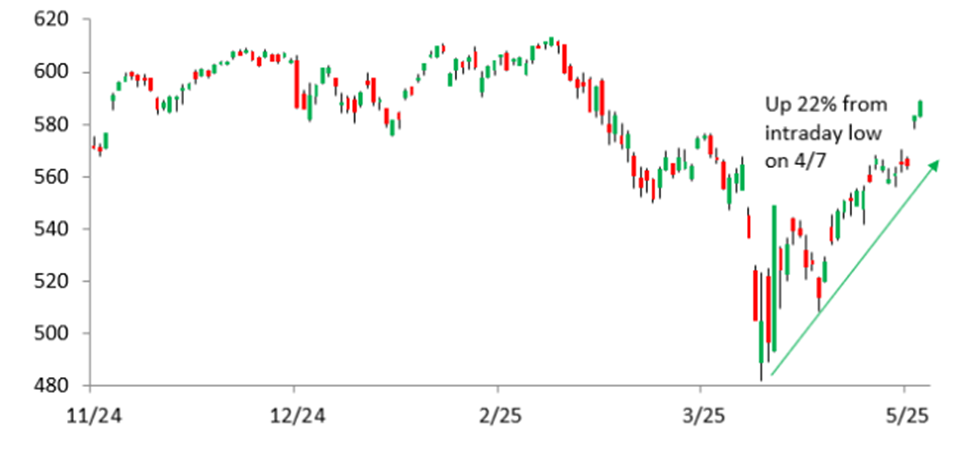

Barrick Gold’s Stock Performance

Over the past year, Barrick’s shares have risen by 29.3%, compared to a 57.1% increase in the broader industry.

Image Source: Zacks Investment Research

High-Performing Stocks to Watch

Currently, Barrick Gold has a Zacks Rank of #3 (Hold). Other notable stocks in the basic materials sector worth considering include ICL Group Ltd. (ICL), Nutrien Ltd. (NTR), and Ingevity Corporation (NGVT).

ICL is scheduled to report its fourth-quarter results on February 26, with the Zacks Consensus Estimate at 6 cents per share. Historically, ICL has beaten consensus estimates in each of the last four quarters, averaging an earnings surprise of 18.1%, and holds a Zacks Rank of #2 (Buy).

Nutrien is expected to release its fourth-quarter results on February 19, with a consensus estimate of 33 cents. It holds a Zacks Rank of #2 and has seen a modest 2% increase in its stock over the past year.

Ingevity will announce its fourth-quarter results on February 18, post-market hours, with a consensus estimate of 12 cents per share. This stock, rated Zacks Rank #1, has surpassed consensus estimates in three of the last four quarters, averaging an impressive earnings surprise of 95.4%.

Special Stock Insights

Our research team has identified five stocks with a high probability of achieving gains of +100% or more in the coming months. Among these, our Director of Research, Sheraz Mian, highlights one particularly innovative firm with a customer base of over 50 million and a variety of advanced solutions poised for growth.

While not every recommendation succeeds, this one has the potential for significant gains, reminiscent of past recommendations like Nano-X Imaging, which saw a rise of +129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

ICL Group Ltd. (ICL) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

For more details, read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.