“`html

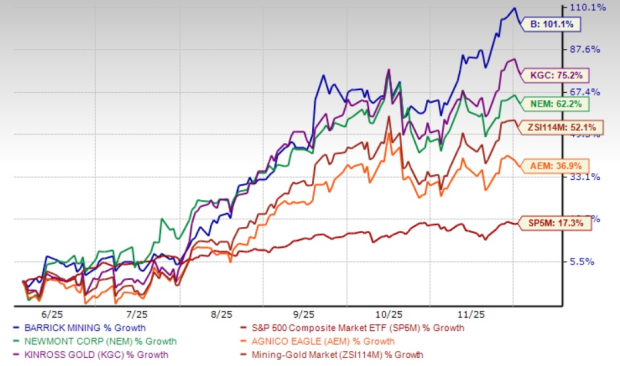

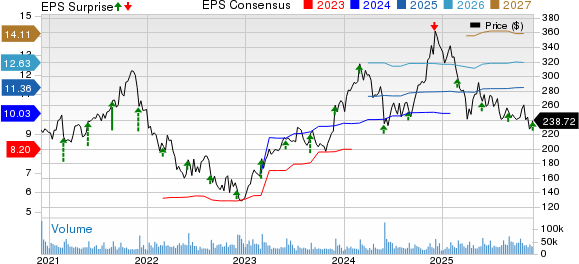

Barrick Mining Corporation has seen its B shares increase by 101.1% over the past six months, driven by rising gold prices that currently exceed $4,200 per ton. This performance notably surpasses the Zacks Mining – Gold industry’s 52.1% rise and the S&P 500’s 17.3% increase in the same timeframe. Key competitors like Newmont Corporation (62.2%), Kinross Gold Corporation (75.2%), and Agnico Eagle Mines Limited (36.9%) have also rallied, but not as significantly as Barrick.

As of Q3 2025, Barrick reported $5 billion in cash and cash equivalents and strong operating cash flows of approximately $2.4 billion, a 105% year-over-year increase. The company also returned $1.2 billion to shareholders via dividends and repurchases in 2024. However, Barrick’s gold production dropped 12% year-over-year to 829,000 ounces in Q3, with a forecast of 3.15-3.5 million ounces for FY 2025, down from 3.91 million ounces in 2024.

Despite challenges such as increased production costs, which rose by 3% year-over-year, Barrick is well-positioned financially to take advantage of market opportunities. The company is focusing on its key growth projects to enhance production, with significant developments underway, including the expansion of the Pueblo Viejo plant and the Reko Diq copper-gold project, expected to yield substantial annual outputs by 2028.

“`