Barrick Mining Sees Major Drop in Gold Production in Q1 2025

Barrick Mining Corporation reported a substantial decline in gold production for the first quarter of 2025, generating 758,000 ounces. This marks a 19% decrease compared to the same quarter last year and a 30% drop from the fourth quarter of 2024. The output is the lowest recorded in recent years, largely due to halted operations at the Loulo-Gounkoto mine due to a dispute with the Malian government regarding economic benefit sharing. Additionally, lower yields were noted at Carlin and Cortez. The decline in production resulted in elevated unit costs, with all-in sustaining costs increasing by 20% year over year.

The company’s forecast for 2025 is cautious, predicting gold production in the range of 3.15 to 3.5 million ounces, excluding Loulo-Gounkoto. Although a possible mine restart could enhance this figure, it represents a decrease from the 3.91 million ounces produced in 2024. Gains from Pueblo Viejo, Turquoise Ridge, Porgera, and Kibali are expected but may be overshadowed by production cuts at Veladero and Phoenix.

In comparison, Newmont Corporation reported a year-over-year decline of approximately 8% in gold production for the first quarter, totaling 1.54 million ounces. The reduced output was impacted by declining contributions from non-core operations. Newmont plans to maintain its anticipated production level for 2025 at around 5.9 million ounces after focusing on Tier 1 assets by divesting non-essential operations.

Agnico Eagle Mines Limited experienced a slight decline of 0.5% in gold production year-over-year, totaling 873,794 ounces, largely due to decreased output at Canadian Malartic. The company completed the acquisition of O3 Mining during the quarter, incorporating the Marban project, which is projected to add about 130,000 ounces annually to the Canadian Malartic complex. Agnico Eagle is on track to meet its 2025 gold production goal of 3.3 to 3.5 million ounces.

Barrick’s first-quarter performance highlights the urgent need to resolve geopolitical challenges and improve operational stability. The company must address operational risks and enhance production levels to maintain its industry standing.

The Zacks Rundown for B

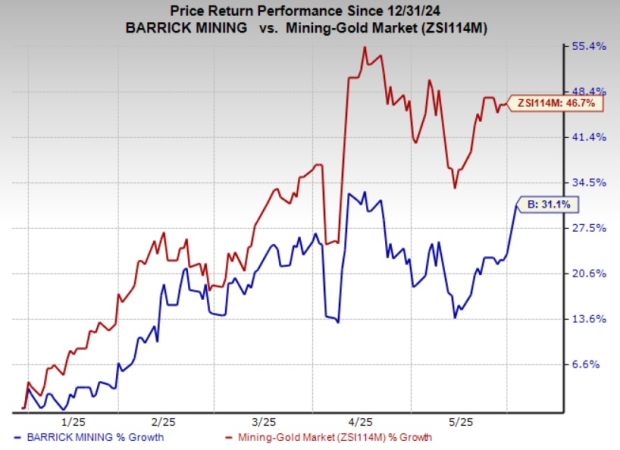

Barrick shares have risen 31.1% year to date, outpacing the Zacks Mining – Gold industry’s gain of 46.7%, a trend mainly driven by rising gold prices.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Currently, Barrick trades at a forward 12-month earnings multiple of 10.8, roughly 21% lower than the industry average of 13.66X, and holds a Value Score of A.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Barrick’s earnings suggests increases of 34.1% and 26.6% year-over-year for 2025 and 2026, respectively. EPS estimates for both years have seen upward adjustments in the past 60 days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Barrick currently has a Zacks Rank of #3 (Hold).

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.