“`html

Barrick Mining Corporation reported a significant increase in free cash flow for Q1 2025, totaling $375 million, up from $32 million in Q1 2024—a nearly 12-fold rise. This increase was driven by higher gold and copper prices, contributing to operating cash flows of approximately $1.2 billion, a 59% year-over-year increase.

In comparison, Newmont Corporation achieved a record first-quarter free cash flow of $1.2 billion, recovering from a negative $74 million in the same period last year, aided by improved operational efficiency. Agnico Eagle Mines Limited also reported robust free cash flows of $594 million, marking a 50% year-over-year increase, and successfully reduced its net debt to $5 million from $212 million sequentially.

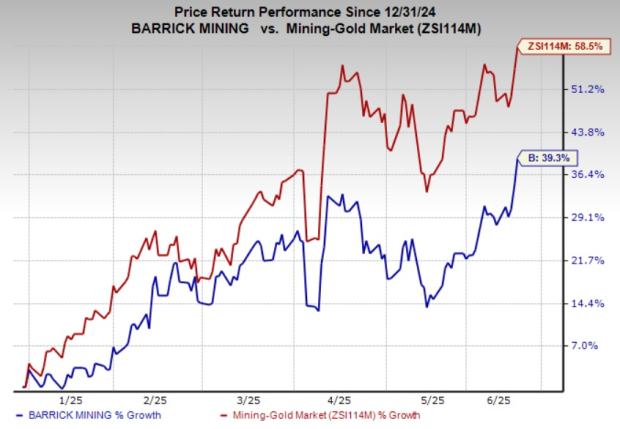

The strong performance enhances Barrick’s balance sheet, providing flexibility for shareholder returns and investments in future projects. Barrick’s shares have risen 39.3% year-to-date, compared to a 58.5% increase in the Mining – Gold industry, bolstered by a rising gold price.

“`