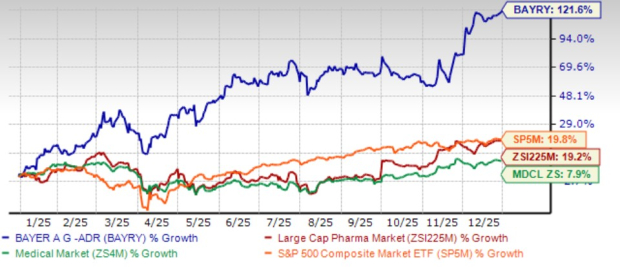

2025 has been a remarkable year for Bayer (BAYRY), with shares soaring 121.6%, significantly outperforming both the industry’s 19.2% gain and the S&P 500. This growth is largely attributed to new drug approvals, including prostate cancer drug Nubeqa, generating €1.68 billion in sales over the first nine months, and kidney disease drug Kerendia, which gained expanded FDA approval. Bayer’s strong performance is also buoyed by favorable developments in its Crop Science business and positive litigation updates regarding its Roundup weedkiller.

As of September 30, 2025, Bayer has reserved $7.6 billion for glyphosate litigation tied to Roundup, having resolved approximately 132,000 of nearly 197,000 claims. The FDA recently granted accelerated approval for Hyrnuo, aimed at adult patients with lung cancer, and Bayer’s pipeline continues to grow with several promising projects underway. The Zacks Consensus Estimate for Bayer’s 2025 earnings per share has increased from $1.32 to $1.41 over the past two months, indicating further positive momentum.

Bayer’s valuation stands at a forward price/earnings ratio of 7.59X, below the industry average of 17X, suggesting it may be undervalued at this time. With ongoing strength in its pharmaceutical division and new product launches on the horizon, existing investors are encouraged to hold their positions, while potential investors may want to monitor future developments for optimal entry points.