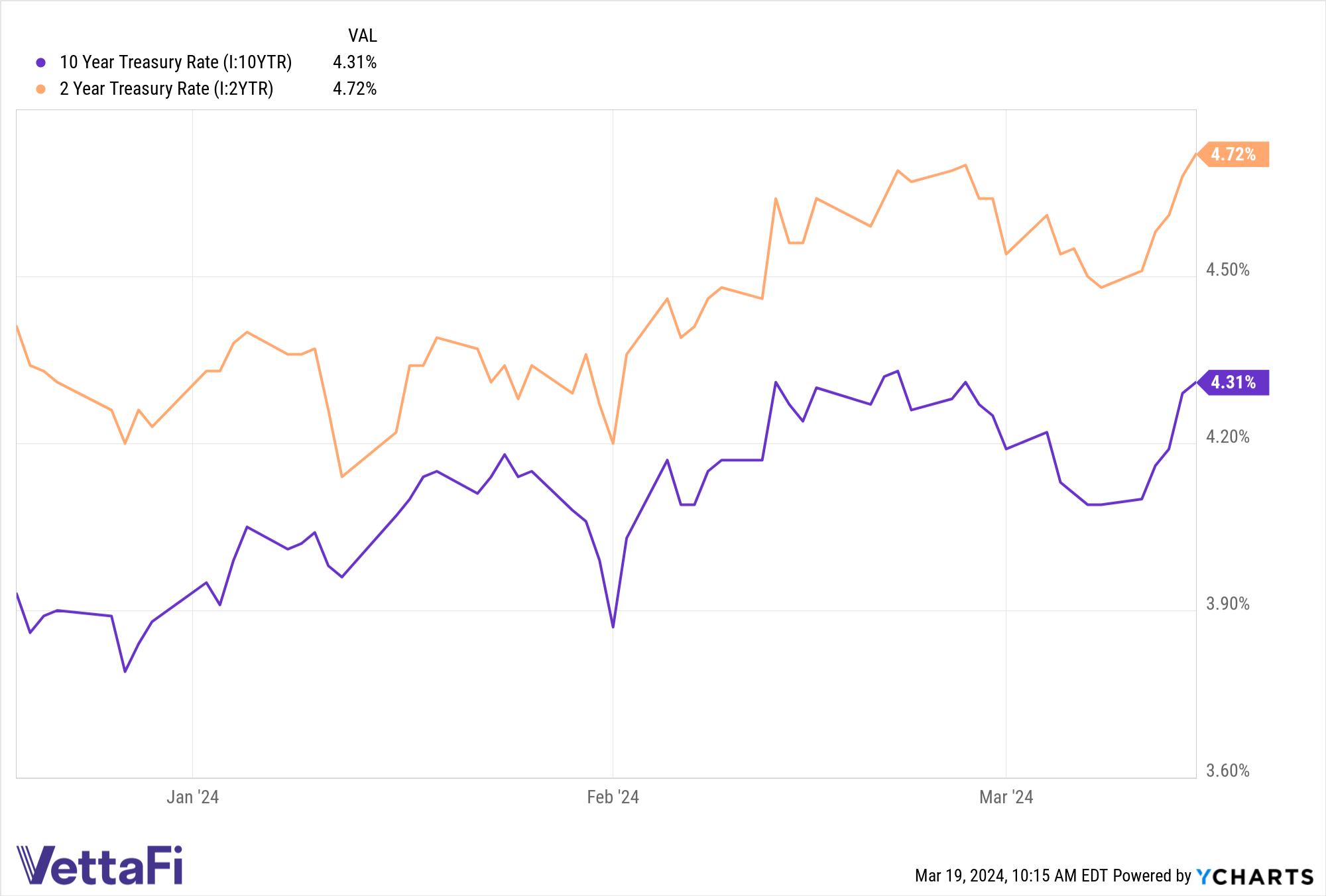

Rising Treasury Yields and Fed Speculation

Amidst rising Treasury yields spurred by new economic data and anticipation surrounding Federal Reserve announcements, investors are navigating choppy waters seeking stability. As the Fed convenes for its latest meeting, the market speculates on future rate moves, hanging on every potential clue. Recent data from BondBloxx shines a light on the resilience of the 1-5 year maturity BBB index. Despite climbing all-in yields for BBB investment-grade corporates, the short and intermediate BBB credit spreads tightened in February.

The Appeal of BBB Corporates

BondBloxx’s research is clear – BBB-rated bonds present a tantalizing prospect for investors chasing higher income and total return potential, especially when compared to broader U.S. Corporate Index offerings. The sweet spot lies in the 1-5 year and 5-10 year maturity ranges within the BBB category, promising attractive yields with less volatility than other investment-grade counterparts. It’s akin to finding a stable oasis amidst the market dunes.

ETF Options for Savvy Investors

Enter BondBloxx’s suite of ETFs tailored for those eyeing the strength of BBB-rated bonds. For investors yearning for shorter-duration corporate bond exposure, the BondBloxx BBB Rated 1-5 Year Corporate Bond ETF (NYSE Arca: BBBS) offers precision and current yields with reduced risks. Alternatively, the BondBloxx BBB Rated 5-10 Year Corporate Bond ETF (NYSE Arca: BBBI) beckons those taking a longer view, potentially capitalizing on future rate cuts while sheltered by investment-grade corporate assets.

Recent Additions to BondBloxx’s Arsenal

In a bid to broaden its offerings, BondBloxx unveiled these ETFs in January 2024, accompanied by the longer-duration $5 million BondBloxx BBB Rated 10+ Year Corporate Bond ETF (NYSE Arca: BBBL). The nascent BBBS oversees around $2.5 million in assets under management, while BBBI commands approximately $5 million in AUM, signaling a promising start.

Broader Financial Insight

For those seeking further financial news, insights, and expert analysis, the Institutional Income Strategies Channel provides a wealth of information. It’s akin to having a trusted guide through the financial forest, offering clarity amidst the market noise.

The perspectives expressed herein belong to the author and do not necessarily align with those of Nasdaq, Inc.