After the completion of the all-stock merger of equals between Allkem and Livent Corporation, investors may be pondering buying shares of the newly formed Arcadium Lithium ALTM. Unfortunately, Arcadium’s stock currently lands a Zacks Rank #5 (Strong Sell) and the Bear of the Day.

While a quick glance at Arcadium’s long-term outlook looks attractive on paper let’s see why investors may want to stay clear at the moment.

Taking a Closer Look Reveals Cause for Short-Term Concern

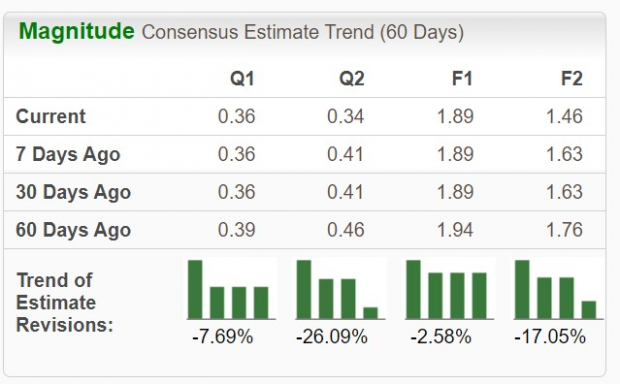

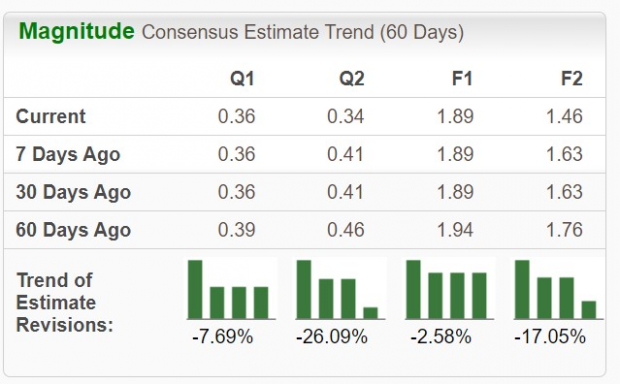

Arcadium began trading last Friday with the merger between Allkem and Livent creating a leading global lithium chemicals producer. The newly formed company says it is committed to safety and responsibly harnessing the power of lithium to improve people’s lives and accelerate the transition to clean energy. According to Zacks estimates, the combined companies are expected to round out fiscal 2023 with annual earnings up 35% to $1.89 per share compared to $1.40 a share in 2022. However, FY24 EPS is projected to drop -23% to $1.46 a share. While Arcadium’s bottom line may still look enticing with shares trading at $6 and just 4.4X forward earnings the trend of earnings estimate revisions shines a dimmer light. Over the last 60 days, FY23 earnings estimates have dipped -2% while FY24 EPS estimates have dropped -17%.

Image Source: Zacks Investment Research

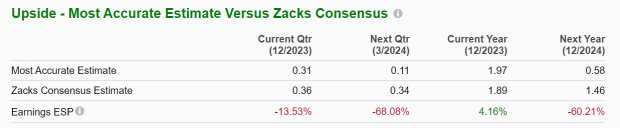

Negative Q4 ESP

The Zacks Earnings ESP (Expected Surprise Prediction) also has Arcadium missing fourth quarter earnings expectations by -13% with the Zacks Consensus having Q4 EPS at $0.36 but the Most Accurate Estimate at $0.31 a share. Arcadium is scheduled to report its Q4 results on Tuesday, February 13, and for now, the possibility of better-than-expected guidance looks slim as its Zacks Chemical-Specialty Industry is in the bottom 17% of over 250 Zacks industries. For Arcadium specifically, Lithium prices have been submerged in volatility over the last year and a sharp rebound in the commodity price may be necessary before investors get overly excited about its stock being cheap.

Image Source: Zacks Investment Research

Bottom Line

The “too-good-to-be-true” feeling about Arcadium’s stock is warranted at the moment and it would be no surprise if shares moved lower even at $6. Although Arcadium’s long-term prospects are still attractive its short-term price movement could be frustrating.

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion. As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Arcadium Lithium PLC (ALTM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.