Cracker Barrel Old Country Store CBRL owns and operates full-service dining locations with a restaurant and a retail store in the same unit. Analysts have taken a bearish stance on the company’s outlook, pushing it down into an unfavorable Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

In addition, the company is in the Zacks Retail – Restaurants industry, which is currently ranked in the bottom 24% of all Zacks industries.

Let’s take a closer look at the company.

Cracker Barrel

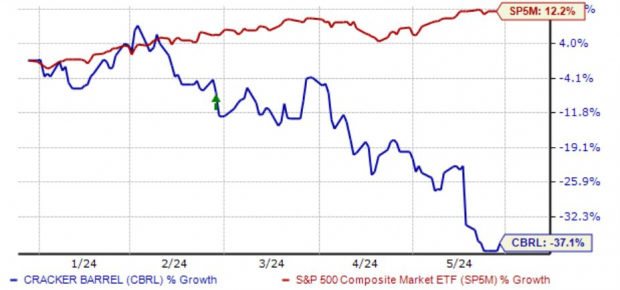

CBRL shares haven’t fared well year-to-date, down 37% and widely underperforming relative to the general market. Shares faced pressure following its latest set of quarterly results despite posting numbers that exceeded expectations.

Image Source: Zacks Investment Research

The adverse price action has bumped up CBRL’s annual dividend yield, currently paying a sizable 11.4% annually. Still, the company’s 107% payout ratio remains a concern, reflecting that it’s paying more out to shareholders than earnings generated.

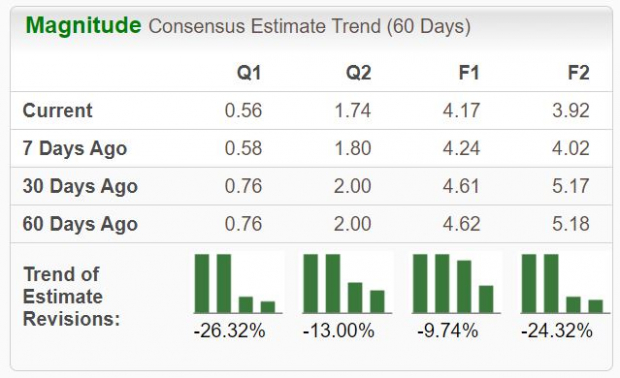

The company has primarily posted mixed earnings results as of late, falling short of the Zacks Consensus EPS Estimate by an average of -7.7% across its last four releases.

Keep an eye out for the company’s upcoming quarterly release expected on May 30, as current consensus expectations allude to a 53% pullback in earnings on -0.7% lower sales. Revenue expectations have moved downward alongside earnings expectations, with the $827 million expected down 1.4% since the beginning of March.

Image Source: Zacks Investment Research

Bottom Line

Negative earnings estimate revisions from analysts and mixed quarterly results paint a challenging picture for the company’s shares in the near term.

Cracker Barrel Old Country Store CBRL is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Cracker Barrel Old Country Store, Inc. (CBRL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.