Missed Expectations

Hasbro, Inc. (HAS) fell short of both fourth quarter earnings and revenue estimates on February 13. The company’s disappointing performance was accompanied by a bleak outlook, adding to its ongoing streak of downward earnings revisions.

The Journey of Hasbro

Hasbro is a prominent player in the toy and game industry, known for its iconic brands such as Play-Doh, Transformers, Monopoly, Star Wars, Marvel, and Magic: The Gathering. The company has been a leading force in the market for many years and is likely to remain so in the future.

Historical Struggles

In recent years, the Rhode Island-based firm witnessed double-digit top-line growth in both 2020 and 2021. However, this impressive performance set a high bar for subsequent years, making it challenging for Hasbro to compete effectively in the industry.

Image Source: Zacks Investment Research

In August, Hasbro announced the sale of its eOne film and TV unit to Lionsgate for $500 million, a move aimed at reducing debt and bolstering its financial position.

Hasbro’s acquisition of eOne in 2019 for $4 billion demonstrated its commitment to expanding its business portfolio. However, the subsequent sale of this unit underscored the company’s shift in focus back to its core operations.

Recent Performance and Future Prospects

Hasbro is currently striving to refocus on its core business, following a 9% sales decline in 2022 and a further 15% drop in 2023. Despite witnessing growth in its Wizards of the Coast and Digital Gaming segment (+10%), this positive momentum was overshadowed by declines in the Consumer Products segment (-19%) and Entertainment segment (-31%). Consequently, the company’s adjusted earnings plummeted from $4.45 to $2.51 per share in 2023.

Looking ahead, Hasbro’s sales for 2024 are projected to decline by 14%. However, the company aims to improve its adjusted earnings by 30% by implementing cost-cutting measures.

Image Source: Zacks Investment Research

Outlook

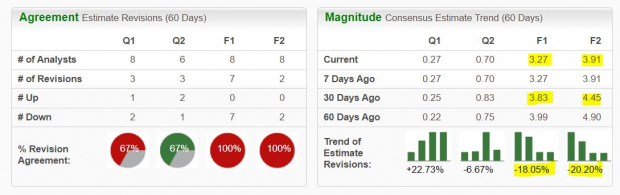

Despite these efforts, Hasbro’s adjusted EPS outlook for 2024 and 2025 has deteriorated, continuing a discouraging trend of downward revisions. As a result, the company currently holds a Zacks Rank #5 (Strong Sell) and operates within the unpropitious Toys – Games – Hobbies industry, positioned in the bottom 12% of all Zacks industries. Furthermore, Hasbro’s dividend payout ratio has surged to alarming levels.

Over the past decade, HAS stock has declined by approximately 9%, in stark contrast to the S&P 500’s remarkable 175% ascent. Currently, Hasbro shares are trading below both their 50-week and 200-week moving averages. Given these indicators, investors may be prudent to exercise caution regarding the stock, at least until updated guidance is provided in the next quarter.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly tripling the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Hasbro, Inc. (HAS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.