The Rise and Fall of JinkoSolar

JinkoSolar Holding Co., Ltd. (JKS) stands as a towering figure in the realm of solar panel manufacturing. However, recent years have seen JinkoSolar, akin to its industry peers, face a challenging landscape marred by escalating interest rates and formidable periods of expansion.

The Foundation of JinkoSolar

JinkoSolar boasts a diverse portfolio, catering to various market segments with its array of solar panels. From residential rooftop solutions to high-performance industrial and commercial systems, the company has successfully navigated through the solar energy market.

The Chinese government’s initiative to bolster solar panel production in the country immensely benefitted JinkoSolar. Its vertically integrated manufacturing model played a pivotal role in cost reduction, enabling the production of high-tech PV panels at a competitive price point.

Recent Financial Struggles

Despite a stellar performance during the Covid era, catalyzed by government incentives and market dynamics, JKS witnessed a meteoric rise in revenue from 2019 to 2023, reaching around $16.62 billion. However, the recent Q4 earnings of $1.21 per share fell significantly short of estimates, triggering a series of downward revisions.

The guidance provided by JinkoSolar for the upcoming quarters painted a bleak picture, prompting analysts to slash their earnings projections. Notably, JinkoSolar’s fourth-quarter gross margin plummeted to 12.5% due to a sharp decline in module prices.

Looking Ahead

As JinkoSolar grapples with its current predicament, it has garnered a Zacks Rank #5 (Strong Sell). CEO Xiande Li acknowledged the challenges faced by the company, hinting at the need for strategic recalibration to overcome the hurdles.

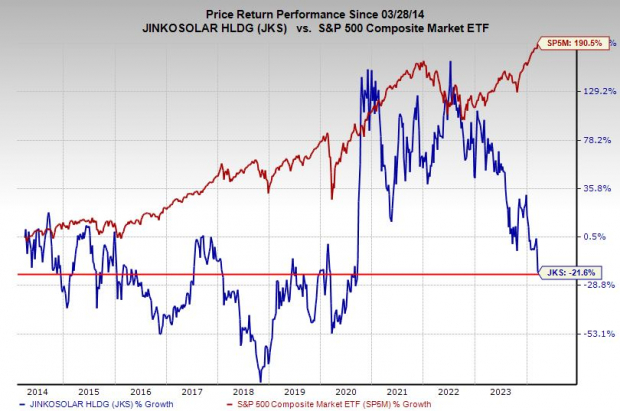

The future of JinkoSolar appears uncertain, with the company’s stock plummeting 22% over the past decade. Investors are advised caution, steering clear of JKS until tangible signs of a turnaround emerge on Wall Street’s horizon.

5 Stocks Set to Double

Opportunities beckon in the stock market as Zacks experts handpick five potential gems for investors to consider. As previous recommendations soared to incredible heights, these under-the-radar stocks present a compelling proposition for astute investors.

Unveil These Promising Stocks Today >>

For the full article, visit Zacks.com.

Please note that the opinions expressed in this article are those of the author and do not necessarily reflect the views of Nasdaq, Inc.