The Calm Before the Storm

Malibu Boats (MBUU), a renowned designer and manufacturer of sport boats, is facing significant headwinds disrupting its top and bottom-line projections, leading to a Zacks Rank #5 (Strong Sell) rating. The exuberant consumer spree that ensued after the Covid-19 lockdown resulted in a surge in purchases of high-value items such as boats. While this surge was initially well-received, it has now created a hurdle by accelerating sales, ultimately constraining future sales for the company.

Reviewing the Numbers

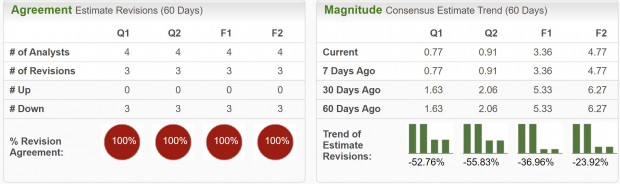

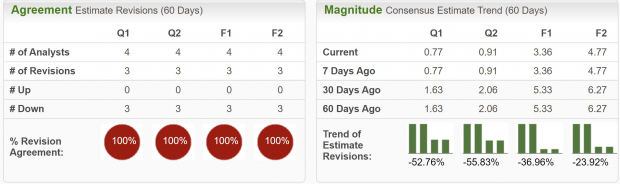

The infrequency of boat purchases implies an anticipated growth slowdown for Malibu Boats in the coming period, making it a less attractive investment option. Analysts have responded to the company’s woes by uniformly revising earnings estimates downward. Current quarter sales have plummeted by -53% in the last two months and are expected to nosedive by -71% year-over-year to a mere $0.77 per share. Furthermore, FY24 earnings estimates have been slashed by -37% with an expected -43% year-over-year decline.

Weathering the Storm

The forecast for top-line growth is equally dreary, with current quarter sales anticipated to plummet by -39% year-over-year to $228 million and FY24 sales by -32% to $940 million. The downtrend in both sales and earnings estimates underscores the challenges that continue to plague Malibu Boats.

Image Source: Zacks Investment Research

Storming the Valuation

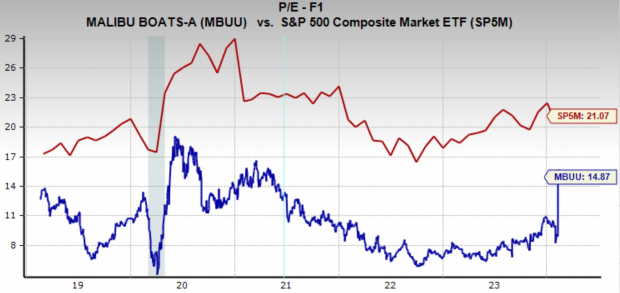

Adding to the concern is the company’s premium valuation, despite the downward spiral in both top and bottom-line figures. With a one-year forward earnings multiple of 14.9x, Malibu Boats stands nearly 50% above its five-year median of 9.9x, warranting a cautious approach for investors.

Image Source: Zacks Investment Research

Navigating Troubled Waters

While Malibu Boats is braving short-term challenges, it would be premature to write off the stock entirely. However, given its current predicament, investors would be better served by exploring alternative opportunities in the market.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Malibu Boats, Inc. (MBUU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.