NIKE, Inc. NKE is in a turnaround mode as revenue has fallen. This Zacks Rank #5 (Strong Sell) is expected to see earnings fall, as well, by the double digits in fiscal 2025.

NIKE is a designer, marketer and distributor of athletic footwear, apparel, equipment and accessories for many sports and fitness activities. It also owns Converse, which also designs, markets and distributes athletic lifestyle footwear, apparel and accessories.

NIKE Revenue Falls 10% in Q1 of Fiscal 2025

On Oct 1, 2024, NIKE reported its fiscal 2025 first quarter results. It beat again on earnings reporting $0.70 versus the Zacks Consensus of $0.52. That makes it 5 earnings beats in a row

However, revenue fell 10% to $11.6 billion. Both direct revenues and wholesale were down. Direct revenue fell 13% to $4.7 billion while wholesale revenue declined 8% to $6.4 billion.

Converse fell as well, with revenue declining 15% on a reported basis to $501 million.

There was some good news in the report. Gross margin increased 120 basis points to 45.3%.

New CEO Starting in October 2024

On Sep 19, 2024, the NIKE Board of Directors appointed Elliott Hill as President and CEO. It was effective as of Oct 14, 2024.

Given the management changes, NIKE postponed its Investor Day.

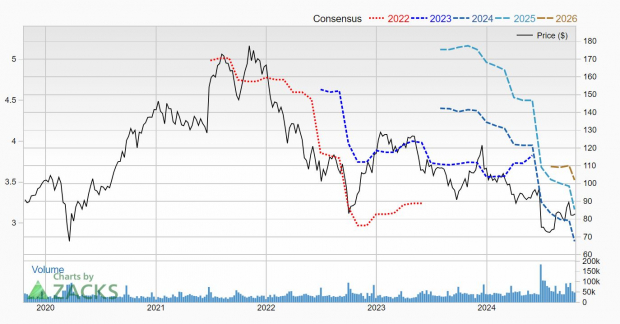

NIKE’s Earnings Estimates Plunge

There’s a lot of uncertainty with NIKE due to management changes. The analysts, however, remain bearish.

For fiscal 2025, 13 estimates have been cut in the last 30 days, with one lowered in just the last week.

The fiscal 2025 Zacks Consensus Estimate has fallen to $2.78 from $3.04 in the last month. That is an earnings decline of 29.6% from fiscal 2024 where NIKE made $3.95.

The analysts do expect a rebound in fiscal 2026 with earnings of $3.17 but the analysts were still cutting for that year as well. 13 estimates were cut in the last 30 days with 1 in the last week.

Here’s what it looks like on the 5-year price-and-consensus chart.

Image Source: Zacks Investment Research

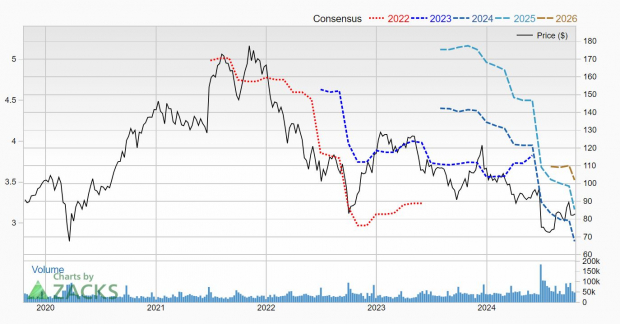

Nike Shares Near Multi-Year Lows But Is It Cheap?

Over the past few years, shares of NIKE have plunged to new multi-year lows.

Image Source: Zacks Investment Research

But the shares are still trading with a forward price-to-earnings (P/E) ratio of 29.9. A P/E ratio over 20 is considered a high P/E and not a value.

It also has a PEG ratio, which is the P/E divided by growth, of 2.0. A low PEG ratio is one that is 1.0 and under.

NIKE has a long tradition of being shareholder friendly. It has raised its dividend every year for the last 22 years.

It’s currently yielding 1.8%.

Additionally, the company is in the middle of a 4-year $18 billion share repurchase program. As of Aug 31, 2024, $10.2 billion has been repurchased.

Interested in investing in NIKE?

Investors might want to wait to see how the management changes shake out and for earnings estimates to start rising again before buying in.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

NIKE, Inc. (NKE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.