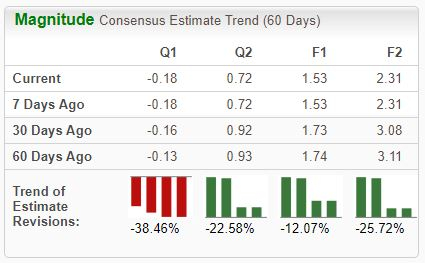

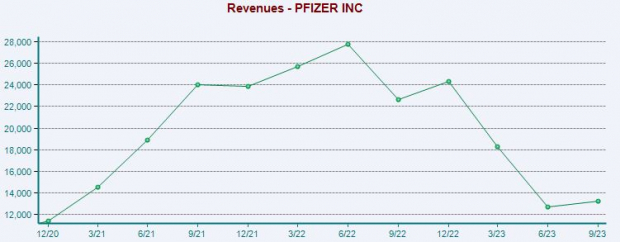

New York-based Pfizer PFE is in the business of selling a wide range of drugs and vaccines. However, analysts have taken a bearish stance on the company’s future, leading to its stock being marked as unfavorable with a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

In addition to this, the company belongs to the Zacks Large Cap Pharmaceutical industry, which is currently ranked in the bottom 30% of all Zacks industries. Let’s delve deeper into the company’s current standing.

Pfizer’s Performance

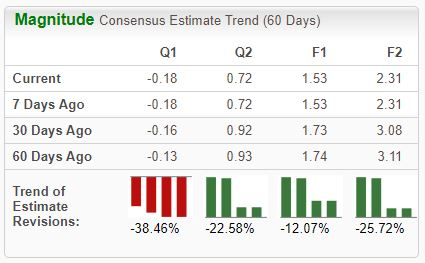

Over the past two years, Pfizer’s shares have plummeted by over 43%, making it a bumpy ride for investors since their peak during 2021. However, there has been a recent surge in purchasing activity, with shares bouncing back by more than 13% following their low in mid-December 2023.

Image Source: Zacks Investment Research

While the recent uptick in stock prices is encouraging, it would be prudent to wait for positive earnings estimate revisions to validate this recent optimism.

The company’s annual dividend yield has experienced a substantial increase amidst the unfavorable price action, with shares now offering a hefty 5.6% annually. It’s also notable that the company has demonstrated a strong commitment to its shareholders, boasting a 3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

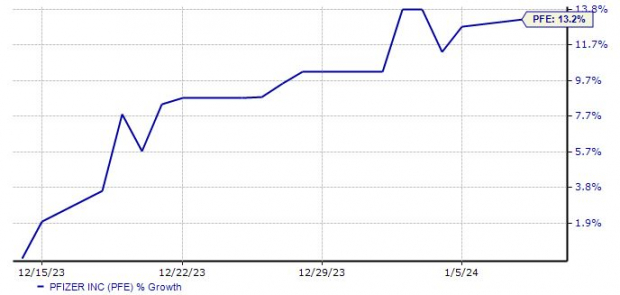

Unfortunately, Pfizer has recently reported mixed quarterly results, consistently falling short of consensus revenue expectations. The company’s top-line growth has stagnated due to declining vaccine sales post-pandemic, as depicted below.

Image Source: Zacks Investment Research

Bottom Line

With negative earnings estimate revisions and dwindling sales, Pfizer’s shares face a challenging trajectory in the near term. The Zacks Rank #5 (Strong Sell) reflects analysts’ pessimistic stance on the company’s earnings outlook.

For investors seeking robust stocks, an approach centered on stocks with a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) is advisable – these stocks exhibit a significantly stronger earnings outlook and present the potential for substantial gains in the near future.

5 Stocks Set to Double

Each stock was meticulously selected by a Zacks expert as the top pick to achieve +100% or more growth in 2023. Previous recommendations have seen remarkable increases of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks included in this report are under the radar of Wall Street, presenting an excellent opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.