Schneider National, Inc. SNDR is seeing a light at the end of the tunnel as the freight recession marches on. However, this Zacks Rank #5 (Strong Sell) still recently cut full year guidance.

Schneider is a multimodal provider of transportation, intermodal and logistics services. In business for 89 years, it has one of the broadest portfolios in the industry.

Schneider’s solutions include Regional and Long-Haul Truckload, Expedited, Dedicated, Bulk, Intermodal, Brokerage, Warehousing, Supply Chain Management, Port Logistics and Logistics Consulting.

Third Miss in a Row in Q1 2024

On May 2, 2024, Schneider National reported its first quarter 2024 results and missed on the Zacks Consensus for the third quarter in a row.

Earnings were $0.11 versus the consensus of $0.13.

Operating revenues fell 8% to $1.3 from $1.4 billion last year.

Truckload revenues, excluding fuel surcharges, increased $1.1 million to $538.1 million compared to the same quarter in 2023.

Intermodal revenues, excluding fuel surcharges, fell 7%, or $18.9 million, to $247.2 million year-over-year. First quarter 2024 volumes were flat compared to the same period a year ago.

Logistics revenues, excluding fuel surcharges, fell 15%, or $57.3 million, to $324.9 million due to decreased revenue per order and 8% lower brokerage volume compared with the year ago quarter. Much of that was due to muted freight conditions.

Schneider Cuts Full Year Earnings Guidance

It’s not all doom and gloom. The industry conditions have been tough in trucking. But Schneider is seeing a light at the end of the tunnel.

“We still believe the cycle is closer to its end than its beginning and anticipate improving conditions as the year progresses; however, we have tempered our outlook on the timing of the recovery,” said Darrell Campbell, Vice President and CFO.

Schneider cut its full year earnings guidance to a range of $0.85 to $1.00 from its prior guidance of $1.15 to $1.30.

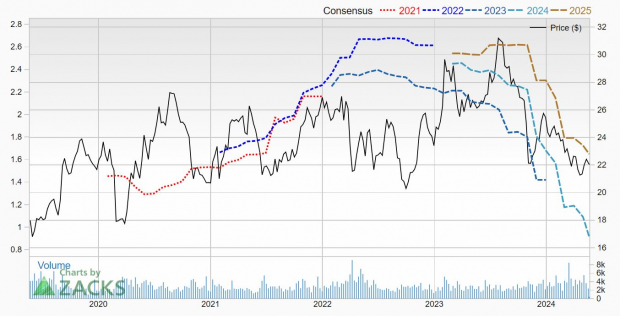

The analysts also have been cutting their estimates. 2 have cut in the last week, which has pushed the Zacks Consensus down to $0.92 from $1.13 just 30 days earlier.

That is an earnings decline of 33% as Schneider made $1.37 last year.

Analysts are also seeing the light at the end of the tunnel, as they expect 2025 earnings to jump 79.8% to $1.65.

Image Source: Zacks Investment Research

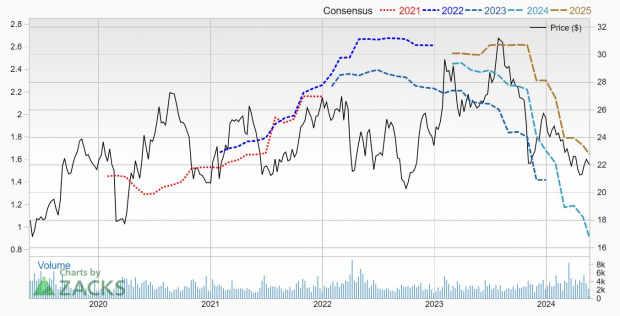

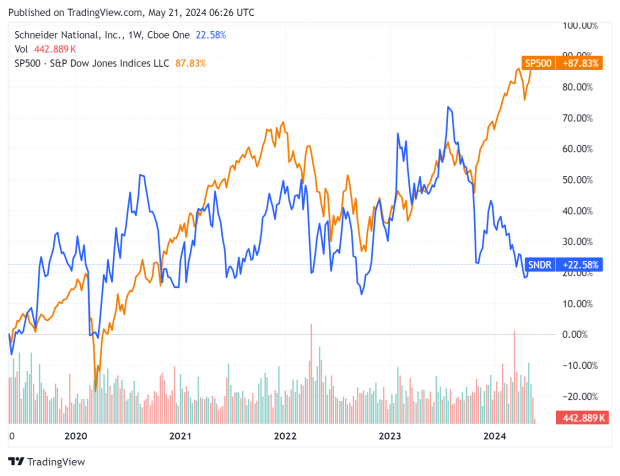

Shares Fall in 2024

Not surprisingly, given the guidance cut and the ongoing freight recession, the shares have been weak in 2024, falling 12.3%.

But they’re not yet back to the 5 year lows, which was in 2020 when the Covid pandemic hit.

Image Source: Zacks Investment Research

With the earnings being cut, it’s not especially cheap, with a forward P/E of 24.

It is, however, shareholder friendly even though the company’s free cash flow decreased $76.5 million in the quarter compared with a year ago.

In Feb 2023, Schneider announced a $150 million stock repurchase program. As of Mar 31, 2024, the company had repurchased 3.1 million Class B shares for a total of $79.2 million.

It also pays a dividend, which is currently yielding 1.7%. As of Mar 31, 2024, Schneider had returned $16.5 million in the form of dividends to shareholders year to date.

The company said in the first quarter press release that the freight recession has lasted longer than it originally anticipated.

But hopefully, it is nearing an end soon. Investors might want to wait on the sidelines for signs that it is, indeed, over.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

Schneider National, Inc. (SNDR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.