Beating the market with dividends alone has often been considered an almost insurmountable feat, especially when stacked against the S&P 500‘s long-term average annual gain of 10%. Yet, in the midst of unusual circumstances, an unexpected opportunity presents itself.

Amid this backdrop, Annaly Capital Management (NYSE: NLY) emerges as an intriguing prospect due to its remarkable 13.9% dividend yield. While the organization has experienced a decline in dividend payments in recent years, the corresponding dip in the stock’s performance positions it as an enticing option for a discerning investor.

Annaly Capital Management: A Closer Look

Annaly, a real estate investment trust (REIT), deviates from the typical REIT structure, which involves owning revenue-generating properties. In contrast, Annaly borrows money to acquire bundles of mortgage loans, profiting from the difference between the interest earned on these mortgages and the interest paid on the borrowed capital.

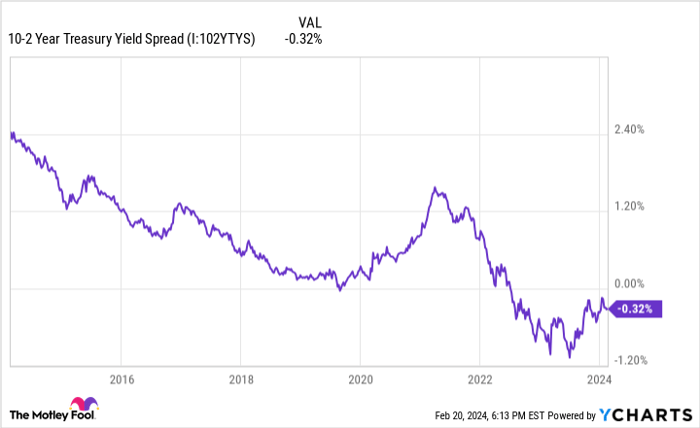

However, recent rapid changes in interest rates, particularly the inverted yield curve since mid-2022, have posed challenges for Annaly. The REIT has found its borrowing costs surpassing the interest payments collected on its mortgage loans, resulting in a period of poor stock performance.

Anticipated Shifts on the Horizon

Despite facing losses on a technical and GAAP basis since the invert, Annaly has managed to sustain dividend payments with available earnings. Yet, concerns loom regarding the organization’s ability to generate sustained GAAP profits and secure its future.

Nevertheless, as domestic and global economies stabilize and the yield curve gradually normalizes, long-term interest rates are projected to rise above short-term rates. Additionally, interest rates are beginning to stabilize around long-term pre-2008 norms, signifying a favorable shift in the investment landscape.

Assessing the Practicality of Investment

While Annaly may not be suitable for every portfolio due to its speculative nature, its current yield presents a compelling opportunity for investors seeking above-average near-term income. However, caution is advised, as the potential for a reduction in the high dividend yield could exert downward pressure on the stock.

Therefore, while the current market conditions offer a window of opportunity for Annaly Capital Management, prudence should prevail for potential investors seeking to capitalize on the REIT’s prospects.

Should you invest $1,000 in Annaly Capital Management right now?

Before you consider investing in Annaly Capital Management, it’s crucial to acknowledge that the Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors to buy now, with Annaly Capital Management not among them. The recommended stocks are anticipated to yield substantial returns in the coming years.

The Stock Advisor service offers investors a comprehensive blueprint for success, delivering insights on portfolio development, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.

Explore the 10 recommended stocks

*Stock Advisor returns as of February 20, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.