Paul Zimmerman/Getty Images Entertainment

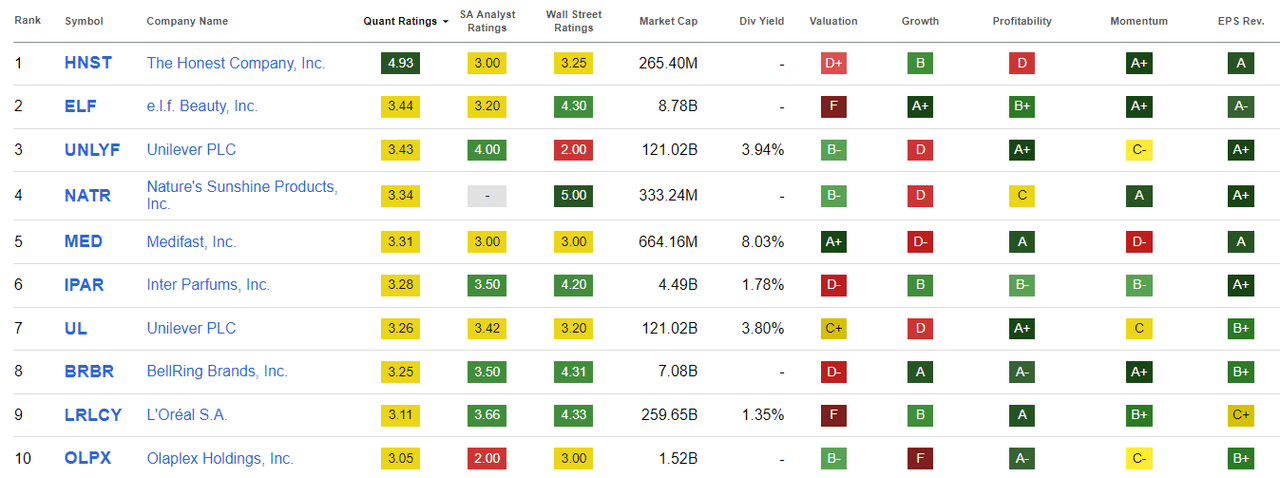

Amidst the fiery blaze of earnings season, two standout stars in the personal care sector are Honest Company (NASDAQ:HNST) and e.l.f. Beauty (NYSE:ELF). Over the past half year, Honest Company’s shares have soared by more than 60%, while e.l.f. Beauty is up over 40%. These two titans have ascended to the very peak of the personal products sector based on a quantitative analysis.

Stellar Performance

In the lead-up to the earnings announcements, Honest Company (HNST) bolstered confidence by reiterating its FY23 revenue and adjusted EBITDA outlook in early January. Market watchers anticipate the company to report revenue of $84.1M and EPS of -$0.07 for FQ1. Notably, the last three EPS revisions on HNST trended upward, while short interest on the stock stands at a mere 3.6% of the total float. Adding to this, the stock trades above its 100-day and 200-day moving averages.

Meanwhile, e.l.f. Beauty (ELF) kicked off the year with a 9% surge. Analysts expect the California-based company to unveil earnings of $231.6M and EPS of $0.51 on February 6. The fact that the last 14 EPS revisions on ELF have all been upward further amplifies the optimism. e.l.f. Beauty also outshines its sector peers in gross profit margin, EBITDA margin, and cash per share, while boasting a stellar five-year sales growth rate of 18.6% on average, eclipsing the sector average.

Upcoming Thunder

This week, Honest Company (HNST) flashes on Seeking Alpha’s Catalyst Watch as CEO Carla Vernon is set to grace the three-day National Retail Federation Big Show with her presence. On the other hand, e.l.f. Beauty (ELF) aims to whip up a storm with a new 15-minute parody film slated for streaming on Amazon Freevee and Youtube. This parody will also illuminate AMC theaters, shining just before Paramount’s new Mean Girls movie.