Invitation Homes Inc.: An Overview of Recent Performance and Market Position

Invitation Homes Inc. (INVH), based in Dallas, stands out as a leading single-family home leasing and management company in the U.S. With a market capitalization of $20.8 billion, Invitation Homes focuses on delivering high-quality, renovated homes in sought-after neighborhoods that align with contemporary lifestyle needs.

Market Position and Portfolio Strategy

Defined as “large-cap stocks,” companies with a market cap of $10 billion or more exemplify stability and investment potential. Invitation Homes fits this category, boasting a portfolio primarily concentrated in the Western U.S., Southeast, Texas, and Florida. The locations feature essential amenities such as job access, quality schools, and good transportation, reinforcing its presence in the residential real estate market.

Recent Stock Performance

On September 4, 2024, INVH reached a two-year high of $37.80, though it is currently trading 10.4% below that peak. Over the past three months, the company’s stock rose by 5.4%, outperforming the Residential REIT ETF (HAUS), which gained 2.6% in the same period.

Despite recent short-term successes, INVH has faced challenges in the longer run. The stock has dropped 6% over the last six months and declined 3.5% year-over-year, in contrast to HAUS, which has experienced a 5.1% decrease over the last six months but a notable 15.9% increase over the past year.

Moreover, INVH has predominantly traded below its 50-day moving average since late September of last year, and it has mostly remained under its 200-day moving average since early October, aside from some fluctuations.

Financial Results and Future Outlook

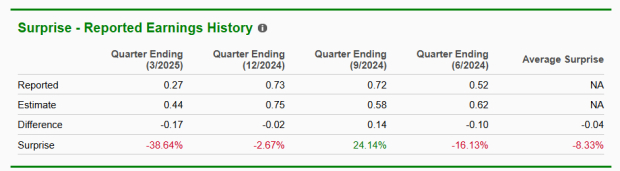

The stock surged 5.5% following the release of impressive fourth-quarter results on February 26. The company reported a year-over-year revenue growth of 5.6%, totaling $659 million, which slightly exceeded analyst forecasts. Core Funds from Operations (FFO) per share also rose by 5.9% year-over-year to $0.47, fueled by strong operational efficiency and consistent rental growth. With average occupancy rates at a remarkable 96.7%, Invitation Homes demonstrates its commitment to operational excellence and investor satisfaction.

For fiscal year 2024, total revenues rose 7.7% year-over-year to $2.6 billion, while Adjusted Funds from Operations (AFFO) per share improved by 6.7% to $1.60. The company has actively expanded its portfolio, adding 2,200 newly built homes. In a challenging broader real estate landscape, Invitation Homes maintains a competitive edge through intentional investments in new developments and careful cost management, laying a strong foundation for future growth.

While INVH has outperformed Equity Residential (EQR), which saw an 8.8% decline over the past six months, it has lagged behind EQR’s impressive 10% increase over the last year.

Analyst Insights

Among the 22 analysts evaluating INVH, the consensus rating is a “Moderate Buy.” The mean price target stands at $36.49, indicating a 7.7% upside from current levels.

On the date of publication, Aditya Sarawgi did not hold positions in any of the securities mentioned in this article. All information and data are for informational purposes only. Please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.