“`html

Warren Buffett’s Key Investments Reveal Strategic Focus Amid Changes

For decades, no money manager has captured the attention of Wall Street professionals and everyday investors quite like Berkshire Hathaway‘s (NYSE: BRK.A)(NYSE: BRK.B) Warren Buffett. His remarkable outperformance of the benchmark S&P 500 since becoming CEO 60 years ago is a testament to his investment acumen. Over this period, he’s managed a staggering aggregate return of over 6,230,000% on his company’s Class A shares (BRK.A), compared to a total return of about 39,700% for the S&P 500 during the same timeframe.

Recently, Berkshire Hathaway has made news during its annual shareholder meeting held on May 3. At this event, the company unveiled its first-quarter operating results and revealed Buffett’s plan to step down as CEO by year-end. His predetermined successor, Greg Abel, will take over upon Buffett’s departure.

Focus on Recent Filings: What Berkshire’s 13F Shows

On May 15, Berkshire Hathaway submitted its Form 13F to the Securities and Exchange Commission. This filing provides details on which stocks Buffett and his top advisors bought and sold in the latest quarter. A notable trend is Buffett’s preference for concentrated investments. He and the late Charlie Munger have historically allocated a significant portion of their capital to their most promising ideas.

Post-13F release, it’s revealed that Buffett has approximately 58% of Berkshire’s $287 billion portfolio invested in just four leading stocks.

Apple: $63.4 Billion (22.1% of Invested Assets)

Leading the pack is Apple (NASDAQ: AAPL), maintaining its status as Berkshire Hathaway’s largest holding, although its share count has decreased significantly. By the end of September 2023, Berkshire owned 915,560,382 shares of Apple; by March 31, 2025, this figure had fallen to 300,000,000 shares. Had Buffett not sold any, this original stake would be valued at $193.4 billion today.

Buffett’s appreciation for Apple stems from his understanding of consumer loyalty. Apple customers are known for their commitment to the brand, willing to pay premium prices for products. This loyalty has been crucial for Apple CEO Tim Cook as he expands the company’s services segment. Subscription-based services enhance customer retention and should improve operating margins over time, along with mitigating fluctuations tied to iPhone replacement cycles.

Additionally, Buffett admires Apple’s robust capital-return program. With Apple repurchasing $49.5 billion worth of shares in the first half of fiscal 2025, they have bought back around $775 billion since launching the program in 2013—effectively increasing Berkshire’s stake in Apple passively.

Image source: American Express.

American Express: $45.4 Billion (15.8% of Invested Assets)

Though Buffett hasn’t purchased American Express (NYSE: AXP) shares recently, this long-held position—maintained since 1991—has grown to $45.4 billion, making it Berkshire’s second-largest holding.

American Express thrives during prolonged economic expansions. As the third-largest credit card processor in the U.S., it generates income from merchant fees and lending activities. This strategy has made it a preferred option for high-income earners, ensuring their loyalty even in economic downturns.

Moreover, Buffett enjoys a substantial yield from American Express, with an annual payout of $3.28 per share against a cost basis of around $8.49. This results in a 38.6% yield on cost for Berkshire.

Coca-Cola: $28.8 Billion (10% of Invested Assets)

Since its acquisition in 1988, Coca-Cola (NYSE: KO) has become another cornerstone of Berkshire’s portfolio. Its resilience stems from selling essential beverages, which helps maintain stability during economic fluctuations. Operating in almost every country, Coca-Cola’s reach allows it to generate reliable cash flow and growth in emerging markets.

Coca-Cola has effectively engaged consumers through innovative marketing strategies, embracing technology to reach younger audiences while maintaining its classic appeal to older generations. The company recently increased its annual dividend for the 63rd consecutive year. With a cost basis of $3.2475 per share and a new dividend of $2.04, this brings Berkshire a staggering yield on cost of 62.8%.

“`

Buffett’s Berkshire Boosts Coca-Cola Investment with Strong Dividends

Berkshire Hathaway is seeing significant gains from its investment in Coca-Cola, effectively doubling its initial investment through dividends approximately every 21 months.

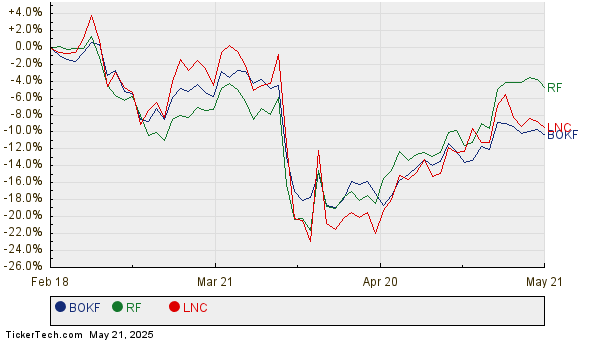

Bank of America: $28.2 Billion Investment (9.8% of Assets)

In addition to Coca-Cola, Berkshire’s investment portfolio includes a substantial stake in Bank of America (NYSE: BAC). This position has dropped from second to fourth place among Berkshire’s holdings recently. A review of Berkshire’s 13F filing shows the company sold 48,660,056 shares of Bank of America during the first quarter. Since July 17, 2024, over 401 million shares have been divested from a total stake that exceeded 1.03 billion shares.

Buffett’s preference for financial stocks stems from his understanding of the sector’s cyclical nature. Rather than predicting economic downturns, Buffett has structured Berkshire’s portfolio to capitalize on extended periods of economic expansion. During robust economic growth, institutions like Bank of America can prudently expand their loan portfolios.

Bank of America stands out as the most interest-sensitive among U.S. money-center banks. As interest rates surged from March 2022 to July 2023, the bank significantly boosted its net interest income. Although the Federal Reserve is entering a rate-easing phase—typically unfavorable for banks—the measured approach allows BofA to continue issuing high-interest loans.

Furthermore, Bank of America maintains a notable capital-return program. It currently provides an annual dividend of $1.04 per share, and its share repurchase initiative has reduced the outstanding share count by nearly 29% since 2017. This reduction positively impacts the bank’s earnings per share.

Should You Consider Investing $1,000 in Apple?

Before investing in Apple, it’s worthwhile to assess your options:

The Motley Fool Stock Advisor analyst team recently identified their top 10 stock picks, notably excluding Apple. The selected stocks may yield significant returns in the upcoming years.

For instance, when Netflix was highlighted on December 17, 2004, a $1,000 investment would now be worth $642,582!

Similarly, if you had invested $1,000 in Nvidia after its feature on April 15, 2005, it would have grown to $829,879!

The Stock Advisor’s average return stands at an impressive 975%, far surpassing the S&P 500’s 172% returns. Consider exploring their latest top 10 list to maximize your investing potential.

The views expressed here represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.