Berkshire Hathaway Defies Market Trends Amid Economic Uncertainty

While much of the Stock market has faced significant sell-offs due to tariffs and economic concerns, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) has shown remarkable resilience. As of now, the shares have risen over 14% year-to-date, contrasting sharply with the S&P 500 index’s 10% decline.

Berkshire’s performance serves as a stabilizing force amid the recent market turmoil, positioning it as a strong investment choice in the current environment. However, can investors anticipate robust returns over the coming years?

Wondering where to invest $1,000 today? Our analyst team has identified the 10 best stocks to buy right now. Continue »

Warren Buffett: The Oracle of Omaha

Warren Buffett, Chief Executive Officer of Berkshire, has truly embodied his title as the “Oracle of Omaha.” This year, he strategically reduced the company’s equity positions while building up cash reserves. Last year, he sold $143 billion in Stock, including major holdings like Apple and Bank of America, with only $9 billion in new purchases.

Starting in May, Buffett also halted the buyback of Berkshire Stock, marking a departure from his previous six years of consistent repurchases. By the end of the year, Berkshire’s cash and short-term investments totaled an impressive $334 billion, bolstered by strong cash flows from its insurance and other operating businesses.

Although Buffett does not focus on timing the market, his recent moves have proven strategic. He managed to lower the company’s equity exposure at advantageous prices before the market downturn. With the current volatility, Berkshire is now poised with significant cash reserves ready for investment opportunities.

Even with a growing cash reserve, Buffett continues to advocate for long-term stock investments. He has, however, acknowledged the stock market’s overvaluation and the risks that were not being factored in.

Armed with $334 billion in cash, Buffett has multiple avenues for investment. He can acquire undervalued stocks or even purchase companies outright. Amid fluctuating market conditions marked by varying tariffs, there could be private firms seeking exit strategies. Historically, Berkshire is seen as a desirable acquirer, with Buffett’s amicable reputation aiding negotiations.

Buffett has previously assisted companies in financing acquisitions, such as backing Mars in buying Wrigley during the financial crisis. He also supported Goldman Sachs by purchasing preferred equity and warrants, earning $3.7 billion on a $5 billion investment in three years. During turbulent periods, Buffett tends to uncover significant investment opportunities.

Image source: Getty Images.

Projected Outlook for Berkshire Hathaway

Berkshire Hathaway’s cash reserves and Buffett’s leadership put the company in a favorable position. However, its shares may not be considered cheap historically, which partly explains Buffett’s decision to stop buying back shares.

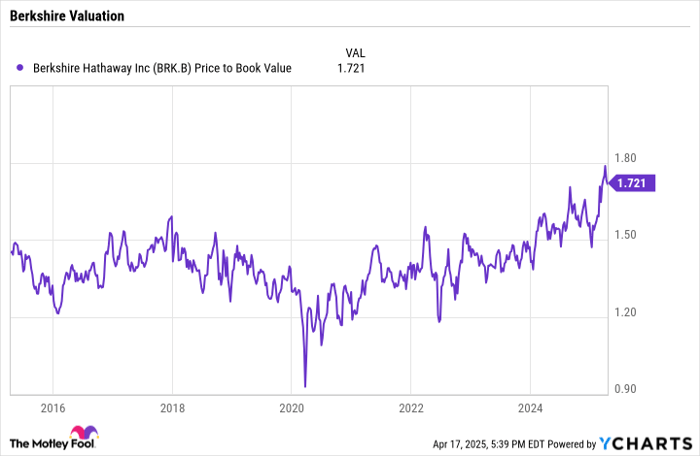

Buffett traditionally relied on price-to-book (P/B) ratio as a key valuation metric. He previously looked to repurchase shares when the stock traded below 1.1 times book value, later raising this threshold to 1.2 times. Eventually, he broadened his approach, opting to repurchase shares based on intrinsic value. Currently, the stock trades at a P/B ratio of 1.7, significantly exceeding the valuations at which Buffett historically engaged in buybacks.

This ratio also represents one of the highest values for the stock over the past decade:

BRK.B Price to Book Value data by YCharts.

While Berkshire appears well-positioned for the long haul, the current valuation suggests only modest upside in the stock price over the next few years. It’s likely Buffett will effectively utilize the cash reserves, but the value of Berkshire’s equity portfolio has also declined, resulting in an even higher P/B ratio than reflected at present.

Overall, while fresh investments from Buffett may increase Berkshire’s book value in the coming years, some decline in valuation is anticipated, leading to respectable but moderate returns.

Is Now a Good Time to Invest $1,000 in Berkshire Hathaway?

Before purchasing Berkshire Hathaway Stock, consider the following:

The Motley Fool Stock Advisor analyst team has pinpointed the 10 best stocks for investors to consider right now, and Berkshire Hathaway is not on that list. The stocks featured could yield impressive returns in the upcoming years.

Reflect on the investment opportunity with Netflix on December 17, 2004… a $1,000 investment back then would now be worth $524,747!* Similarly, look at Nvidia from April 15, 2005… a $1,000 investment then would amount to $622,041!*

Notably, the average total return of Stock Advisor stands at 792% — significantly beating 153% for the S&P 500. Join Stock Advisor to access the latest top 10 stocks.

see the 10 stocks »

*Stock Advisor returns as of April 14, 2025

Bank of America is an advertising partner of Motley Fool Money. Geoffrey Seiler holds no position in any of the stocks mentioned. The Motley Fool is invested in and recommends Apple, Bank of America, and Berkshire Hathaway. The Motley Fool’s disclosure policy is available for review.

The views and opinions expressed herein reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.