Berkshire Hathaway Achieves Strong Market Performance Amid Challenges

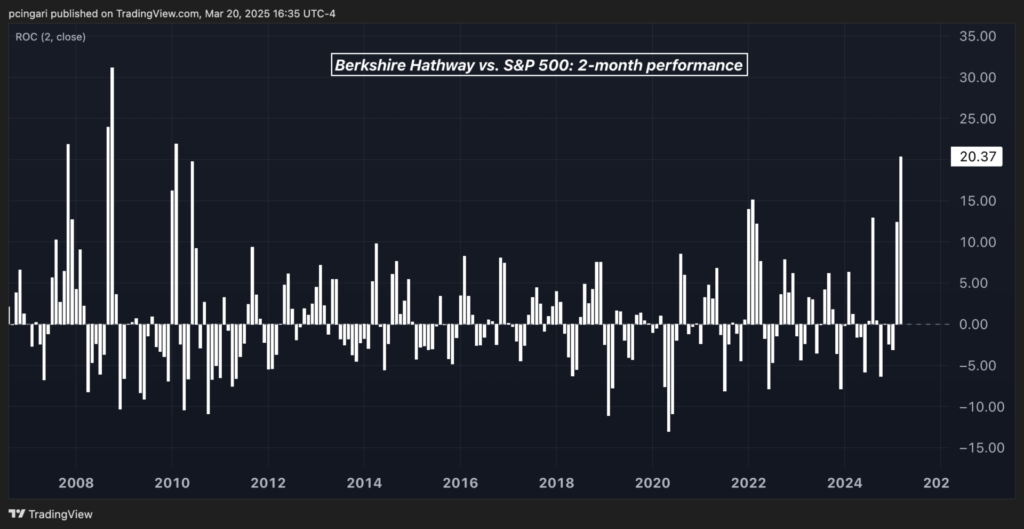

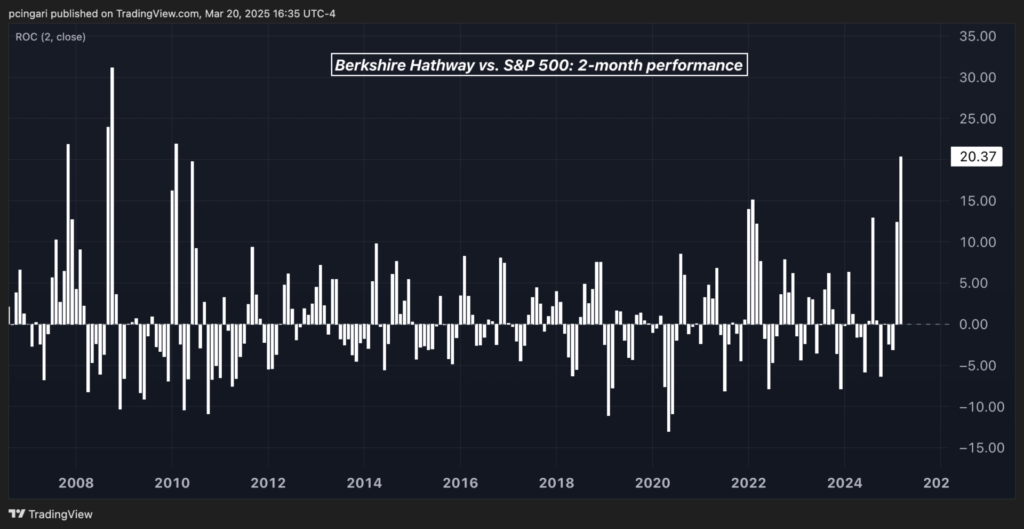

As market conditions shift, Warren Buffett‘s Berkshire Hathaway Inc. BRK is poised for its most robust two-month performance in comparison to the S&P 500 since 2010.

In February 2025, the Omaha-based conglomerate saw a significant increase of 10.3%, its best month since March 2022. This upward trend continued in March with an additional gain of 2.5%.

In contrast, the SPDR S&P 500 ETF Trust SPY, which reflects the broader market movement, experienced a decline of 1.3% in February, followed by a nearly 5% drop in March.

This divergence has pushed Berkshire’s performance ahead of the S&P 500 by 20 percentage points since February, marking the company’s most notable two-month period against the index in over a decade.

Looking back at 2024, Berkshire Hathaway only slightly outperformed the S&P 500 with a margin of 1.8 percentage points.

On Thursday, shares of Berkshire Hathaway Inc. New achieved all-time highs, closing at $528.73.

Buffett’s Long-Term Investment Philosophy

Berkshire’s current momentum reflects Warren Buffett’s enduring investment strategy elaborated in the company’s latest annual letter to shareholders. The 93-year-old billionaire stresses the value of a patient, long-term outlook: “Over time, we think it highly likely that gains will prevail – why else would we buy these securities? – though the year-by-year numbers will swing wildly and unpredictably. Our horizon for such commitments is almost always far longer than a single year. In many, our thinking involves decades. These long-termers are the purchases that sometimes make the cash register ring like church bells.”

Buffett also pointed out Berkshire’s significant contribution as a taxpayer, noting that it has paid more in corporate income taxes than any U.S. company, including tech leaders with trillion-dollar valuations. In 2024 alone, Berkshire made four payments to the IRS totaling $26.8 billion, accounting for approximately 5% of all corporate taxes collected in the U.S.

Berkshire’s Major Holdings

As of December 2024, Berkshire’s latest 13F filing indicates that Apple Inc. AAPL remains its largest investment, comprising 28.1% of the portfolio. Following Apple are American Express Co. AXP with 16.8% and Bank of America Corp. BAC at 11.2%.

Read Next:

Image created using artificial intelligence via Midjourney.

Momentum75.50

Growth47.14

Quality83.02

Value8.01

Market News and Data brought to you by Benzinga APIs