Bernstein Rates Eaton as Outperform with Promising Growth Ahead

Fintel has reported that on November 5, 2024, Bernstein started coverage of Eaton (NYSE:ETN), giving it an Outperform rating.

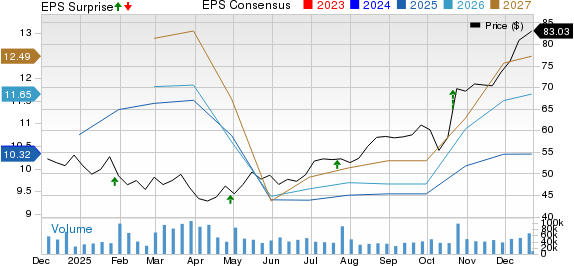

Analysts Predict a 6.82% Increase

As of October 21, 2024, the average one-year price target for Eaton stands at $360.66 per share. Estimates stretch from a low of $282.80 to a high of $412.65. This average target indicates a potential gain of 6.82% from Eaton’s recent closing price of $337.63 per share.

Insights on Fund Sentiment

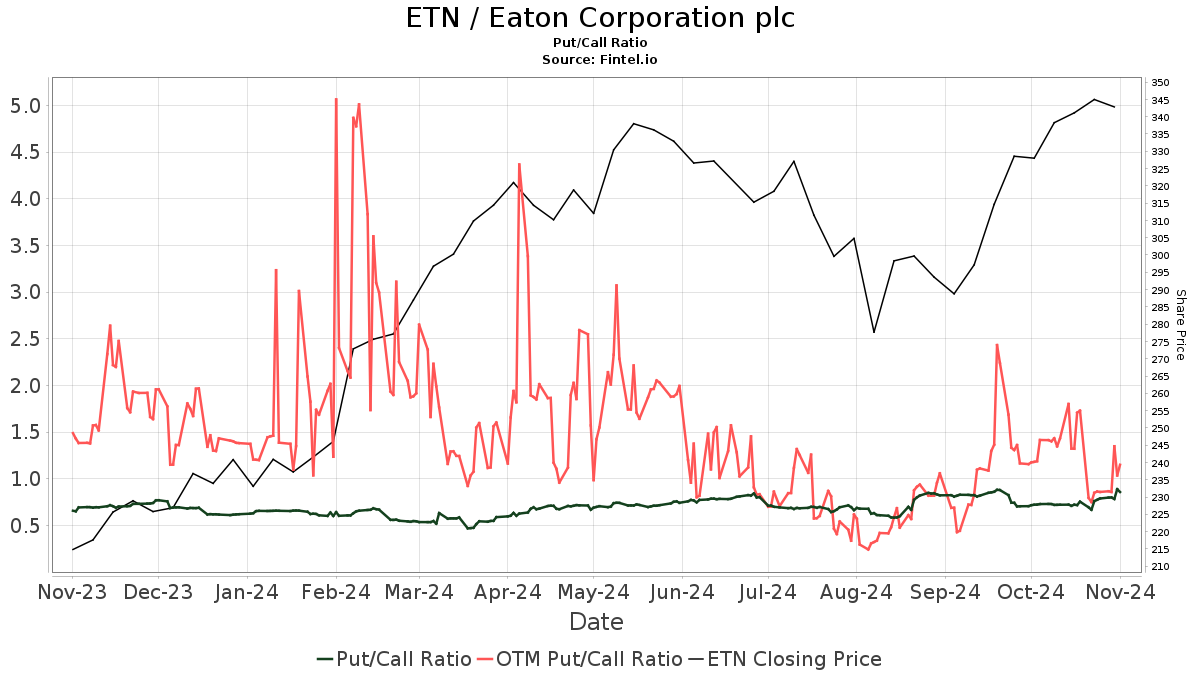

Currently, 3,209 funds or institutions have reported their holdings in Eaton, marking an increase of 131, or 4.26%, from the previous quarter. The average portfolio weight for all funds invested in ETN is 0.48%, which is up by 6.77%. However, the total shares owned by institutions fell by 0.47% over the past three months, totaling 380,915K shares.  The current put/call ratio for ETN stands at 0.93, indicating a generally optimistic outlook.

The current put/call ratio for ETN stands at 0.93, indicating a generally optimistic outlook.

Changes in Shareholder Holdings

JPMorgan Chase currently holds 22,011K shares, which equates to 5.57% ownership of Eaton. In its last filing, the firm reported owning 23,990K shares, reflecting a decrease of 8.99% and a reduction in its portfolio allocation by 10.65% over the last quarter.

Bank of America owns 12,652K shares, translating to 3.20% ownership. Previously, they reported ownership of 13,538K shares, indicating a 7.01% decline and a substantial cut in allocation by 78.04% this quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) has 12,644K shares, accounting for 3.20% ownership. Their last report showed ownership of 12,553K shares, marking a slight increase of 0.72%, although their portfolio allocation dropped by 1.78%.

Massachusetts Financial Services possesses 10,323K shares, or 2.61% ownership, down from 11,811K shares, a decline of 14.42%. They’ve also reduced their allocation in ETN by 86.16% in this last quarter.

The Vanguard 500 Index Fund (VFINX) holds 10,261K shares, which is 2.60% of the company. In the previous filing, they owned 10,062K shares, showing a rise of 1.94%, but with a 3.20% decrease in their portfolio allocation this quarter.

About Eaton

(Provided by the company.)

Eaton’s mission focuses on enhancing quality of life and protecting the environment through its power management technologies and services. Their sustainable solutions ensure customers manage electrical, hydraulic, and mechanical power more efficiently and reliably. In 2020, Eaton reported revenues of $17.9 billion and operates in over 175 countries with a workforce of approximately 92,000 employees.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

The platform offers extensive data including fundamentals, analyst reports, ownership data, fund sentiment, and more, all designed to enhance investment decisions.

Read the full story on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.