Bernstein Begins Coverage of Home Depot with Cautious Outlook

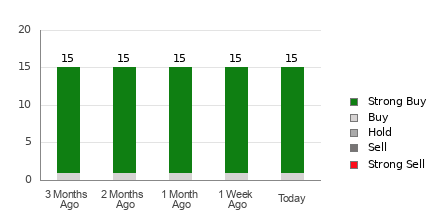

On October 22, 2024, Bernstein announced its initiation of coverage on Home Depot (XTRA:HDI), rating the company as Market Perform.

Analysts Predict Slight Decline in Stock Price

As of October 21, 2024, analysts have set an average one-year price target for Home Depot at 375,00 €/share. This range varies, with predictions detailing a low of 268,76 € and a high of 443,20 €. Based on these forecasts, this average target reflects a 2.10% decrease from Home Depot’s most recent closing price of 383,05 € per share.

For those interested, check out our list of companies with the largest potential upside in their price targets.

Strong Revenue Growth Expected

The projected annual revenue for Home Depot stands at 166,339MM, which marks a 9.37% increase. Additionally, the estimated annual non-GAAP EPS is forecasted at 17.30.

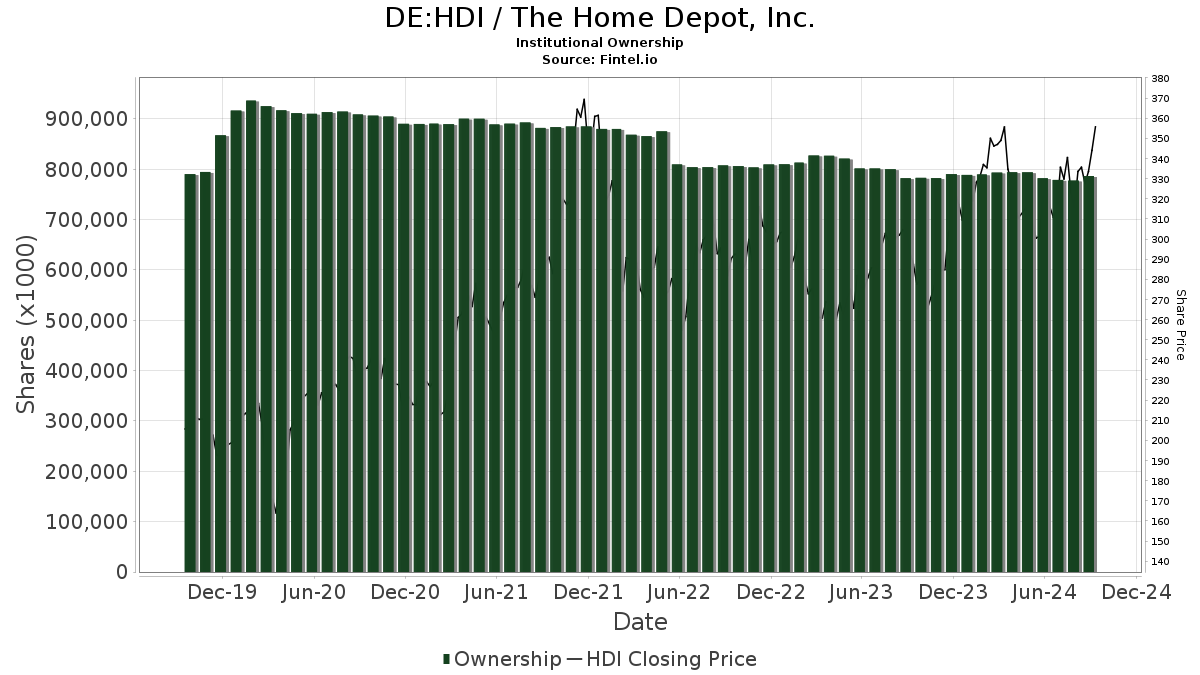

Investor Sentiment Towards Home Depot

Currently, there are 5,042 funds and institutions holding positions in Home Depot, reflecting an increase of 52 owners or 1.04% in the last quarter. The average portfolio weight for all funds invested in HDI is 0.72%, showing a rise of 6.27%. Additionally, institutional shares owned have increased by 4.65% over the past three months to 794,500K shares.

Actions of Notable Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 31,317K shares, which equates to 3.15% of the company. This reflects a slight increase from 31,269K shares reported previously, marking an increase of 0.15%. However, the firm’s overall portfolio allocation in HDI has decreased by 12.60% over the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 25,436K shares, corresponding to 2.56% ownership. This shows an increase from their prior holding of 25,081K shares, resulting in a gain of 1.39%. Yet, this firm also reduced its HDI allocation, dropping by 13.85% over the last three months.

Capital World Investors, once owning 37,665K shares, now holds 25,102K shares, reflecting a significant decrease of 50.05%. This institution has reduced its allocation in HDI by 41.08% during the last quarter.

Geode Capital Management increased its stake to 21,267K shares, representing 2.14% ownership, from 20,693K shares, an uptick of 2.70%. Yet, their portfolio allocation in HDI was cut by 54.30% in recent months.

Bank of America owns 14,189K shares, indicating 1.43% ownership. Previously, this institution reported owning 14,671K shares, now down by 3.39%. Their allocation in HDI experienced a drastic reduction of 79.66% in the past quarter.

Fintel remains a vital resource for individual investors, traders, financial advisors, and small hedge funds seeking comprehensive investment research.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.