Bernstein Starts Coverage of Merck with Cautious Outlook

On October 17, 2024, Bernstein began its analysis of Merck (LSE:0QAH), issuing a Market Perform recommendation.

Analysts Predict Significant Upside Potential

According to data from September 25, 2024, analysts have set the average one-year price target for Merck at 144.06 GBX per share. This figure represents a potential increase of 31.09% from the recent closing price of 109.90 GBX. Price forecasts vary, with estimates ranging from a low of 127.42 GBX to a high of 164.26 GBX.

For a broader perspective, see our leaderboard of companies with the largest potential price increases.

Merck’s Projected Revenue and Earnings

The anticipated annual revenue for Merck stands at 62,221MM, indicating a slight decrease of 0.41%. Additionally, the expected annual non-GAAP EPS is 8.65.

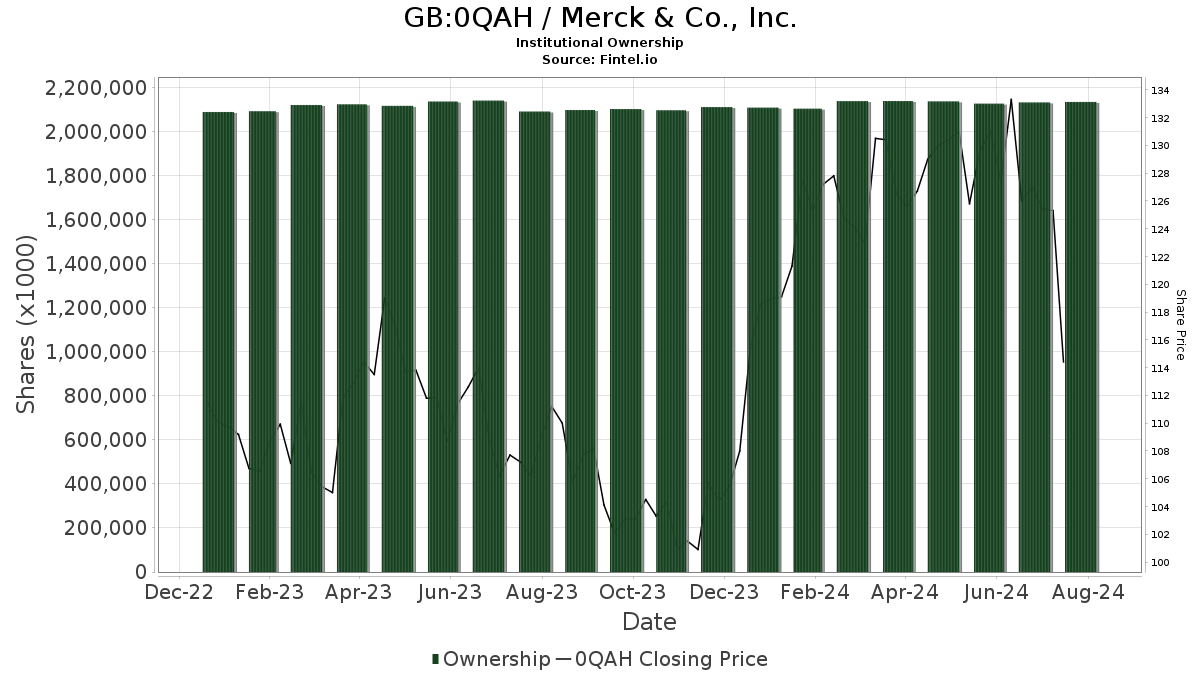

Institutional Interest in Merck

Recent data reveals that 5,087 funds or institutions currently hold shares in Merck, reflecting an increase of 28 owners, or 0.55%, over the past quarter. On average, these funds allocate about 0.74% of their portfolios to this stock, which is an increase of 10.18%. In the last three months, total shares owned by institutions rose by 3.55%, reaching 2,164,637K shares.

Activity Among Major Institutional Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares, known as VTSMX, holds 80,020K shares, which equates to 3.16% ownership of Merck. This is up slightly from the previous 79,658K shares, showing an increase of 0.45%. However, VTSMX reduced its allocation in Merck by 8.35% in the past quarter.

Wellington Management Group LLP now owns 72,482K shares, representing 2.86% of the company. This is a significant decline from their last report of 86,348K shares, or a decrease of 19.13%. Their portfolio allocation in Merck also slipped drastically by 88.82% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) has increased its holdings to 65,007K shares (2.56% ownership), up from 63,859K shares with a rise of 1.77%, but also reduced its allocation by 9.59% recently.

Geode Capital Management holds 57,021K shares, giving them 2.25% ownership. An increase of 1.07% from 56,411K shares was noted, but they too have decreased their allocation by 53.01% in the last quarter.

Moreover, Bank of America increased its holdings to 39,280K shares, an 8.32% rise from 36,012K shares; nevertheless, they cut back their portfolio allocation in Merck by 76.01% during the same period.

Fintel offers one of the most comprehensive investing research platforms available, catering to individual investors, traders, financial advisors, and small hedge funds. Their extensive data includes fundamentals, analyst reports, ownership data, fund sentiment, insider trading information, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.