Bernstein Begins Coverage of Eli Lilly with Strong Recommendation

On October 17, 2024, Bernstein announced it has initiated coverage of Eli Lilly (WBAG:LLYC), giving the company an Outperform rating.

Current Fund Sentiment Towards Eli Lilly

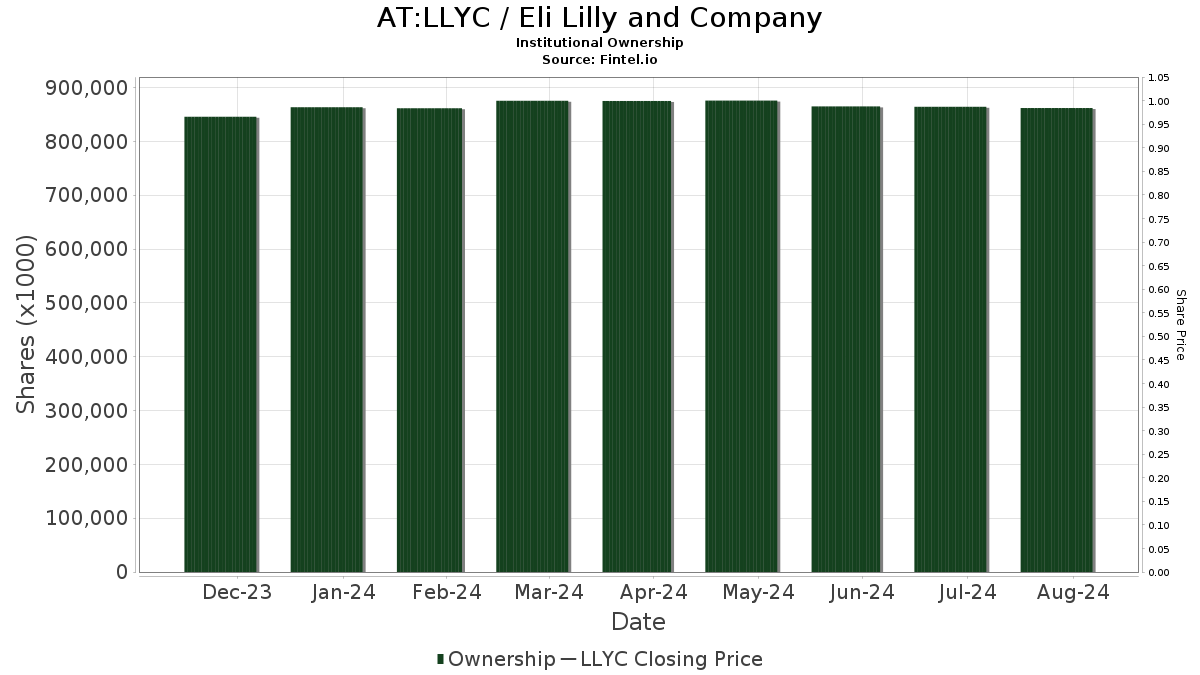

There are currently 5,162 funds or institutions that hold positions in Eli Lilly. This marks an increase of 140 owners, or 2.79%, since last quarter. The average portfolio weight of all funds invested in LLYC has risen to 1.28%, an increase of 4.86%. Over the past three months, total shares owned by institutions grew by 2.77% to reach 872,253K shares.

Institutional Ownership Insights

Lilly Endowment is a major stakeholder, holding 96,892K shares, which represents 10.76% ownership of the company. However, this is a slight decrease from the 97,367K shares reported previously, reflecting a 0.49% decline.

Pnc Financial Services Group owns 51,405K shares, accounting for 5.71% of the company. The firm reduced its ownership marginally from 51,438K shares, which is a 0.06% decrease. Nonetheless, Pnc increased its overall investment in LLYC by 11.40% over the last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 27,024K shares, indicating a 3.00% stake in Eli Lilly. The fund showed growth, increasing from 26,883K shares prior, marking a 0.52% increase and a 13.76% rise in portfolio allocation during the last quarter.

Capital World Investors reported 21,814K shares held, which represents 2.42% ownership, down from 24,536K shares—signifying a 12.48% decline. Their portfolio allocation in LLYC did see a slight increase of 1.94% in the past quarter.

Price T Rowe Associates owns 20,652K shares, equating to 2.29% ownership. This reflects a modest increase from the 20,613K shares reported earlier, an uptick of 0.19%. The firm has boosted its allocation in LLYC by 13.83% over the last quarter.

Fintel serves as a leading research platform for investors, offering data on fundamentals, analyst reports, and fund sentiment, among other insights. With tools designed for improved investment strategies, the platform supports traders and financial advisors alike.

This report initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.