Ford’s Future: Bernstein Downgrades to Market Perform

On November 7, 2024, Bernstein updated its outlook for Ford Motor (XTRA:FMC1), lowering it from Outperform to Market Perform.

Analysts Project a 19.25% Upside for Ford

The average one-year price target for Ford Motor is set at 11,54 €/share as of October 22, 2024. Predictions range from a low of 8,38 € to a high of 19,35 €. This average indicates a potential upside of 19.25% from the latest closing price of 9,68 € per share.

Revenue Decline and Earnings Forecast

Ford Motor’s projected annual revenue stands at 158,131MM, reflecting a decrease of 13.47%. Meanwhile, the anticipated annual non-GAAP EPS is estimated at 1.67.

Current Fund Sentiment Towards Ford

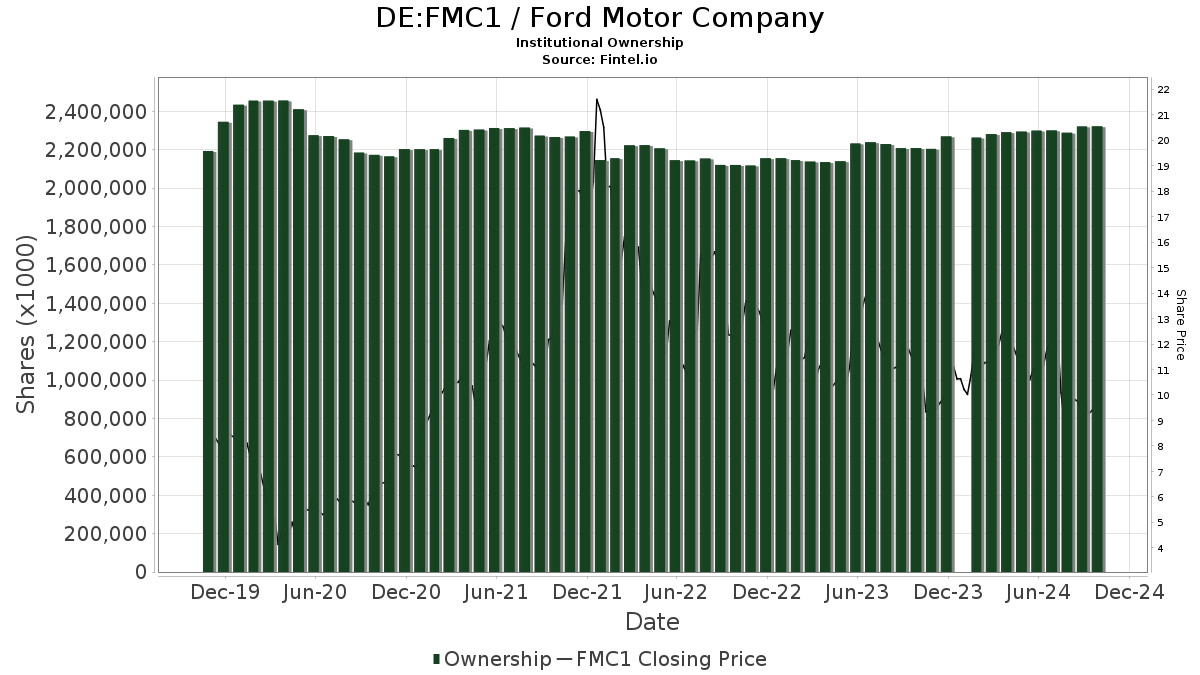

According to recent reports, 2,313 funds or institutions hold positions in Ford Motor, a reduction of 37 owners, or 1.57%, from the previous quarter. The average portfolio weight of these funds focused on FMC1 increased by 13.69% to 0.15%. Furthermore, total shares owned by institutions rose by 5.06% over the last three months, amounting to 2,345,806K shares.

Institutional Shareholder Activities

Newport Trust owns 154,196K shares, equating to 3.95% of the company. This marks a negligible decrease from 154,227K shares, representing a decline of 0.02%. The allocation in FMC1 decreased by 12.73% last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 124,050K shares, which is 3.18% of Ford. In its previous report, it held 122,888K shares, reflecting a 0.94% increase. However, its portfolio allocation in FMC1 dropped by 7.31% over the past quarter.

Charles Schwab Investment Management has 117,338K shares in Ford, or 3.01% ownership. It reported holding 116,200K shares before, which is a 0.97% increase but also included a significant reduction of 34.38% in allocation during the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares maintains ownership of 100,648K shares, representing 2.58%. Previously, it owned 98,323K shares, a 2.31% boost, though its allocation in FMC1 is down by 8.50% since last quarter.

SCHD – Schwab U.S. Dividend Equity ETF currently holds 92,100K shares (2.36% ownership), up from 90,706K (1.51% increase). Despite this, allocation in FMC1 fell by 14.60% in the last three months.

Fintel is a leading research platform for investors, traders, and financial advisors, providing extensive data on fundamentals, analyst reports, ownership, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.