Top Oversold Real Estate Stocks Present Investment Opportunities

Investors looking for undervalued opportunities in the real estate sector may find solace in oversold stocks. The Relative Strength Index (RSI), a momentum indicator, can help identify these potential gains. By comparing a stock’s price strength on days with upward movement against days with downward movement, traders can better predict short-term performance. A stock is generally deemed oversold when its RSI falls below 30, according to Benzinga Pro.

Below is the current roster of key oversold companies within this sector, indicating an RSI near or below 30.

Easterly Government Properties Inc DEA

- Easterly Government Properties is set to report its first quarter financial results on April 29. The company has seen its stock decline roughly 23% over the past month, hitting a 52-week low of $7.79.

- RSI Value: 23.8

- DEA Price Action: Shares of Easterly Government Properties slipped 0.8% to close at $8.30 on Tuesday.

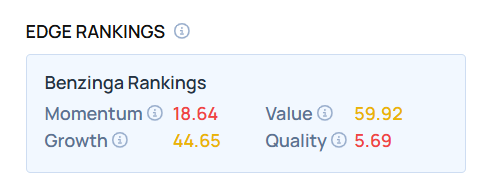

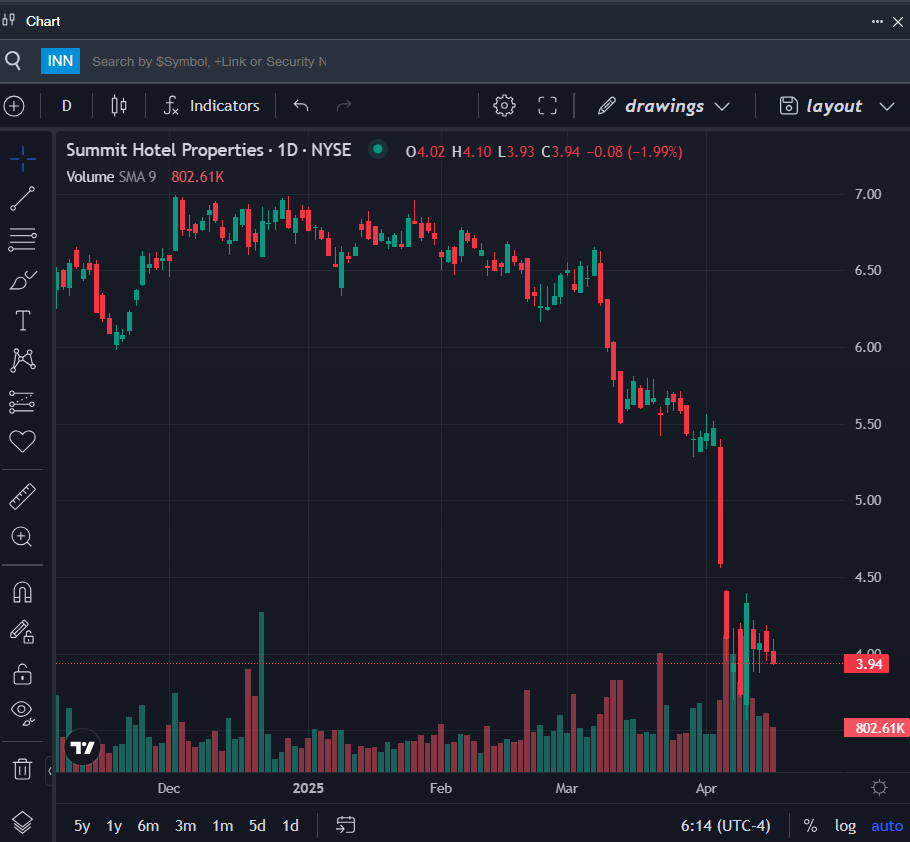

- Stock Ratings: 18.64 Momentum score with a Value score of 59.92.

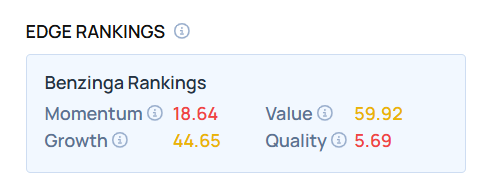

Summit Hotel Properties Inc INN

- Summit Hotel Properties anticipates delivering its financial results for the first quarter on April 30 after the market closes. Recently, the company’s stock has dropped around 32% within the past month, reaching a 52-week low of $3.57.

- RSI Value: 24.6

- INN Price Action: Summit Hotel Properties shares fell 1.8% to finish at $3.94 on Tuesday.

- Benzinga Pro’s charting tool has helped identify this downward trend in INN stock.

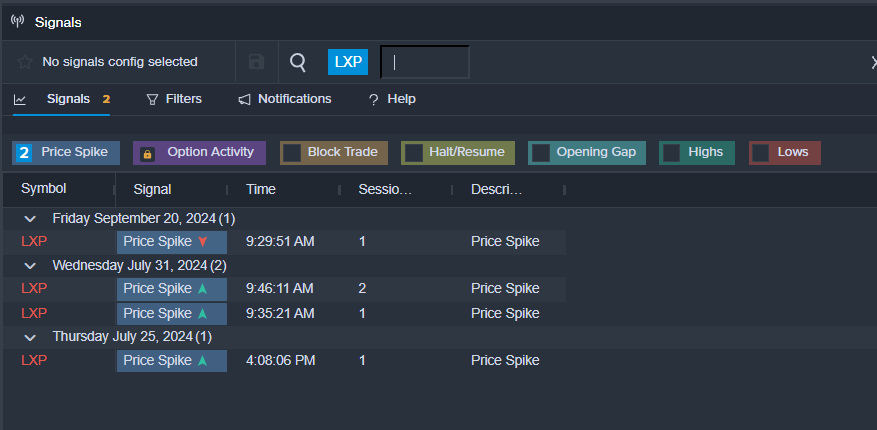

LXP Industrial Trust LXP

- LXP Industrial Trust will announce its first quarter financial results before the market opens on May 1. Over the past month, the company’s share price has decreased approximately 16%, marking a 52-week low of $6.85.

- RSI Value: 28.4

- LXP Price Action: LXP Industrial Trust saw its shares rise 0.1% to end at $7.69 on Tuesday.

- Indications from Benzinga Pro’s signals feature suggest a potential breakout for LXP shares.

For additional insights on BZ Edge Rankings, click here to view scores for other stocks in this sector and see how they stack up.

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs