Investors eye oversold stocks in consumer discretionary sector as a chance to invest in undervalued firms.

The Relative Strength Index (RSI) is a key momentum tool for traders. It compares the days a stock closes higher to the days it closes lower. An RSI below 30 typically indicates that a stock is oversold, suggesting a potential buying opportunity, according to Benzinga Pro.

Here’s a rundown of notable stocks in the consumer discretionary sector that have an RSI at or below 30.

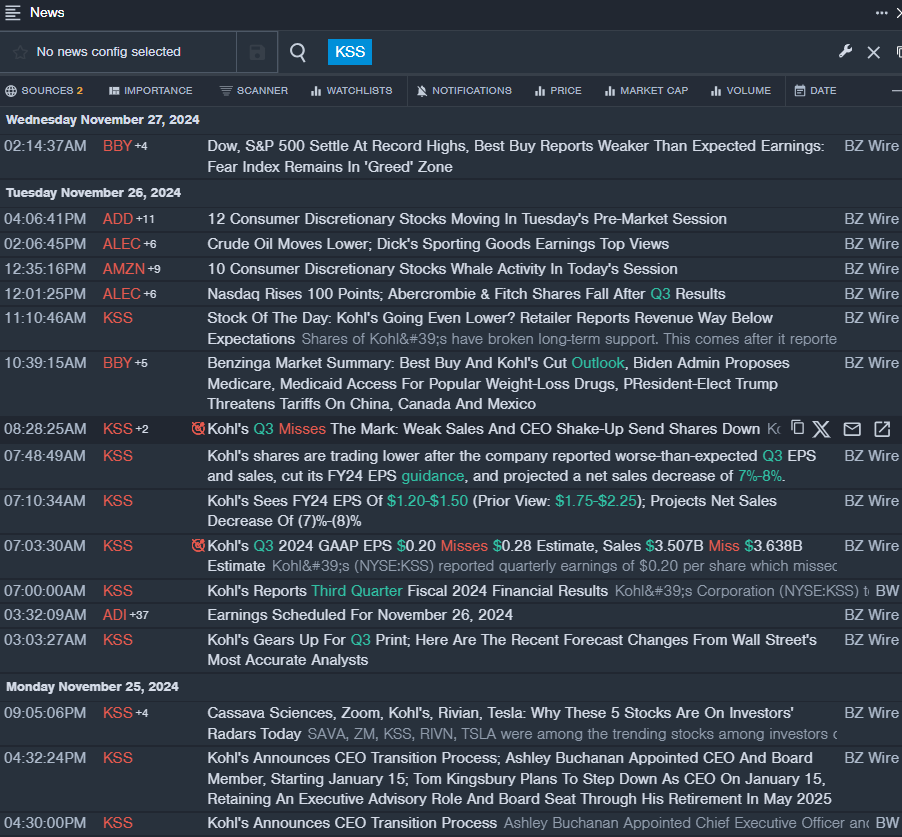

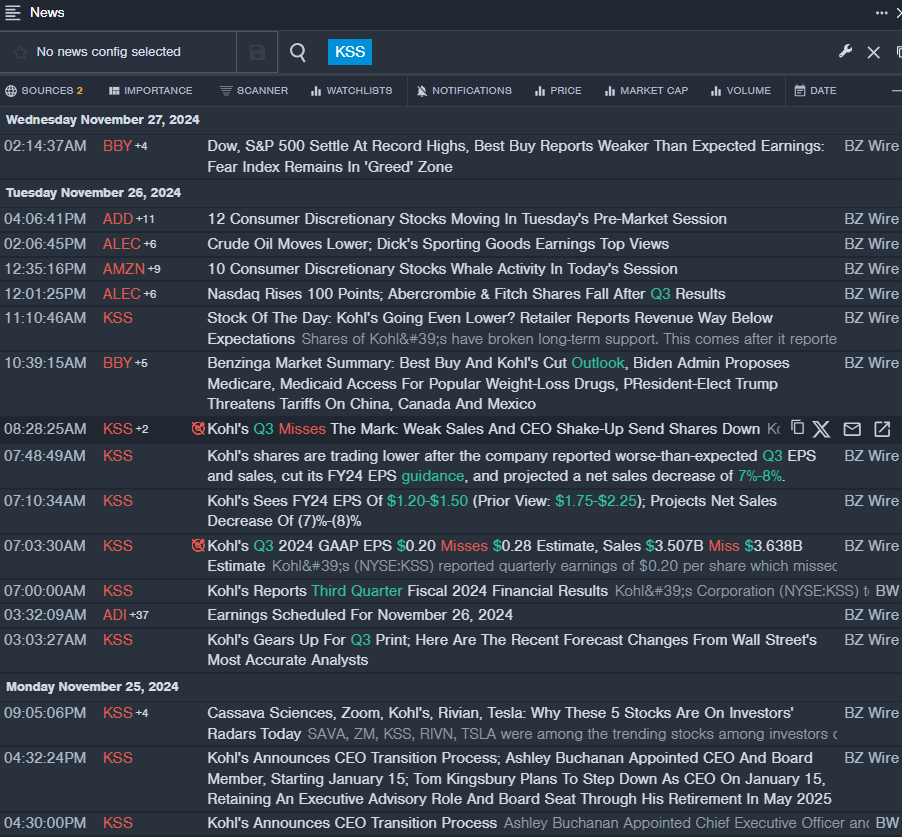

Kohl’s Corp KSS

- As of Nov. 26, Kohl’s shares are trading lower after the company issued disappointing third-quarter results. Kohl’s also lowered its fiscal year 2024 earnings per share (EPS) guidance and projects a 7%-8% decrease in net sales. CEO Tom Kingsbury commented, “Our third quarter results did not meet our expectations as sales remained soft in our apparel and footwear businesses. Though we performed well in growth areas like Sephora and home decor, these gains were not enough to counterbalance declines in our core business.” The stock has dropped about 20% over the last month, reaching a 52-week low of $14.22.

- RSI Value: 26.35

- KSS Price Action: Kohls shares fell 17%, closing at $15.22 on Tuesday.

- Benzinga Pro’s real-time newsfeed highlighted the latest developments regarding KSS.

Honda Motor Co Ltd HMC

- On Nov. 6, Honda Motor reported a dip in first-half profits and adjusted its annual profit forecast downward. For the first half of FY24, Honda saw a 12.4% increase in revenue year-over-year, totaling 10.798 trillion yen ($69.9 billion). However, their profits decreased by 19.7%, amounting to 494.6 billion yen ($3.20 billion). Over the past month, the stock has dropped about 17%, hitting a 52-week low of $25.57.

- RSI Value: 25.03

- HMC Price Action: Shares of Honda fell 3%, closing at $25.87 on Tuesday.

- Benzinga Pro’s charting tools helped track the downward trend of HMC stock.

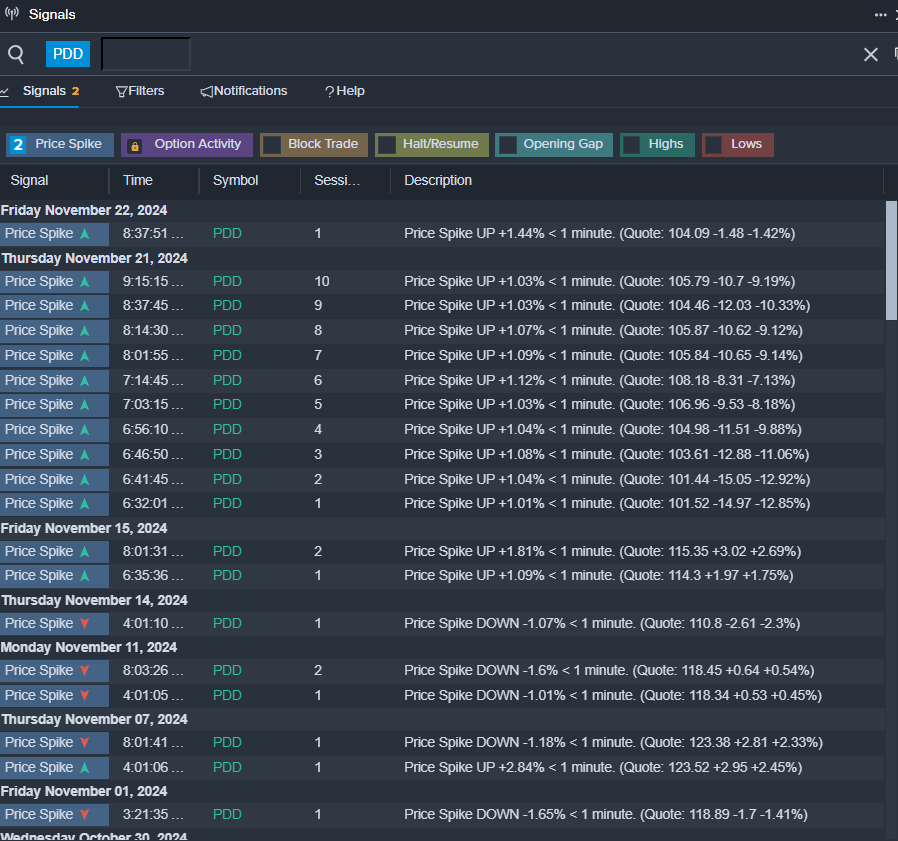

PDD Holdings Inc – ADR PDD

- On Nov. 21, PDD Holdings shared disappointing third-quarter financial results. The company reported a 44% increase in fiscal third-quarter 2024 revenue year-over-year, totaling $14.16 billion (68.84 billion Chinese yuan), but fell short of the analyst consensus estimate of $14.47 billion. In the last month, PDD’s stock has seen a decline of about 21%, reaching a 52-week low of $88.01.

- RSI Value: 29.89

- PDD Price Action: Shares of PDD slipped 1.4%, closing at $99.31 on Tuesday.

- Benzinga Pro’s signals feature flagged a potential breakout for PDD shares.

Read More:

Market News and Data brought to you by Benzinga APIs