“`html

Energy Stocks Show Promise as 2024 Closes In

The energy sector is performing well this year, with the average stock in the S&P 500 rising 14% as we approach December. While this growth trails the S&P 500 overall, it’s impressive given the weaker oil and gas prices in 2024. Looking ahead, energy demand is expected to increase in 2025 and beyond, making certain energy stocks appealing long-term investments as we finish up this year. Notably, Black Hills (NYSE: BKH), Western Midstream Partners (NYSE: WES), and Brookfield Renewable (NYSE: BEP)(NYSE: BEPC) have caught the eye of some Fool.com contributors, suggesting they are worth buying before the new year begins.

A Hidden Gem: Black Hills

Reuben Gregg Brewer (Black Hills): Black Hills tends to be overlooked in the stock market, as it is a utility company providing natural gas and electricity to 1.3 million customers across multiple states including Arkansas and Wyoming. It focuses on delivering reliable service, and it does so effectively.

This consistent performance is evident in Black Hills’ impressive history of increasing its dividend every year for 54 consecutive years, earning it the title of a Dividend King. The company has a strong financial foundation, with a $4.3 billion budget for capital spending, indicating it can sustain its growth strategies.

Its investments include system upgrades and other projects, all aimed at meeting rising energy demand and improving older infrastructure. These are precisely the kinds of developments that regulators prefer to see.

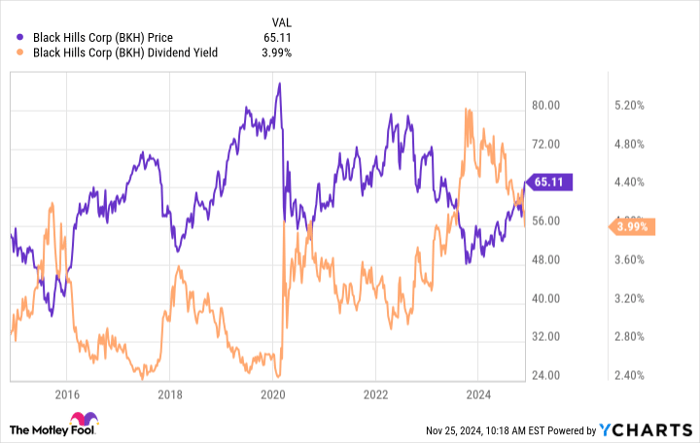

BKH data by YCharts

In addition to its reliability, Black Hills offers a very competitive 4% dividend yield, significantly higher than the S&P 500’s 1.2% and higher than the average utility’s 2.8%. This makes Black Hills an intriguing option for investors seeking steady returns.

Western Midstream Partners: Strong Fundamentals Ahead

Matt DiLallo (Western Midstream Partners): Western Midstream Partners is also having a productive year. The master limited partnership (MLP) is projected to grow its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) to $2.3 billion, marking an 11% increase from the previous year. Their free cash flow is expected to increase by 19%, reaching nearly $1.2 billion.

A successful acquisition last year of Meritage Midstream has helped the company thrive, along with growth in its core operations. These achievements have allowed Western Midstream to reduce its leverage ratio to 3.0 times, improving by 0.7 times since last year.

With growing free cash flow and an improved financial position, Western Midstream was able to raise its quarterly distribution to $0.875 per unit, a substantial 52% increase. Currently, investors benefit from a yield exceeding 9%.

This high yield will serve as a solid return for investors in 2025. The MLP also plans to invest $700 million to $850 million on capital projects this year, further boosting its cash flow capabilities.

The company remains flexible financially, enabling it to pursue new acquisitions or repurchase units to enhance value for investors, making it a strong candidate for those willing to navigate the MLP structure, which sends out Schedule K-1 tax forms annually.

Brookfield Renewable: Positioned for Future Growth

Neha Chamaria (Brookfield Renewable): Brookfield Renewable is set to enjoy a record-setting year, with funds from operations (FFO) per unit increasing by 7% over the first nine months of the year. There was an 11% growth in the third quarter alone, with management optimistic about achieving over 10% growth in 2024.

Despite market challenges, Brookfield finds ways to grow its FFO by leveraging its renewable energy assets as well as selling off older ones when beneficial. Management has projected that 2024 will be a milestone year for asset recycling, expecting to achieve nearly $2.3 billion from sales. This will also fuel significant growth investments.

Brookfield Renewable stands as one of the largest clean energy companies globally. With plans to invest between $8 billion and $9 billion over the next five years, the company anticipates at least 10% annual FFO growth and a dividend increase of 5% to 9% annually. For these reasons, Brookfield appears to be a promising investment option as we look towards 2025.

A Unique Investment Opportunity Awaits

If you’ve ever felt as though you missed out on investing in top-performing stocks, now may be a crucial time to consider your options.

Our team of analysts occasionally issues a “Double Down” stock recommendation for companies poised for substantial growth. If you’re worried about having missed your chance to invest, now might be the time to act before it’s too late. The historical performances speak volumes:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $358,460!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,946!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $478,249!*

Currently, we are issuing “Double Down” alerts for three extraordinary companies—another chance like this may not come soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Matt DiLallo has positions in Brookfield Renewable and Brookfield Renewable Partners. Neha Chamaria has no positions in any stocks mentioned. Reuben Gregg Brewer holds positions in Black Hills and Brookfield Renewable Partners. The Motley Fool recommends Brookfield Renewable and Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`