As the markets ebb and flow, discerning investors seek solace in potential gainers. Let’s dive into three resolute forcefields of growth:

Cardinal Health: Prescribing Success

Cardinal Health (CAH), a titan in the drug distribution realm, has staked its claim as a beacon of resilience. Boasting a Zacks Rank #1 (Strong Buy), this stalwart has seen its earnings projection escalate by 4.9% in the past two months.

The Cardinal Health Paradox

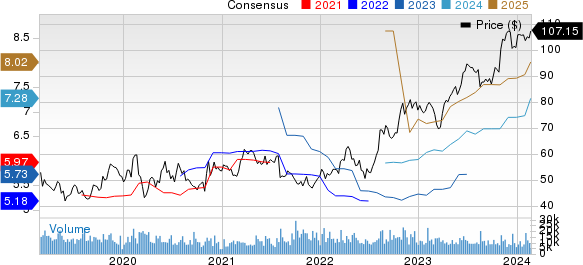

Explore the price-consensus-chart for detailed insights.

The Prowess of Cardinal Health’s PEG Ratio

Cardinal Health’s PEG ratio stands proud at 0.92, trumping the industry’s 2.31. A testament to its Growth Score of A.

Powell Industries: Powering Ahead

Powell Industries (POWL), the maestro of intricate electrical systems, shines bright with a Zacks Rank #1. Its fiscal year earnings forecast has skyrocketed by 44.2% in the recent past, manifesting robust potential.

A Glimpse into Powell Industries’ Trajectory

Delve into the price-consensus-chart for a bird’s eye view.

The Litmus Test: Powell Industries’ PEG Ratio

Powell Industries’ PEG ratio of 1.46 surpasses the industry’s 1.57, accompanied by a glowing Growth Score of A.

Patria Investments Limited: Nurturing Growth

Patria Investments Limited (PAX), a sage in asset management services, exudes promise with a Zacks Rank #1. The forthcoming year’s earnings projection has upswelled by 4.7% in the last 60 days, unveiling a journey of growth.

The Fortitude of Patria Investments Limited’s PEG Ratio

Patria Investments Limited parades a formidable PEG ratio of 0.81, outshining the industry’s 0.82, underscored by a Growth Score of B.

Unveil the full array of top-ranking stocks here.

Gain insight into the essence of the Growth score and its intricate calculations here.

Excited to explore the future elite performers in 2024? The Zacks Top 10 Stocks for 2024, meticulously curated by Sheraz Mian, have trumped the S&P 500, showcasing a staggering +974.1% growth since 2012. Discover the New Top 10 Stocks >>

Explore more details on Zacks.com.

The perspectives expressed herein mirror the author’s stand and do not necessarily align with those of Nasdaq, Inc.