Venturing into the stock market waters can sometimes feel like navigating a vast sea of uncertainty. Amidst the ebb and flow of economic tides, investors are constantly on the lookout for the proverbial ‘diamond in the rough.’ Today, on February 29, we present you with three such gems:

The Progressive Corporation PGR sets sail as an insurance holding company. Recently, its Zacks Consensus Estimate for the current year earnings has been on the rise, showing a 7.5% increase over the last 60 days.

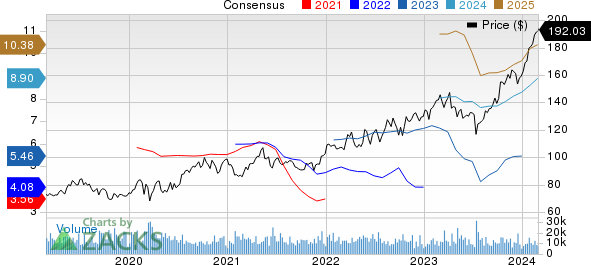

A Glimpse of Prosperity: The Progressive Corporation Price and Consensus

Witness the journey of The Progressive Corporation in the price-consensus-chart | The Progressive Corporation Quote

With a PEG ratio of 1.00 – standing tall against the industry’s 1.47, The Progressive Corporation boasts a Growth Score of B.

Evaluating Growth: The Progressive Corporation PEG Ratio (TTM)

An inside look at The Progressive Corporation’s performance in peg-ratio-ttm | The Progressive Corporation Quote

Sylvamo Corporation SLVM, a key player in the paper manufacturing sector, holds a Zacks Rank #1, signifying a position of strength. The Zacks Consensus Estimate for its current year earnings has surged by a notable 23.7% over the past 60 days.

Charting Success: Sylvamo Corporation Price and Consensus

A visual representation of Sylvamo Corporation’s performance in price-consensus-chart | Sylvamo Corporation Quote

With a strikingly low PEG ratio of 0.34, overshadowing the industry’s 0.78, Sylvamo Corporation radiates promise. Its Growth Score stands proudly at B.

Behind the Scenes: Sylvamo Corporation PEG Ratio (TTM)

Exploring Sylvamo Corporation’s performance in peg-ratio-ttm | Sylvamo Corporation Quote

Textron Inc. TXT, a diverse company operating in aircraft, defense, industrial, and finance sectors, proudly dons a Zacks Rank #1. The Zacks Consensus Estimate for its current year earnings has brightened by 6.6% over the past 60 days.

The Textron Way: Textron Inc. Price and Consensus

Witness Textron Inc.’s journey in the price-consensus-chart | Textron Inc. Quote

With a PEG ratio of 1.21, towering above the industry average of 2.92, Textron Inc. shines bright. Its Growth Score? A robust B.

In the Financial Arena: Textron Inc. PEG Ratio (TTM)

Exploring Textron Inc.’s performance in peg-ratio-ttm | Textron Inc. Quote

Curious for more? Feel free to peruse the full list of top-ranked stocks available.

Delve deeper into understanding the Growth score and its calculations here.

The Call of Innovation: Top 5 ChatGPT Stocks Unveiled

Zacks Senior Stock Strategist, Kevin Cook, unveils a quintet of stocks poised for significant growth in the realm of Artificial Intelligence. By 2030, analysts predict the AI industry to rival the economic impact of the internet and iPhone, hitting a staggering $15.7 Trillion.

Seize the opportunity today to invest in this futuristic wave. An automation that doesn’t just stop at answering questions but dares to challenge fallacies, correct missteps, and decline unwarranted demands. As one of the selected companies aptly puts it, “Automation liberates individuals from the mundane, empowering them to achieve the extraordinary.”

Unlock Your Free ChatGPT Stock Report Now >>

Get a Free Stock Analysis Report on Textron Inc. (TXT)

Explore a Free Stock Analysis Report on The Progressive Corporation (PGR)

Discover a Free Stock Analysis Report on Sylvamo Corporation (SLVM)

For more insightful articles, visit Zacks.com by clicking here.

Explore the world of investment research at Zacks Investment Research

Remember, these perspectives and thoughts belong solely to the author and do not necessarily mirror those of Nasdaq, Inc.