Growth is the name of the game when it comes to investing, and on today, February 8th, three companies are particularly catching the eye of discerning investors.

Textron Inc.: A Strong Contender in the Sky

Textron Inc. (TXT) operates across aircraft, defense, industrial, and finance, assessing as a Zacks Rank #1. Over the past 60 days, the Zacks Consensus Estimate for its current year earnings has risen by 4.3%. The company’s PEG ratio stands at 1.22, which compares favorably with the industry’s 2.04. Furthermore, Textron boasts a Growth Score of B.

Textron Inc. Price and Consensus

Textron Inc. price-consensus-chart | Textron Inc. Quote

Textron Inc. PEG Ratio (TTM)

Textron Inc. peg-ratio-ttm | Textron Inc. Quote

Royal Caribbean Cruises Ltd.: Navigating Promising Waters

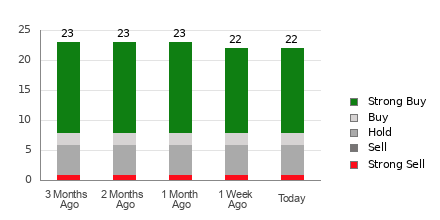

Royal Caribbean Cruises Ltd. (RCL) sets sail with a Zacks Rank #1, and has experienced a 5.1% surge in the Zacks Consensus Estimate for current year earnings over the past 60 days. With a PEG ratio of 0.48, compared with 1.09 for the industry, and a sparkling Growth Score of A, Royal Caribbean Cruise Ltd. is sending a strong signal to potential investors.

Royal Caribbean Cruises Ltd. Price and Consensus

Royal Caribbean Cruises Ltd. price-consensus-chart | Royal Caribbean Cruises Ltd. Quote

Royal Caribbean Cruises Ltd. PEG Ratio (TTM)

Royal Caribbean Cruises Ltd. peg-ratio-ttm | Royal Caribbean Cruises Ltd. Quote

Sanmina Corporation: Crafting a Path to Success

Sanmina Corporation (SANM) as a manufacturing solutions provider secures a Zacks Rank #1, benefitting from a 2% rise in the Zacks Consensus Estimate for its current year earnings over the last 60 days. The company’s PEG ratio of 0.78 compared with the industry’s 1.21 is a promising sign, complemented by a Growth Score of B.

Sanmina Corporation Price and Consensus

Sanmina Corporation price-consensus-chart | Sanmina Corporation Quote

Sanmina Corporation PEG Ratio (TTM)

Sanmina Corporation peg-ratio-ttm | Sanmina Corporation Quote

For a complete list of top-ranked stocks, click here.

Find out more about the Growth score and how it is calculated here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has soared more than +800% since it was recommended, yet our new top chip stock has greater potential for growth. With robust earnings expansion and an ever-increasing client base, it’s well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is projected to leap from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Textron Inc. (TXT) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Sanmina Corporation (SANM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.