Investing in Cloud Computing: Key Stocks to Watch

Discover how to take advantage of the booming cloud computing sector with insights on top companies like Amazon and Arista Networks.

Zacks Thematic Screens allows investors to explore 30 innovative themes that are shaping the future of finance. From advanced technology and renewable energy to healthcare breakthroughs, these themes help you connect your investments to your values.

To view the full thematic lists, please click here >>> Thematic Screens – Zacks Investment Research.

In this article, we will examine the ‘Cloud Computing’ theme, focusing on prominent stocks, including Amazon (AMZN) and Arista Networks (ANET).

Understanding Cloud Computing

Cloud computing provides on-demand access to various computing resources such as servers, storage, databases, networking, software, analytics, and artificial intelligence over the Internet, all based on a pay-per-use model. This represents a significant change from traditional on-premises storage methods to more adaptable cloud-based solutions.

Organizations no longer need to buy, own, or maintain physical data centers and servers. Instead, they can tap into a virtual pool of shared resources provided by cloud services as needed. This model reduces operating costs, boosts productivity, and enhances flexibility and scalability.

Amazon’s AWS: A Leader in Cloud Services

Investors looking to engage with the cloud computing market may find Amazon an appealing choice. Amazon Web Services (AWS) leads the global cloud market, offering a wide range of services including computing power, data storage, databases, and machine learning tools.

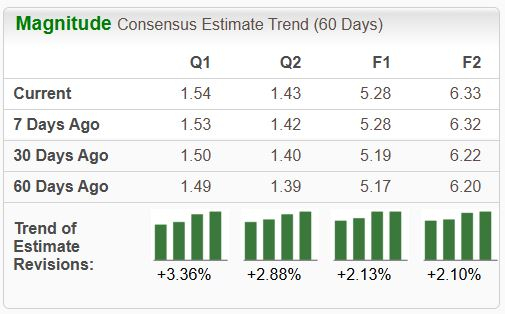

Recently, analysts have adjusted their earnings forecasts upward, reflecting a positive outlook. The Zacks Consensus EPS estimate stands at $4.74, indicating a robust year-over-year growth of 63%. Amazon is positioned with a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Arista Networks: Solid Performance and Forecast

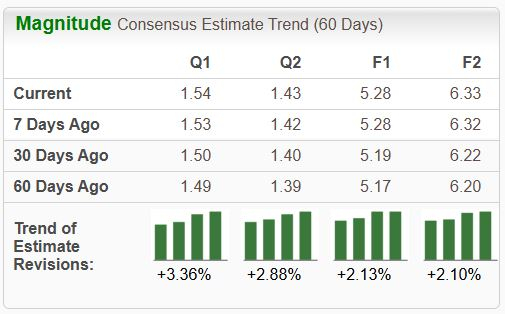

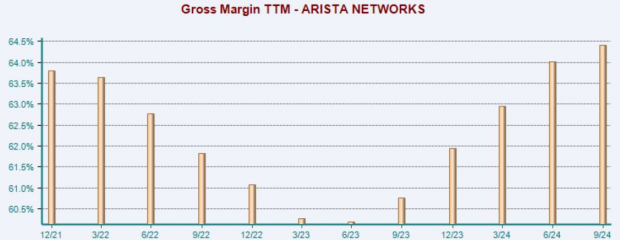

Arista Networks excels in providing data-driven networking solutions for major data centers, campuses, and routing environments. Analysts are optimistic about their earning potential, currently ranking the stock as Zacks Rank #2 (Buy).

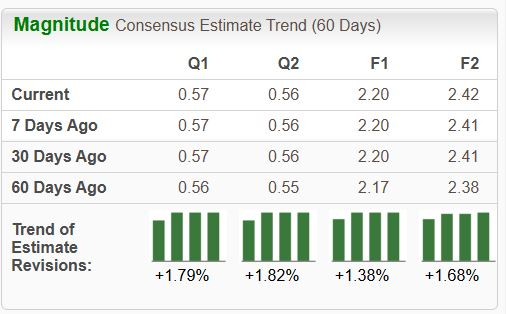

In its recent earnings report, Arista showcased strong results, enjoying both margin expansion and substantial growth in earnings per share (EPS) and sales. The margin chart displayed below highlights this success over the trailing twelve months.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion: Thematic Investing in Action

Thematic investing has become a powerful strategy for aligning investment portfolios with emerging trends. A combination of long-term and short-term themes increasingly determines which companies thrive as economies grow and markets evolve.

While the stocks discussed are not direct recommendations, they provide a valuable starting point for further research. Utilizing Zacks Rank and other financial metrics can help identify the best fits for your investment strategy. Each featured stock includes a Zacks report, equipping you with the necessary tools to evaluate their performance and potential.

Both Amazon (AMZN) and Arista Networks (ANET) are key players in the Zacks Cloud Computing Thematic Screen.

Just Released: Zacks Top 10 Stocks for 2025

Act fast to access our top ten stock picks for 2025, selected by Zacks Director of Research Sheraz Mian. This portfolio has shown remarkable success, gaining an impressive +2,112.6% since its inception in 2012, far surpassing the S&P 500’s +475.6%. Sheraz has meticulously analyzed 4,400 companies using the Zacks Rank to identify the top ten stocks worth your investment as we move into 2025. Don’t miss this opportunity to discover these newly released stocks with significant potential.

See New Top 10 Stocks >>

Stay informed with the latest recommendations from Zacks Investment Research. Download our report on the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

For further reading, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.