U.S. Auto Industry Faces Affordability Challenges as 2024 Sales Decline

The U.S. auto industry encountered significant challenges in 2024, highlighted by affordability issues stemming from high interest rates and increased vehicle prices. These factors suppressed demand, resulting in a 2% year-over-year decrease in new vehicle sales during the third quarter—the second straight quarterly decline. As a response, production forecasts for North American light vehicles have been revised down to 15.5 million units from an earlier estimate of 15.8 million, with automakers strategically reducing output to better manage inventory.

Inflation and Interest Rates Shape 2025 Outlook

Concerns about vehicle affordability are expected to persist into 2025, as inflation remains stubbornly high. Although interest rates may gradually decrease, the Federal Reserve’s approach under Chairman Jerome Powell suggests fewer cuts than previously expected. Additionally, potential tariff proposals under the Donald Trump administration could further inflate vehicle prices.

According to S&P Global Mobility, U.S. auto sales are expected to climb to 16.2 million units in 2025, reflecting a modest 1.2% increase from the projected 2024 figures. In this uncertain landscape, large-cap stocks such as Tesla (TSLA), General Motors (GM), and CarMax (KMX) represent solid investment opportunities, given their favorable earnings outlooks that balance stability with growth potential.

Why Large-Cap Stocks are a Safe Bet

During turbulent market conditions, large-cap stocks stand out as reliable investment choices. Their established presence, solid financial health, and consistent performance make them appealing, especially for investors with a low-risk appetite. Moreover, these companies often focus on returning value to shareholders through dividends and stock buybacks, which enhances their attractiveness.

While larger companies may not provide the rapid growth found in smaller, more volatile firms, their stability adds a layer of protection against market fluctuations. Thus, they play a crucial role in any well-rounded investment portfolio, particularly given the unpredictable conditions anticipated in 2025.

Three Stocks to Consider Investing In

Tesla: This leading electric vehicle (EV) manufacturer has experienced significant growth since the 2024 elections. Despite potential rebate cuts due to the Trump administration, Tesla remains poised for success without reliance on subsidies, largely due to its cost efficiency and extensive production capabilities. CEO Elon Musk forecasts vehicle delivery growth of 20%-30% for 2025, reflecting strong demand. Moreover, its expanding Energy Generation & Storage business, Supercharger network, and advancements in artificial intelligence position Tesla favorably.

Supported by a strong balance sheet and ample liquidity, Tesla is well-equipped to maintain innovation and growth. Its efforts in autonomous vehicle technology—including the anticipated launch of robotaxi services in 2025—further solidify its status as a vital player in the clean energy and tech arenas.

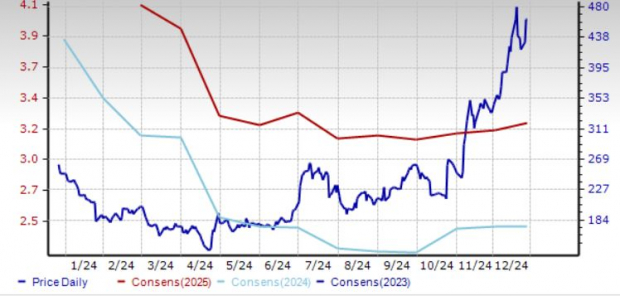

The Zacks Consensus Estimate predicts Tesla’s revenue and earnings will increase by 17.5% and 32%, respectively, in 2025. Recent adjustments to earnings per share (EPS) estimates suggest an increase to $3.26. With a market capitalization of roughly $1.5 trillion, TSLA holds a Zacks Rank #2 (Buy).

Price & Consensus: TSLA

Image Source: Zacks Investment Research

General Motors: As America’s top-selling automaker, GM offers a diverse product line, especially in pickups and SUVs, which remains in strong demand. The company has implemented cost-cutting measures and is on track to achieve a $2 billion net reduction by year-end. With automotive liquidity of $40.2 billion as of September 30, GM’s robust buyback program, having repurchased approximately $12.5 billion in shares since last November, signals financial health.

GM is also making strides in its electric vehicle production, focusing on lowering battery costs, launching new models, and expanding its market share. The company’s efforts aim to make its EVs profitable by the end of the year.

Consensus estimates for GM suggest a modest 2.7% growth in earnings for 2025, with EPS estimates moving up by 13 cents to $10.62 over the last month. The company has a solid track record, having exceeded earnings expectations in each of the last four quarters. GM, valued at around $59 billion, currently has a Zacks Rank #2.

Price & Consensus: GM

Image Source: Zacks Investment Research

CarMax: As the leading used car retailer in the U.S., CarMax benefits from a vast network and strong logistics capabilities. For fiscal 2025 (ending February 2025), KMX plans to open five new stores, including smaller cross-functional ones, and enhance its operations with additional facilities and offsite auctions. This growth strategy aims to solidify its market position.

Recent acquisitions, such as Edmunds, have bolstered CarMax’s digital expertise, while collaborations like with Recurrent improve insights into used EV batteries. Omnichannel growth strategies, including initiatives like MaxOffer and online appraisal tools, are driving increased purchases and sales, underlined by data science and AI enhancements.

The Zacks Consensus Estimate anticipates earnings growth for CarMax of 4.3% in fiscal 2025 and 22.2% in fiscal 2026. Over the past week, EPS estimates have increased by 14 cents and 11 cents, respectively. With a market capitalization of about $13 billion, KMX also carries a Zacks Rank #2.

Price & Consensus: KMX

Image Source: Zacks Investment Research

For those interested, you can view a complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Zacks Identifies Top 10 Stocks for 2025

Curious to learn which stocks might perform well in 2025?

Historically, the Zacks Top 10 Stocks portfolio has shown impressive results. From 2012 to November 2024, it gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Zacks’ Director of Research, Sheraz Mian, is in the process of selecting the best 10 stocks from over 4,400 options for the coming year. Don’t miss out on these picks when they are revealed on January 2.

Discover the latest insights from Zacks Investment Research. Today, you can download 5 Stocks Set to Double. Click to access this free report.

General Motors Company (GM): Free Stock Analysis Report

CarMax, Inc. (KMX): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.