Two Stocks to Consider With Strong Buy Ratings Today

On March 4th, investors may want to take a closer look at two stocks exhibiting strong momentum and a buy rank:

Option Care Health, Inc. Overview

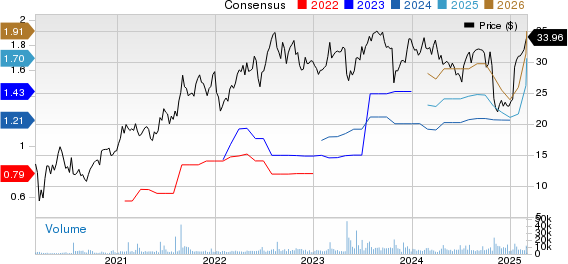

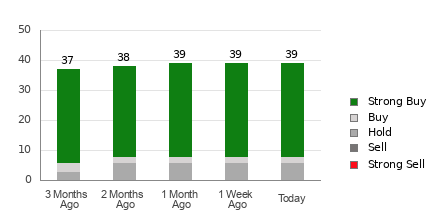

Option Care Health, Inc. (OPCH) is a company specializing in home and alternate site infusion services. It holds a Zacks Rank of #1 and has seen a significant 19.4% increase in the Zacks Consensus Estimate for its earnings this year over the past 60 days.

Recent Performance

In the last three months, OPCH’s shares surged by 49.5%. In contrast, the S&P 500 index experienced a decline of 3.7%. Additionally, the company has a solid Momentum Score of A.

Price Trends

Option Care Health, Inc. price | Option Care Health, Inc. Quote

LeMaitre Vascular, Inc. Overview

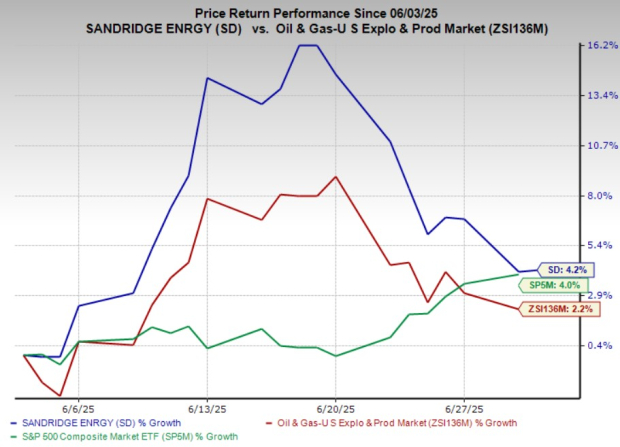

LeMaitre Vascular, Inc. (LMAT) operates in the medical devices and implants sector. Also holding a Zacks Rank of #1, its earnings estimates for the current year rose by 2.8% in the past two months.

Recent Performance

LeMaitre Vascular’s shares gained 36.7% over the past year, whereas the S&P 500 saw an increase of 15.2%. The company, like OPCH, boasts a Momentum Score of A.

Price Trends

LeMaitre Vascular, Inc. price | LeMaitre Vascular, Inc. Quote

Further Stock Opportunities

For those interested in exploring more top-ranked stocks, refer to the complete list here.

To understand the Momentum Score and its calculation, click the link for additional insights.

Access Zacks’ Buys and Sells for Just $1

We’re serious.

Years ago, we surprised our members by offering 30-day access to all our stock picks for only $1. There’s no obligation to spend more.

Many have utilized this opportunity while others hesitated, thinking it might be too good to be true. The reason is simple: we want you to become familiar with our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more. These programs closed 256 positions with double- and triple-digit gains in 2024.

LeMaitre Vascular, Inc. (LMAT): Free Stock Analysis Report

Option Care Health, Inc. (OPCH): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.