In 2024, initial public offerings (IPOs) in the U.S. stock market raised a total of $30 billion, while secondary offerings accounted for nearly $170 billion. Data from SIFMA underscores the importance of stock markets in financing, revealing that companies returned about $1 trillion each year to investors through buybacks and dividends. Notably, the top 11 companies represented nearly half of the announced buybacks, totaling approximately $500 billion.

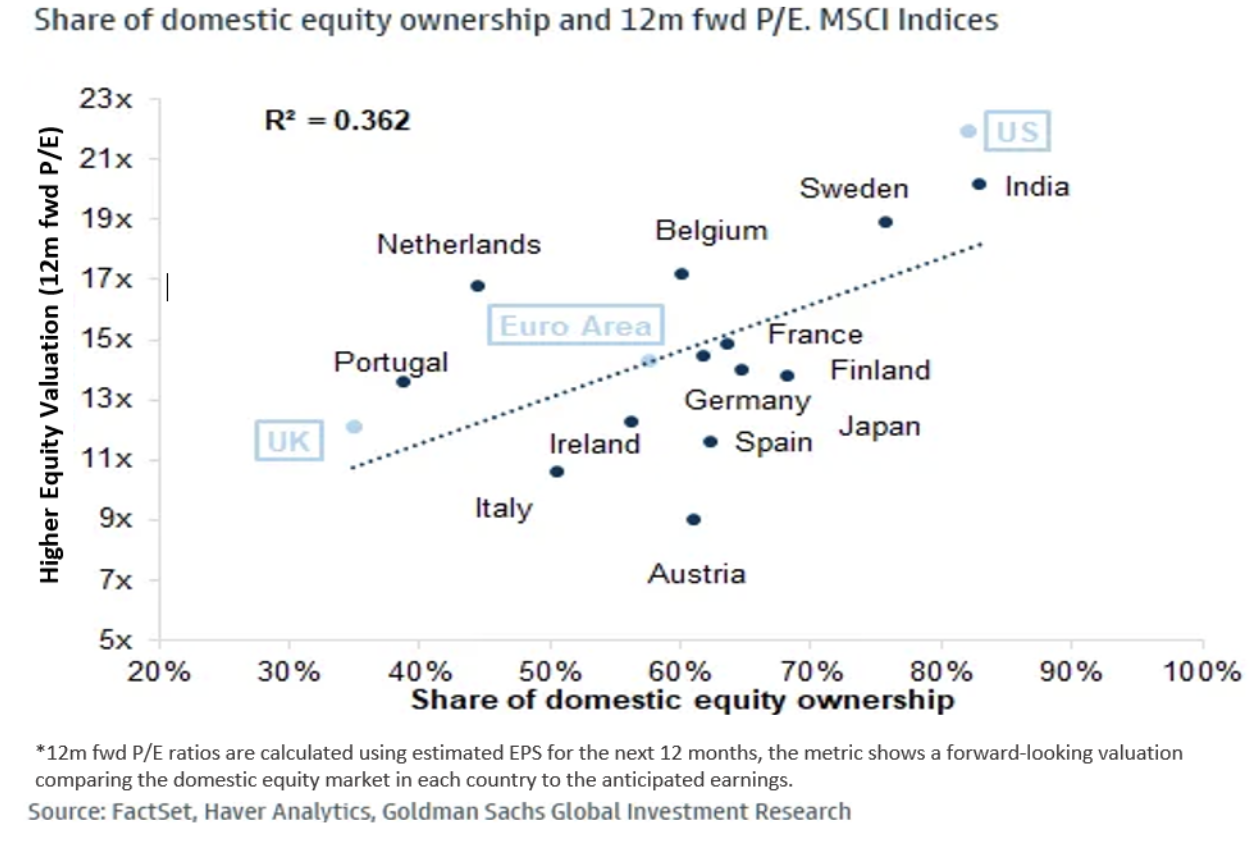

Research indicates that countries with higher direct stock ownership, like the U.S., Sweden, and Australia, tend to have elevated stock valuations. This correlation suggests that stock markets foster economic growth by enabling companies to access capital for expansion, ultimately benefiting investors through wealth creation. Data shows that a substantial portion of stock trading is moving off-exchange, with current estimates indicating over 50% of trading occurs outside traditional exchanges.

As markets evolve, there is a growing push towards 24-hour trading to accommodate global investors, particularly in the tech sector. This shift aims to enhance market efficiency and ensure better price discovery, though challenges remain with market fragmentation and the economics of providing competitive National Best Bid and Offer (NBBO) pricing. Continuous monitoring of trading activity reveals that only 38.5% of listed stocks engage actively in after-hours trading, highlighting a need for improvements in market structure.