Semiconductor Stocks: Investing Insights for 2025

In 2025, the global semiconductor market is expected to grow significantly, generating interest among investors. NVIDIA Corporation (NVDA) and Taiwan Semiconductor Manufacturing Company Limited (TSMC) have performed exceptionally well, while Advanced Micro Devices, Inc. (AMD) has struggled. This article explores investment opportunities in these three companies.

The Semiconductor Market’s Promising Expansion

Rising demand for Internet of Things (IoT) devices, advances in digital economies, and substantial investments in semiconductor production are projected to support market growth this year and beyond.

According to Statista, global semiconductor revenues are estimated to reach $702.40 billion in 2025, up from $607.41 billion in 2024. Projections suggest that revenues could attain $980.80 billion by 2029, reflecting a compound annual growth rate (CAGR) of 8.70%. Integrated circuits will significantly contribute to this growth, followed by discrete semiconductors, optoelectronics, and sensors.

This year, semiconductor stocks have gained traction, with the iShares Semiconductor ETF (SOXX) up 9.2% year to date, following a 12.2% increase last year.

Top Picks for Investors: NVIDIA & TSMC

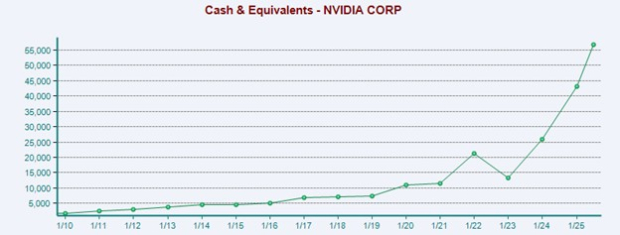

Within SOXX, NVIDIA and TSMC stand out for their strong performance and promising outlook. NVIDIA’s chips are in high demand, which is likely to push its stock prices higher.

Shipments of NVIDIA’s new Blackwell chips have surged this quarter, boasting improved energy efficiency and a 30 times faster AI interface compared to previous models. CEO Jensen Huang has also confirmed robust demand for the older Hopper chips, which remain competitive against Intel Corporation (INTC).

With a significant share in the graphics processing unit (GPU) market, NVIDIA is well-positioned for future gains. The global GPU market is projected to grow from $75.77 billion in 2024 to $101.54 billion in 2025, according to Precedence Research.

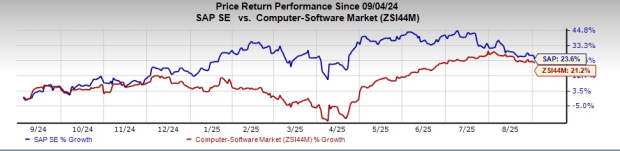

Given this positive trend, now might be a good time to invest in NVIDIA stock. Currently, it holds a Zacks Rank #2 (Buy), with a Zacks Consensus Estimate for earnings per share (EPS) of $2.94, reflecting a 46.3% increase from a year ago (read more).

Image Source: Zacks Investment Research

TSMC’s leading position in the global foundry market is likely to enhance its stock performance further. The demand for TSMC’s custom AI chips from major companies like Broadcom Inc. (AVGO) indicates strong future growth. Increased pre-orders for TSMC’s upcoming 2-nanometer (nm) chips this year have also surpassed demand for 3 and 5nm chips.

TSMC currently has a Zacks Rank #2, and its EPS is expected to grow by 21% from last year, with a Zacks Consensus Estimate of $9.12 (read more).

Image Source: Zacks Investment Research

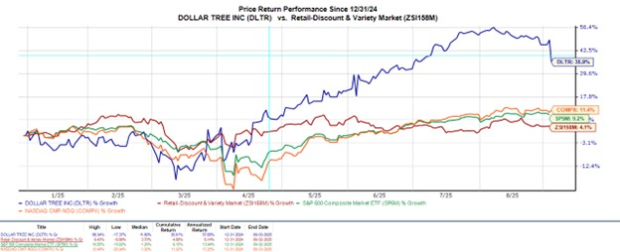

Consider Avoiding AMD for Now

In contrast to NVIDIA and TSMC, investors may want to hold off on Advanced Micro Devices (AMD). Its stock has been underperforming in recent years, largely due to weakness in the personal computer market heightened by the pandemic. Additionally, AMD has struggled to capitalize on the AI growth that has benefited NVIDIA, and the demand for gaming consoles has not bolstered its stock either.

AMD faces risks from exchange rate fluctuations due to its significant revenue generation outside the United States, which could hinder its near-term prospects. It currently holds a Zacks Rank #4 (Sell). For a complete list of Zacks #1 (Strong Buy) Rank stocks, click here.

Zacks Highlights a Top Semiconductor Stock

Among semiconductor stocks, one standout opportunity is identified by Zacks, which is only 1/9,000th the size of NVIDIA, which has jumped more than 800% since Zacks’ initial recommendation. With expanding earnings and a rising customer base, this stock is well-suited to meet the soaring demand for Artificial Intelligence, Machine Learning, and IoT devices. Global semiconductor manufacturing is expected to grow from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Intel Corporation (INTC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

iShares Semiconductor ETF (SOXX): ETF Research Reports

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.