Are you searching for undervalued stocks with strong potential? Look no further. Here are three pristine picks that boast buy rank and robust value characteristics that every discerning investor should consider delving into on February 6th:

First Horizon Corporation: Embracing Growth Potential

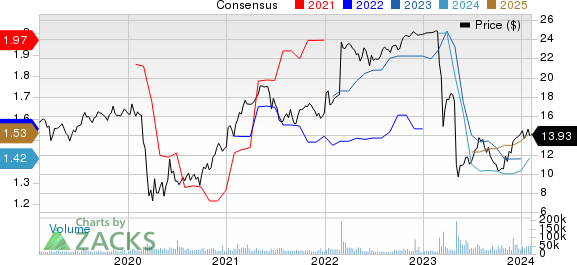

First Horizon Corporation (FHN), the bank holding company for First Horizon Bank, has recently acquired a prestigious Zacks Rank #1, solidifying its position as a choice investment. Over the past 60 days, First Horizon has seen a commendable 6% surge in the Zacks Consensus Estimate for its current year earnings.

First Horizon Corporation Price and Consensus

With a price-to-earnings ratio (P/E) of 9.84, compared to 13.20 for the industry, First Horizon Corporation showcases a compelling Value Score of A.

First Horizon Corporation PE Ratio (TTM)

Seeking a stock with growth potential? First Horizon Corporation is undoubtedly a top contender.

Century Communities, Inc.: A Beacon of Growth

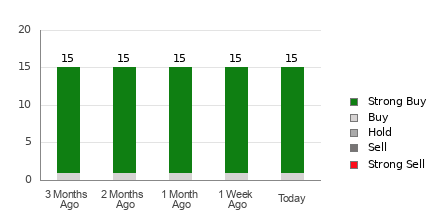

Another gem for your consideration is Century Communities, Inc. (CCS), a residential development company that holds a Zacks Rank #1. Over the past 60 days, Century Communities has seen its Zacks Consensus Estimate for current year earnings soar by an impressive 7.9%.

Century Communities, Inc. Price and Consensus

Boasting a price-to-earnings ratio (P/E) of 10.05 versus 10.50 for the industry, Century Communities exudes a value-driven ethos with a solid Value Score of A.

Century Communities, Inc. PE Ratio (TTM)

Positioning themselves in the sweet spot for growth, Century Communities embodies a beacon of potential within the investment landscape.

Southside Bancshares, Inc.: Ready for Ascension

Prepare to elevate your portfolio with Southside Bancshares, Inc. (SBSI), a bank holding company for Southside Bank. Carrying a Zacks Rank #1, Southside Bancshares has encountered a substantial 7.5% upsurge in the Zacks Consensus Estimate for its next year earnings over the past 60 days.

Southside Bancshares, Inc. Price and Consensus

With a price-to-earnings ratio (P/E) of 11.13 compared to 13.20 for the industry, Southside Bancshares stands poised for exponential growth, justified by a laudable Value Score of B.

Southside Bancshares, Inc. PE Ratio (TTM)

Ready to ascend to greater financial heights? Southside Bancshares offers a captivating opportunity for investors.

For a comprehensive list of top ranked stocks, refer to this link.

To better grasp the concept of Value score and how it is calculated, visit this resource.

If you’re eager to translate value stocks into early price gains, Zacks Investment Research has distilled the elite 7 from its roster of 220 Zacks Rank #1 Strong Buys. The track record is impressive; since 1988, the full list has outperformed the market by 2X with an average annual gain of +24.0%. Don’t miss the boat on these hand-picked seven.

Keen on receiving the latest recommendations from Zacks Investment Research? Discover the 7 Best Stocks for the Next 30 Days for a comprehensive look at potential investments. Click here.

To delve into a detailed analysis of each of the highlighted stocks, go through the free stock analysis reports for First Horizon Corporation (FHN), Century Communities, Inc. (CCS), and Southside Bancshares, Inc. (SBSI).

For the Zacks.com version of this article, visit Zacks.com. To stay informed with timely recommendations, research, and updates, explore Zacks Investment Research.

Disclaimer: The opinions expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.