For investors seeking stocks with strong value characteristics, January 10th presents three promising options to consider:

EnerSys (ENS): This stored energy solutions company boasts a Zacks Rank #1 and has seen the Zacks Consensus Estimate for its current year earnings grow by 7.4% over the last 60 days.

EnerSys Performance and Outlook

Enersys price-consensus-chart | Enersys Quote

EnerSys has an inviting price-to-earnings ratio (P/E) of 12.03, outshining the industry’s figure of 18.20. With a remarkable Value Score of A, this company is particularly compelling.

Assessment of Panasonic Holdings Corporation

Panasonic Holdings Corporation (PCRFY): This electrical and electronic products company also bears a Zacks Rank #1 and has observed a substantial 19.2% surge in the Zacks Consensus Estimate for its current year earnings over the last 60 days.

Progress and Prospects for Panasonic Corp.

Panasonic Corp. price-consensus-chart | Panasonic Corp. Quote

Impressively, Panasonic boasts a P/E ratio of 8.08, significantly better than the industry’s 18.90. With a robust Value Score of A, this company is a captivating prospect for investors.

Evaluating Reinsurance Group of America, Incorporated

Reinsurance Group of America, Incorporated (RGA): This reinsurance company obtains a Zacks Rank #1 and has experienced a 3.6% increase in the Zacks Consensus Estimate for its current year earnings over the last 60 days.

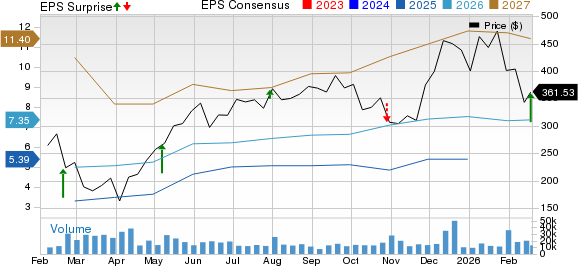

Review of Reinsurance Group of America, Incorporated

Reinsurance Group of America, Incorporated price-consensus-chart | Reinsurance Group of America, Incorporated Quote

With a P/E ratio of 8.82, surpassing the industry’s 9.60, along with a commendable Value Score of A, Reinsurance Group of America, Incorporated presents an appealing investment opportunity.

For a comprehensive list of top-ranked stocks, visit here.

For a better understanding of the Value score and how it is calculated, click here.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the entire list has outperformed the market more than double with an average gain of +24.0% per year. Therefore, investors are encouraged to give these hand-picked 7 stocks immediate attention.

Download 7 Best Stocks for the Next 30 Days for free

Access Free Stock Analysis Report for Reinsurance Group of America, Incorporated (RGA)

Access Free Stock Analysis Report for EnerSys (ENS)

Access Free Stock Analysis Report for Panasonic Corp. (PCRFY)

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.