As we approach January 29th, investors are eyeing three stocks with a buy rank and robust value characteristics. Here is a closer look at the offerings from these stalwart companies:

Independent Bank Corporation: A Beacon of Stability

Independent Bank Corporation (IBCP) is a bank holding company that proudly carries a Zacks Rank #1. Over the last 60 days, the company’s Zacks Consensus Estimate for its current year earnings has surged by 4.9%. Furthermore, with a price-to-earnings ratio (P/E) of 9.35, compared with the industry’s 10.60, Independent Bank Corporation stands out. The company also possesses a commendable Value Score of B, making it a beacon of stability in the financial landscape.

Independent Bank Corporation Price and Consensus

Independent Bank Corporation has a price-to-earnings ratio (P/E) of 9.35, compared with 10.60 for the industry. The company possesses a Value Score of B.

Independent Bank Corporation PE Ratio (TTM)

Banco Bilbao Vizcaya Argentaria, S.A.: A Strong Contender

Banco Bilbao Vizcaya Argentaria, S.A. (BBVA), a company providing retail banking, wholesale banking, and asset management services, boasts a Zacks Rank #1. Over the last 60 days, the Zacks Consensus Estimate for its current year earnings has surged by 3.7%. With a price-to-earnings ratio (P/E) of 5.97 compared with 8.70 for the industry, Banco Bilbao Vizcaya Argentaria, S.A. shines. The company also holds a solid Value Score of B, cementing its position as a strong contender.

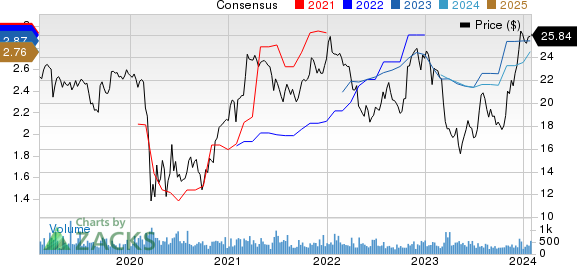

Banco Bilbao Viscaya Argentaria S.A. Price and Consensus

Banco Bilbao Vizcaya Argentaria has a price-to-earnings ratio (P/E) of 5.97, compared with 8.70 for the industry. The company possesses a Value Score of B.

Banco Bilbao Viscaya Argentaria S.A. PE Ratio (TTM)

Midland States Bancorp, Inc.: A Trustworthy Option

Midland States Bancorp, Inc. (MSBI), a financial holding company for Midland States Bank, boasts a Zacks Rank #1. Over the last 60 days, the Zacks Consensus Estimate for its next-year earnings has increased by 1%. With a price-to-earnings ratio (P/E) of 8.91 compared with 11.30 for the S&P, Midland States Bancorp, Inc. shines. The company’s Value Score of B further solidifies its position as a trustworthy option for investors.

Midland States Bancorp, Inc. PE Ratio (TTM)

For a comprehensive list of top-ranked stocks, click here.

Enhance your understanding of the Value score and how it is calculated here.

Discover Potential with the 7 Best Stocks for the Next 30 Days

Our experts have carefully selected 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys. These particular tickers are deemed “Most Likely for Early Price Pops.” Since 1988, the full list has outperformed the market by more than 2X, yielding an average gain of +24.0% annually. Don’t miss this opportunity to unearth potential gems in the market.

Banco Bilbao Viscaya Argentaria S.A. (BBVA) : Free Stock Analysis Report

Independent Bank Corporation (IBCP) : Free Stock Analysis Report

Midland States Bancorp, Inc. (MSBI) : Free Stock Analysis Report

Read the full article on Zacks.com by clicking here

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.