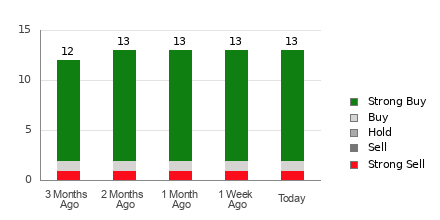

Investors looking for strong value stocks should consider these three companies with high buy rankings as of November 27:

Three Promising Value Stocks to Buy Right Now

Powell Industries, Inc. (POWL)

Powell Industries, a custom equipment manufacturer, holds a Zacks Rank #1. In the past 60 days, the Zacks Consensus Estimate for its current year earnings has risen by 13%.

Price and Earnings Outlook

Powell Industries, Inc. price-consensus-chart | Powell Industries, Inc. Quote

Powell Industries has a price-to-earnings ratio (P/E) of 19.96, lower than the industry average of 21.20. The company also has a Value Score of B.

Mach Natural Resources LP (MNR)

This oil and gas company also carries a Zacks Rank #1. In the past 60 days, the consensus estimate for its current year earnings has increased by 2.4%.

Price and Earnings Outlook

Mach Natural Resources LP price-consensus-chart | Mach Natural Resources LP Quote

Mach Natural Resources has a P/E ratio of 7.67, significantly lower than the S&P average of 24.95. The company possesses a strong Value Score of A.

The Gap, Inc. (GAP)

This well-known apparel retailer is also rated #1 by Zacks. Over the last 60 days, the consensus estimate for its current year earnings has risen by 5.3%.

Price and Earnings Outlook

The Gap, Inc. price-consensus-chart | The Gap, Inc. Quote

The Gap has a P/E ratio of 12.51, well below the industry average of 28.00, and holds a Value Score of A.

Exploring More Top Stocks

Investors can view the complete list of top-ranked stocks here.

For those interested in understanding the Value Score and its calculation, further resources are available.

Discover 7 Top Stocks for the Next 30 Days

Experts have selected 7 elite stocks from the Zacks Rank #1 Strong Buy list, highlighting them as “Most Likely for Early Price Pops.” This group of stocks has outperformed the market significantly since 1988, with an average yearly gain of +24.1%.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.