As the buzz around artificial intelligence (AI) continues to grow, so do the financial prospects. Projections indicate that the AI market is set to soar to $738.8 billion by 2030, up from $305.9 billion in 2024.

This sweeping trajectory is fueling the momentum of longtime tech giants International Business Machines (NYSE: IBM) and Microsoft (NASDAQ: MSFT). Both companies have seen their stocks surge in the past year, thanks to the increasing demand for their AI solutions.

IBM shares climbed from a low of $120.55 in May to a high of $196.90 this year, while Microsoft’s stock rose from $245.61 last March to a peak of $420.82 on Feb. 9.

But if forced to choose between the two, which one should investors place their bets on?

IBM: A Legacy in AI

IBM has been at the forefront of AI since the 1950s, well ahead of the establishment of Microsoft in 1975. The company’s groundbreaking AI platform, watsonx, debuted in the early stages of the third quarter last year and swiftly gained traction.

The success of watsonx translated into a doubling of IBM’s book of business in the fourth quarter compared to the third quarter. This surge in AI adoption propelled Q4 revenue to a 4% year-over-year increase, totaling $17.4 billion.

One standout use case of IBM’s AI prowess is its collaboration with the Sevilla Fútbol Club. By leveraging watsonx to analyze soccer players from a multitude of scouting reports, the club identified prime signings with unprecedented precision.

Another feather in IBM’s cap is its fleet of over 20,000 consultants dedicated to AI solutions. These consultants play a pivotal role in assisting IBM’s clients in formulating and executing AI strategies.

During the Q4 earnings call, CEO Arvind Krishna highlighted, “We are the only provider today that offers both a technology stack and consulting services for deploying and managing generative AI.” IBM’s consulting division reported a 6% year-over-year revenue growth in Q4, amounting to $5 billion.

Microsoft: Pioneering the AI Wave

CEO Satya Nadella envisions AI as the next major wave of computing and is dedicated to positioning Microsoft as a frontrunner in the AI landscape.

Resultantly, Microsoft made substantial investments in OpenAI, the creator of ChatGPT, and seamlessly integrated AI technology across a diverse array of products. Nadella articulated on a recent earnings call, “By embedding AI across our entire tech ecosystem, we are not only attracting new clientele but also driving substantial advantages and productivity enhancements.”

An illustrative case in point is Microsoft’s AI software development tool, GitHub Copilot, which boasted over 1 million subscribers in the fiscal second quarter, marking a 30% increase from the preceding quarter.

The strategic integration of AI has translated into tangible financial gains for Microsoft, evident in an 18% year-over-year revenue surge to $62 billion in Q2.

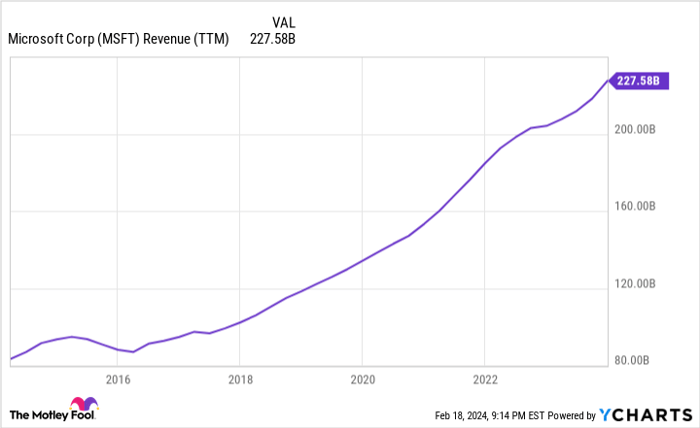

Following years of revenue growth spurred by the pivot to cloud computing under Nadella’s leadership, Microsoft is now witnessing a fresh wave of prosperity driven by AI advancements.

Data by YCharts.

Azure, Microsoft’s cloud platform that underpinned its transition to cloud computing, continues its growth trajectory with a 30% year-over-year surge in Q2 sales following the integration of AI.

Choosing Between Giants

While both IBM and Microsoft boast formidable AI arsenals, diversifying investments between the two stalwarts is prudent. However, before picking one over the other, there are additional considerations to ponder.

IBM’s robust dividend yield, currently exceeding 3%, outshines Microsoft’s sub-1% yield. Furthermore, IBM’s Q4 free cash flow of $6.1 billion marked an improvement over the prior year’s $5.2 billion, solidifying the company’s dividend payment capacity, which it has consistently raised for 28 years.

Conversely, Microsoft’s revenue streams are varied, encompassing digital advertising and the omnipresent Windows operating system, providing income diversification. For instance, its gaming division witnessed a remarkable 61% year-over-year revenue upswing in Q2 following the acquisition of Activision Blizzard.

Considering these factors alongside Microsoft’s AI triumphs, the scales tip in favor of Microsoft as the superior investment choice. Given the recent pullback from its 52-week high, now presents an opportune moment to capitalize on the price dip and secure Microsoft shares.

Where to invest $1,000 right now

With a storied history of successful stock analyses, the analysts at Motley Fool Stock Advisor have identified the top 10 stocks for investors, including Microsoft among them. However, there are 9 other stocks that might be flying under your radar.

Explore the top 10 stocks

*Stock Advisor returns as of February 20, 2024

Robert Izquierdo maintains positions in both International Business Machines and Microsoft. The Motley Fool holds positions in and endorses Microsoft. Additionally, The Motley Fool advocates for International Business Machines and recommends strategies including long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft, following a disclosure policy.

The opinions expressed herein, penned by the author, do not necessarily mirror those of Nasdaq, Inc.