Stepping into the world of artificial intelligence (AI) investing is like entering a bustling marketplace, abundantly primed with diverse ways to ride the trend. Whether it’s the hardware, software, or application plays, each segment harbors its own set of allures and snags. In this maze, two heavyweights, Nvidia (NASDAQ: NVDA) and Palantir (NYSE: PLTR), stand tall as the hardware and software champs respectively, boasting supremacy in the AI arena.

The companies cater to different types of AI investments

Nvidia’s forte, the GPUs (graphics processing units), is the bedrock of AI computing. Its GPUs excel at tackling intricate computational loads, particularly in training AI models. With a reputation for best-in-class GPUs, Nvidia reigns as the go-to company for AI-centric GPUs.

On the other hand, Palantir’s software, initially tailor-made for governmental data processing and actionable insights, has now branched out to the commercial realm. Though government revenue still forms the crux of its operations, Palantir’s software is exceedingly flexible, catering to a spectrum of industries like healthcare, insurance, and manufacturing.

Considering the dichotomy in their market outreach, these behemoths stand distinctly apart with respect to their attributes.

Their revenue models diverge

Nvidia, being a hardware company, relies on non-recurring revenue streams. Its growth hinges on the sale of additional GPUs, leaving its revenue vulnerable to demand fluctuations.

Conversely, Palantir’s software model revolves around customer renewals within a stipulated time frame, accompanied by a fee for product continuation. Thus, in the event of an economic downturn, while Nvidia’s revenue stream might run aground due to project deferments, Palantir might stay unscathed owing to the integration of its software into clients’ systems.

Champion: Palantir

Nvidia outshines Palantir in the growth race

When it comes to sheer growth, Nvidia towers over Palantir. In the third quarter of fiscal year 2024, Nvidia’s revenue soared by a staggering 206% year over year, eclipsing Palantir’s fourth quarter of fiscal year 2023 growth at a relatively modest 20%.

Although Nvidia holds an undeniable edge in growth, Palantir’s growth rate, given its status as a software company, remains commendable.

Champion: Nvidia

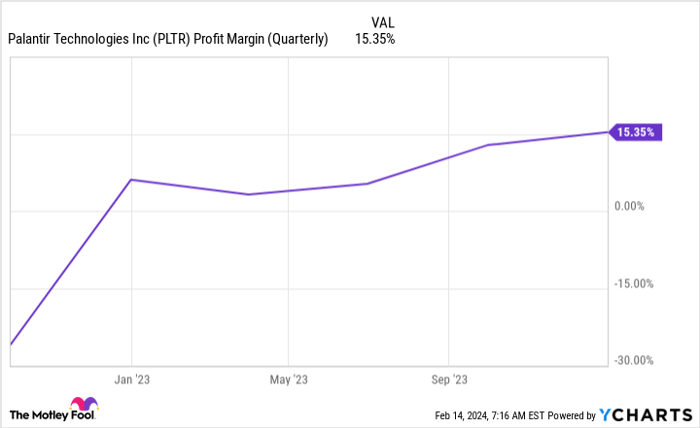

Profitability favors both contenders

In contrast to numerous growth companies, Palantir has mastered the art of profitability, boasting a 15% profit margin in Q4. Palantir has steadily ascended in profit margins over the past few years, and its trajectory seems far from its culmination. However, Nvidia’s profit margins, being characteristic of a mature business, overshadow Palantir’s considerably.

If Nvidia were to experience another downturn due to demand erosion, do not be surprised if its margins dip below Palantir’s. However, for the time being, Nvidia holds a commanding lead over Palantir in this regard.

Champion: Nvidia

Nvidia and Palantir entail a challenging comparison from a valuation perspective

Valuing Palantir, which is yet to reach its zenith profitability, using a metric such as the price-to-earnings (P/E) ratio is problematic. Hence, a revenue-centric measure like the price-to-sales (P/S) ratio finds prevalence. Similarly, for a mature company like Nvidia, the P/S ratio takes a backseat in favor of the P/E ratio.

Consequently, pitting these rivals against each other becomes an intricate task, warranting a comparison with their peers instead. At 25 times sales, Palantir carries a lofty price tag. Nevertheless, such valuation isn’t unprecedented and finds semblance with peers such as CrowdStrike, Snowflake, and Cloudflare, all wallowing in the same league, but boasting a year-over-year revenue growth in the ballpark of 30% as compared to Palantir’s 20%. Consequently, Palantir emerges as a decidedly expensive stock.

Nvidia’s price-to-earnings ratio hovers at a lofty height, nearing 100 times earnings. However, with forward earnings in play (encompassing the ensuing 12 months of growth), Nvidia’s valuation flips a more sanguine picture, pegged at 35 times forward earnings. Standing shoulder to shoulder with peers like Microsoft and Apple, trading at 35 and 28 times forward earnings respectively, Nvidia’s valuation doesn’t seem as forbidding, especially when factoring in its supersonic growth rate.

With Nvidia finding closer valuation kinship among its peers, it clinches this round.

Champion: Nvidia

The final verdict

With a final score of three to one, Nvidia trumps Palantir. However, the sole category where Palantir stole the show – revenue type – could potentially tip the scales in its favor across all four domains, should Nvidia encounter a demand slump.

At present, though, Nvidia emerges as the preferred investment choice.

Would you bet $1,000 on Nvidia now?

Before plunging into Nvidia, ponder this:

The Motley Fool Stock Advisor analyst squad has just pinpointed the presumed 10 best stocks for investors to hitch their wagons to, and Nvidia missed the cut. The chosen 10 stocks are poised to unleash mammoth returns in the times ahead.

The Stock Advisor service equips investors with an easily navigable blueprint for triumph, complete with portfolio-building counsel, regular analyst updates, and a pair of fresh stock picks each month. Since 2002*, the Stock Advisor service has propelled returns triple the S&P 500.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Keithen Drury dabbles in Cloudflare, CrowdStrike, and Snowflake. The Motley Fool dabbles in and vouches for Apple, Cloudflare, CrowdStrike, Microsoft, Nvidia, Palantir Technologies, and Snowflake. The Motley Fool endorses the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool abides by a disclosure policy.

The perspectives and opinions delineated herein mirror the author’s viewpoint and not necessarily those of Nasdaq, Inc.