The chip industry is the theatre where Artificial Intelligence (AI) warriors battle for supremacy. The allure of this realm has skyrocketed with the surge in demand for graphics processing units (GPUs), the heartbeat of AI operations. Nvidia, reigning over GPUs, witnessed unprecedented growth, with a stock climb of over 280% in the past year, fueled by a surge in chip sales.

But amid the triumphant cries of Nvidia, two contenders emerge from the shadows to challenge its dominion: Advanced Micro Devices (NASDAQ: AMD) and Intel (NASDAQ: INTC). These stalwarts, investing heavily in the AI domain, may harbor untapped potential, poised for a meteoric rise in the AI landscape due to their nascent AI endeavors.

As we descend into the depths of these companies’ domains, we embark on a quest to discern the superior AI stock at this juncture.

Advanced Micro Devices: The Underdog Rises

In the realm of AI, AMD prowls as Nvidia’s formidable rival, clinching the second-largest share in GPUs. While slightly tardy to the AI soirée, AMD realigned its focus, priming its arsenal to seize the burgeoning AI industry, potentially reaping vast rewards in the forthcoming years to meet the escalating GPU demands.

In a grand unveiling last December, AMD birthed the MI300X AI GPU, a creation forged to directly engage Nvidia’s offerings. Its allure has already captivated tech titans like Microsoft and Meta Platforms, drawing them into its orbit.

AMD, however, does not rest its laurels solely on GPU conquests; it seeks to sculpt its own AI domain by intensifying its AI-driven PCs. With research from IDC projecting a surge in PC shipments this year, AI integration stands as the linchpin. A prophetic Canalys report forecasts that 60% of PCs shipped in 2027 will bear the AI imprimatur.

AMD’s trajectory in AI appears luminous. Moreover, its free flow of cash surged past $1 billion last year, dwarfing Intel’s negative-$14 billion. This robust financial taper indicates AMD’s healthier financial stance, poised to fuel continuous AI investments.

Intel: A Titan’s Struggle

In a symphony of silicon unveiled last December, Intel unfurled an array of AI chips, featuring Gaudi3, a GPU seeking to rival Nvidia and AMD hardware. Intel also showcased new Core Ultra processors and Xeon server chips, integrating neural processing units to run AI programs with panache.

Alas, Intel struck turbulent waters since then. Following its fourth-quarter 2023 earnings, Intel’s stock plummeted over 9% post January 25. Despite a 10% revenue growth year over year, surpassing Wall Street forecasts by $230 million, Intel’s ebullient stride was stifled.

However, pallid guidance cast a shadow on Intel’s path. The envisaged $0.13 per share for first-quarter 2024 earnings paled against analysts’ $0.42 per share projection.

A seismic shift in the chip domain saw CPU demand wane, while GPU sales thrived. Riding the CPU crest, Intel witnessed business repercussions.

Intel’s endowments in brand prowess and infrastructure portend a triumph in the AI epoch. Yet, prospective investors face a protracted wait for fruition.

Debating the Best Bet for March 2024: AMD or Intel?

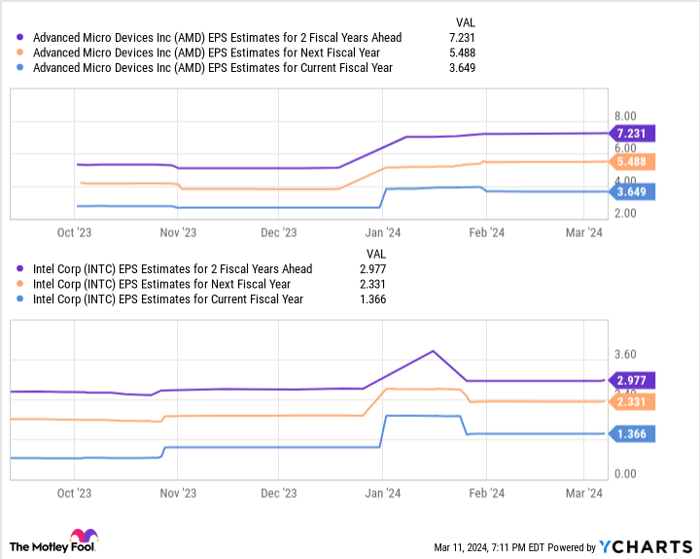

Both AMD and Intel beckon as alluring investments, beckoning investors to leap into the fray and clasp these shares indefinitely. Earnings per share (EPS) augur massive growth prospects in the near future, endorsing a promising vista.

Data by YCharts

This graphical oracle foresees AMD’s earnings breaching $7 per share over the ensuing two fiscal years, while Intel’s are envisioned to narrowly miss the $3 per share zenith. Computing these figures by the duo’s forward price-to-earnings ratios (AMD’s 55 and Intel’s 33) prophecies stock prices of $396 for AMD and $99 for Intel.

Despite the stark projection favoring Intel, AMD’s potential to mirror its price and the sturdiness of its AI-centric business steer it as the prime choice over Intel this month. AMD holds a steadier grip in the AI milieu, arguing for its stock’s preference over Intel’s.

Where to invest $1,000 right now

An educated investor heeds the counsel of our analysts, for their advisories echo insight. The annals of the Motley Fool Stock Advisor, flourishing for two decades, yielding returns tripling the market ripple with wisdom.*

Their most recent scrolls unveil the 10 best stocks for investment, with Advanced Micro Devices gracing the list—burnished by the lingering whispers of 9 overshadowed stocks.

Behold the 10 stocks

*Stock Advisor returns as of March 11, 2024

Offshoots of this discourse reflect the author’s sentiments solely and may not mirror those of Nasdaq, Inc.