Artificial intelligence (AI) has emerged as a potent driver for corporations over the last 15 months. This comes as no surprise given, the technology’s capacity to revolutionize various sectors and stimulate the global GDP by $7 trillion over the following decade, according to Goldman Sachs. Consequently, investors are scouting for companies positioned to benefit from this immense windfall.

Advanced Micro Devices (NASDAQ: AMD) and Palantir Technologies (NYSE: PLTR) are two such companies that have experienced rapid ascension in the past year, fueled by the AI frenzy. Both tech stocks have delivered astonishing gains and are trading at premium valuations, despite their growth rates lagging behind their soaring share prices. Investors are banking on AI to escalate their growth prospects.

If investors have to opt for one of these potential AI frontrunners, which one should they favor? Let’s delve into a thorough analysis.

The Argument for AMD

AMD is undeniably perched on a colossal addressable opportunity owing to AI. The chipmaker approximates that the market for AI chips utilized in data centers could balloon to a staggering $400 billion by 2027, up from $45 billion last year.

The heartening news is that AMD’s recent results indicate its readiness to leverage this phenomenal growth vista. In its latest report, AMD management projected that AMD is on track to rake in at least $3.5 billion in revenue in 2024 from sales of its newly launched Instinct MI300 series of AI processors, which hit the market in December 2023. In a prior earnings update, management had estimated AI chip revenue to total $2 billion.

The substantial surge in AMD’s AI revenue guidance affirms the increasing traction of its AI chips among customers. The company has bolstered its production capacity of AI chips with the aid of its supply chain partners, betting on additional customer demand.

Concurrently, AMD anticipates that the adoption of AI-powered personal computers (PCs) could be another catalyst for the company. On the latest earnings conference call, CEO Lisa Su emphasized:

Millions of AI PCs powered by Ryzen processors have shipped to date, and Ryzen CPUs power more than 90% of AI-enabled PCs currently in [the] market. Our work with Microsoft and our PC ecosystem partners to enable the next generation of AI PCs expanded significantly in the quarter.

AMD is set to further advance in this domain and emphasizes that next-generation PC processors “are expected to deliver more than three times the AI performance” compared to its Ryzen 7040 series processors. With the demand for AI PCs projected to surge at an annual rate of 50% through 2030, according to Counterpoint Research, AMD is strategically maneuvering its cards in this sphere.

In sum, the burgeoning demand for AI chips and PCs will be two robust catalysts for AMD in the future, elucidating why analysts anticipate a steady rise in AMD’s earnings in 2024 and beyond.

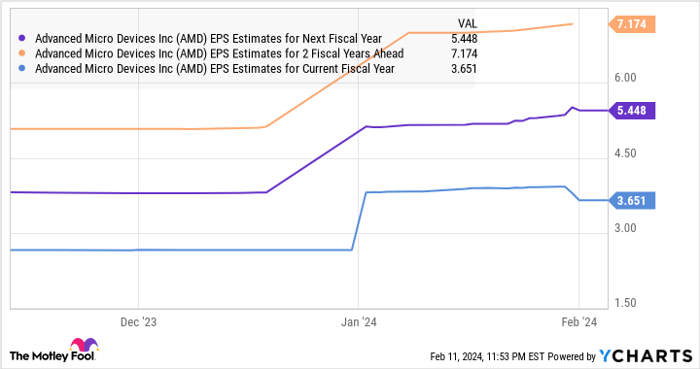

AMD EPS Estimates for Next Fiscal Year data by YCharts

Specifically, as per the chart, AMD’s earnings could escalate by 38% this year from the prior year’s reading of $2.65 per share. Additionally, the anticipated annual earnings growth rate of 25% over the next five years seems robust, indicating that the escalating demand for AI hardware is poised to positively impact this chipmaker’s business.

The Argument for Palantir Technologies

While AMD stands as a beneficiary of the burgeoning demand for AI hardware, investors should anticipate that Palantir is gearing up to capitalize on a potential spike in AI software demand. This is affirmed by Palantir being hailed as the leading provider of AI software platforms in 2021, according to IDC, and the company’s recent results suggest that its sturdy position in this domain will steer robust growth.

Palantir unveiled fourth-quarter 2023 results on Feb. 5, witnessing a substantial surge in the count of commercial customers, propelled by the escalating demand for its Artificial Intelligence Platform (AIP).

On its latest earnings conference call, Palantir management remarked:

Our momentum in AIP is driving both new customer conversions and existing customer expansions. The transformation that AIP is having on our business is best highlighted in our U.S. commercial bookings and backlog.

Specifically, Palantir saw a 55% year-over-year rise in the number of commercial customers in the U.S., translating into a 70% year-over-year escalation in U.S. commercial customer revenue last quarter to $131 million. Meanwhile, overall commercial revenue (including international markets) surged 32% year over year to $284 million, fueled by a 44% year-over-year increase in customer count.

Aside from the burgeoning customer count, Palantir underscores that it is seeing shorter sales cycles, accelerated new customer acquisition, and increased spending by existing customers, thanks to AI. This is evident from the fact that Palantir sealed 103 deals worth $1 million or more in the fourth quarter of 2023, doubling the count from the prior-year period.

Therefore, as Palantir’s commercial business gathers momentum on the back of the growing adoption of its AIP, already in use by over 300 customers within a mere year of its launch, its growth momentum should upscale accordingly. This aligns with analysts’ forecasts following a 17% uptick in the company’s revenue in 2023 to $2.23 billion.

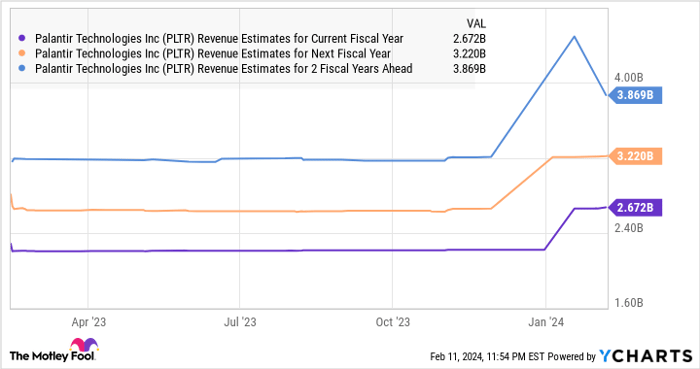

PLTR Revenue Estimates for Current Fiscal Year data by YCharts

Furthermore, analysts foresee Palantir clocking an annual earnings growth of 85% over the next five years, indicating that AI could indeed ignite its future growth.

Which AI stock presents a better opportunity?

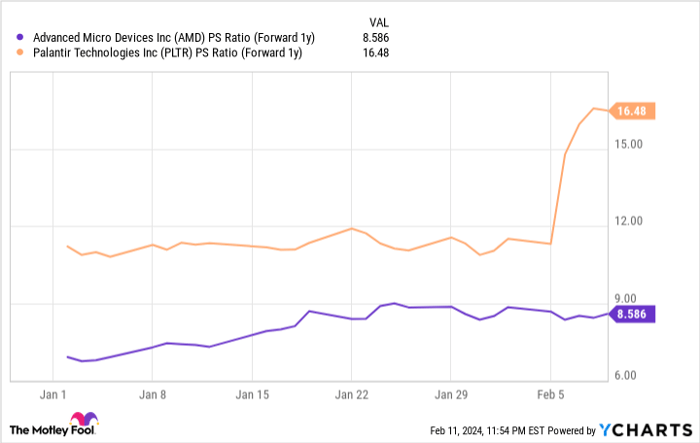

As highlighted previously, both AMD and Palantir command premium valuations. While AMD boasts a price-to-sales ratio of 12, Palantir is even pricier at 25 times sales. The forward sales multiples of both companies indicate promising top-line growth.

AMD PS Ratio (Forward 1y) data by YCharts

The chart reveals that Palantir remains the pricier choice. However, we have witnessed that analysts anticipate Palantir to grow at a much faster pace than AMD. This does not come as a surprise, as Palantir is purportedly the forerunner in the swiftly expanding AI software market. On the other hand, AMD has to contend with Nvidia in the AI chip market.

The silver lining is that AMD could eventually secure a substantial share of the AI chip market and deliver commendable growth, making it a compelling option for investors seeking a more affordable AI stock. Conversely, those with a higher risk tolerance might consider investing in Palantir, as the software behemoth could well validate its valuation by delivering stronger-than-anticipated growth.

Before you invest $1,000 in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

*Stock Advisor returns as of February 12, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Goldman Sachs Group, Microsoft, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.